Christina Chalimova, LLB, CFP®; Senior Wealth Consultant, Client Consultation Group

Estate planning is a deeply personal experience that can often feel complex, especially when it comes to understanding the nuances of the probate process and the fees that often come with it. For many Canadians, probate fees raise concerns about the potential erosion of the estate intended for their loved ones. In response, an increasing number of Canadians are turning to probate planning strategies in hopes of minimizing probate fees and facilitating the transfer of assets to their loved ones without court intervention. This article provides key insights to help you understand what probate is, what it costs, common probate planning strategies and what to consider before implementing them in your estate plan. Contact an Edward Jones Financial Advisor if you have questions.

What is probate?

Probate1 is the court process of validating your last Will after your death and confirming the executor's legal authority to administer your estate2. Applying for probate namely requires the Will to be filed with the court record for validation, which then usually renders it accessible to the public. When an application for probate is complete and the Will is not challenged, a grant of probate3 is issued by the court and your executor can begin carrying out the terms of your Will. A third party which acts in good faith on the instructions of an executor named by the court in a grant of probate is protected from liability for following those directions. As a result, financial institutions and others regularly require this document to ensure that they are dealing with the court-validated last Will and taking instructions from the person that has the lawful authority to administer the estate. Without a grant of probate, an executor or financial institution may face legal complications if they distribute assets and, later, another Will surfaces with different distribution terms, or someone challenges the Will.

How long does probate take?

Multiple factors impact the time it takes obtain a grant of probate. First, an application for probate must be completed and submitted to the court. This often requires the applicant (usually the executor named in what is believed to be the last Will of the deceased) some time to collect information on the deceased's assets/liabilities and gather key supporting documents, such as the Will and death certificate. Then, the court must process the application for probate, which may depend on how complete the application is, whether anyone challenges the Will, and the court's availability. For these reasons, and others, probate can be a complex and time-consuming process, which explains why many executors turn to a lawyer for assistance.

What are probate fees in Canada?

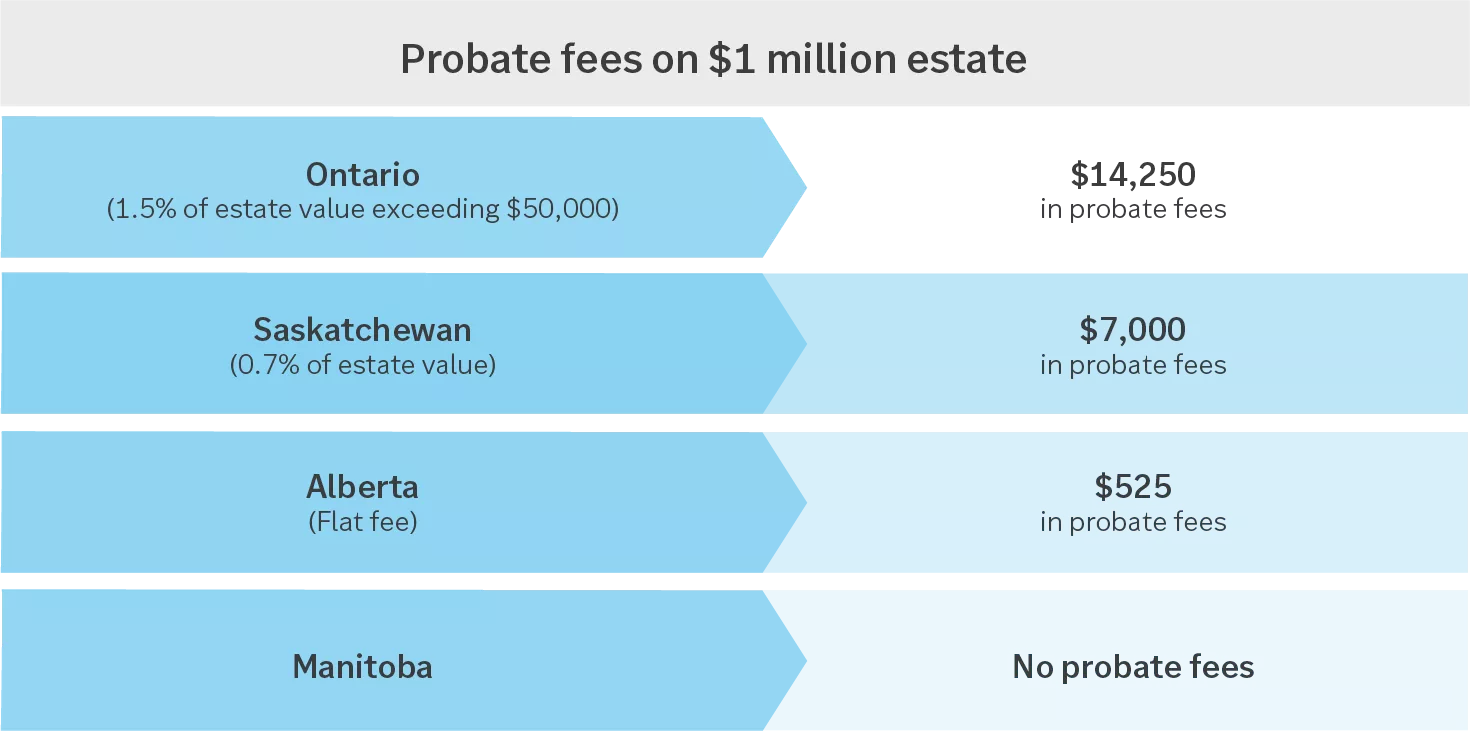

Applying for probate may require the payment of estate administration taxes or probate fees4. While probate fees differ across jurisdictions, they are generally levied on the gross value of the estate or more precisely, the fair market value of the assets owned by the deceased at death minus certain secured liabilities registered against real property5.

Probate fees should not be confused with income taxes payable at death as they serve distinct purposes. For instance, in addition to probate fees, capital gains taxes may need to be paid out of the estate in relation to certain assets that have increased in value during the deceased's lifetime. It should also be noted that probate fees cannot be deducted by the estate for income tax purposes.

In some jurisdictions, probate fees may be a flat fee or non-existent, while in others, they may be a percentage that can considerably reduce the value of an estate to be distributed to beneficiaries. To give you an idea of how much probate can cost, here is an illustration of probate fees due on a $1 Million estate across a few different provinces: