Geopolitics and labour data: Looking for the calm amidst the market storm

Key Takeaways:

- There was something of a perfect storm in markets this week. An oil price spike in the wake of the conflict in Iran sparked concerns over higher inflation, while a weak payrolls report added to fears around U.S. growth.

- Markets pulled back given this stagflationary mix, especially amid uncertainty over the willingness of the Fed to ease policy in this environment. In response, we saw sell-offs across bonds and equities as part of a broad risk-off move. Nonetheless, the S&P 500 is still higher by about 17% over the past year and remains just 3% below all-time highs.

- It seems possible we will see further volatility in coming days and weeks as the conflict in the Middle East unfolds. However, history tells us that the impact of geopolitical crises on markets can be short-lived and at times provide opportunities for investors.

- More broadly, we remain constructive on the longer-term outlook for growth and corporate profitability. Most indicators point to healthy U.S. and global activity, and it would take a large and sustained spike in oil to derail this story, in our view.

- Therefore, we recommend staying invested and well diversified as investors weather the latest spike in uncertainty across the economy and markets.

Few places to hide

Last week was a difficult one in markets. Oil prices spiked more than 30%, major U.S. equity markets were down between 2%-5%, Canadian equities slipped 4%, international and emerging-market equites fell an even larger 5%-10%, and 10-year Canadian government bond yields jumped nearly 30 basis points (0.3%).

Let's start with Friday's U.S. payrolls data to help understand this broad risk-off move.

A disappointing payrolls report

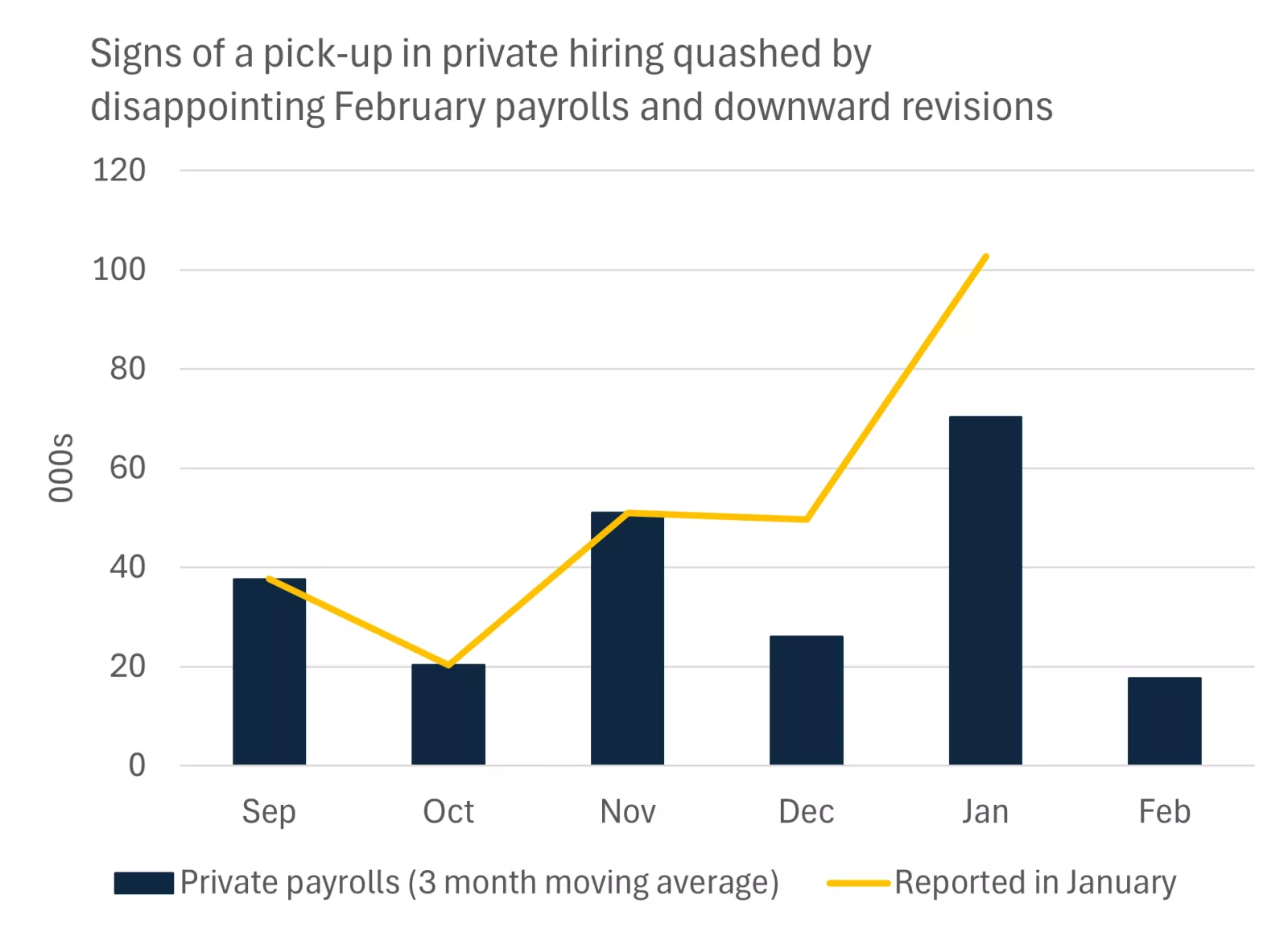

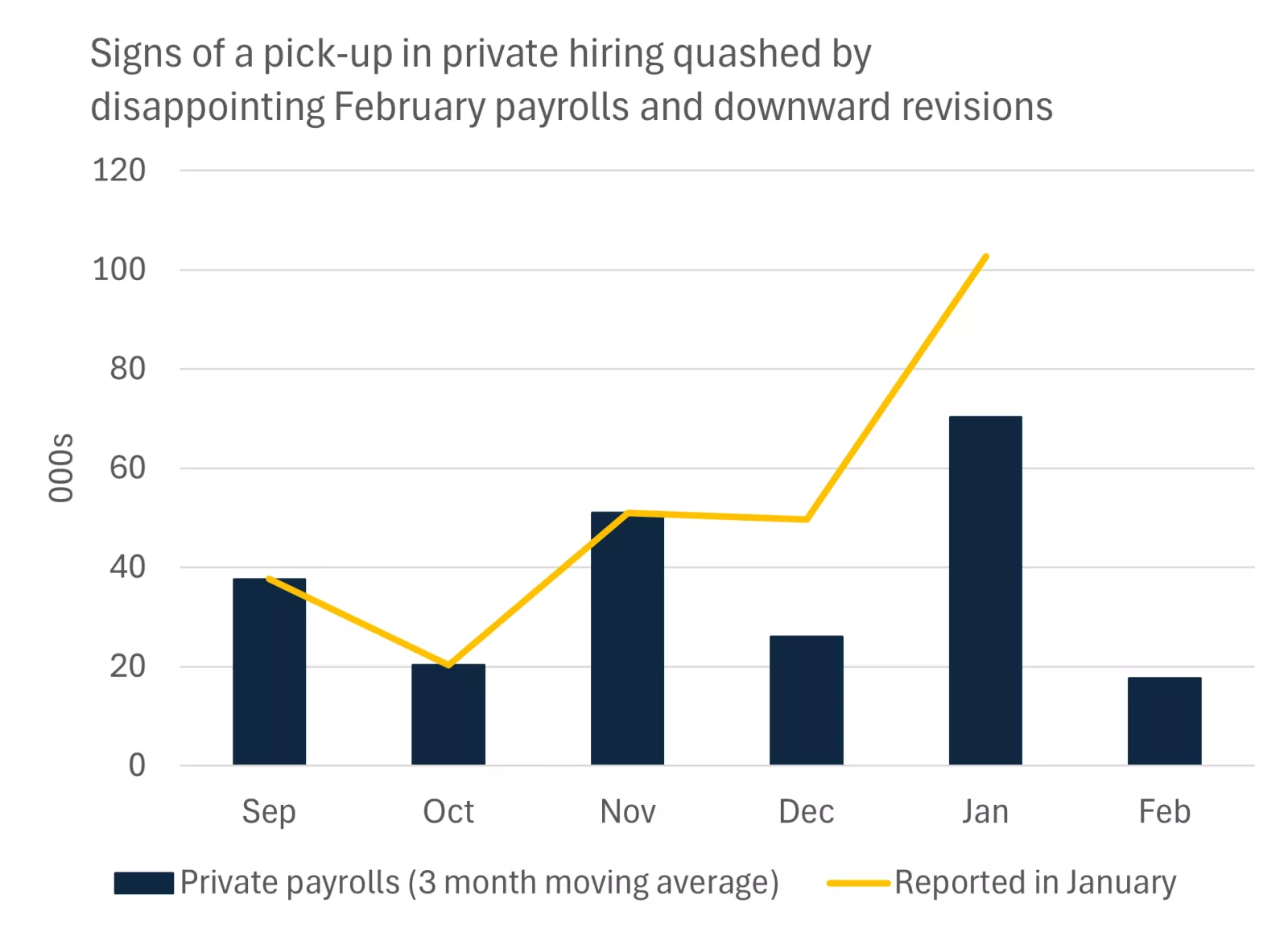

Headline payrolls fell by 92,000 in February, missing expectations for a 55,000 gain in jobs over the month. Adding to this disappointment were downward revisions to jobs numbers for January and December, which left the average gain in total payrolls over the past three months at just 6,000, with the private sector only marginally stronger at 18,000.

This chart shows that previous signs of a pick-up in private payrolls were quashed by weaker February data and downward revisions to past months to show a much weaker trend in hiring.

This chart shows that previous signs of a pick-up in private payrolls were quashed by weaker February data and downward revisions to past months to show a much weaker trend in hiring.

From experience, we know that it is prudent to not overreact to a single month's data, and the February numbers were likely in part dampened by strike action, weather disruptions, and potentially some payback from a strong January report.

Moreover, given an ageing U.S. population and lower net migration, it takes fewer jobs each month to keep the labour market ticking along, and many estimates suggest that a net gain between 20,000-50,000 in payrolls might be enough to keep the labour market stable. Consistent with this view, the unemployment rate in February increased only marginally to 4.4% and remains low, helping ease concerns that we are seeing a sharp deterioration in the labour market.

Still, markets didn't like the report, and there are likely a couple of reasons for this concern.

- First, sluggish hiring momentum potentially makes the economy vulnerable should lay-offs start to rise.

- Second, an improvement in hiring trends this year is likely needed to underpin consumer spending, which remains a critical part of the economy.

Normally, a weak payroll report would help bolster expectations for Fed cuts, providing some comfort for equity investors. However, the oil price spike this week complicates matters, as investors appear to question the willingness of the Fed to ease in the face of renewed inflation risks.

Let's dig into the oil price disruptions as they stand, and the implications for the economy.

A global energy shock

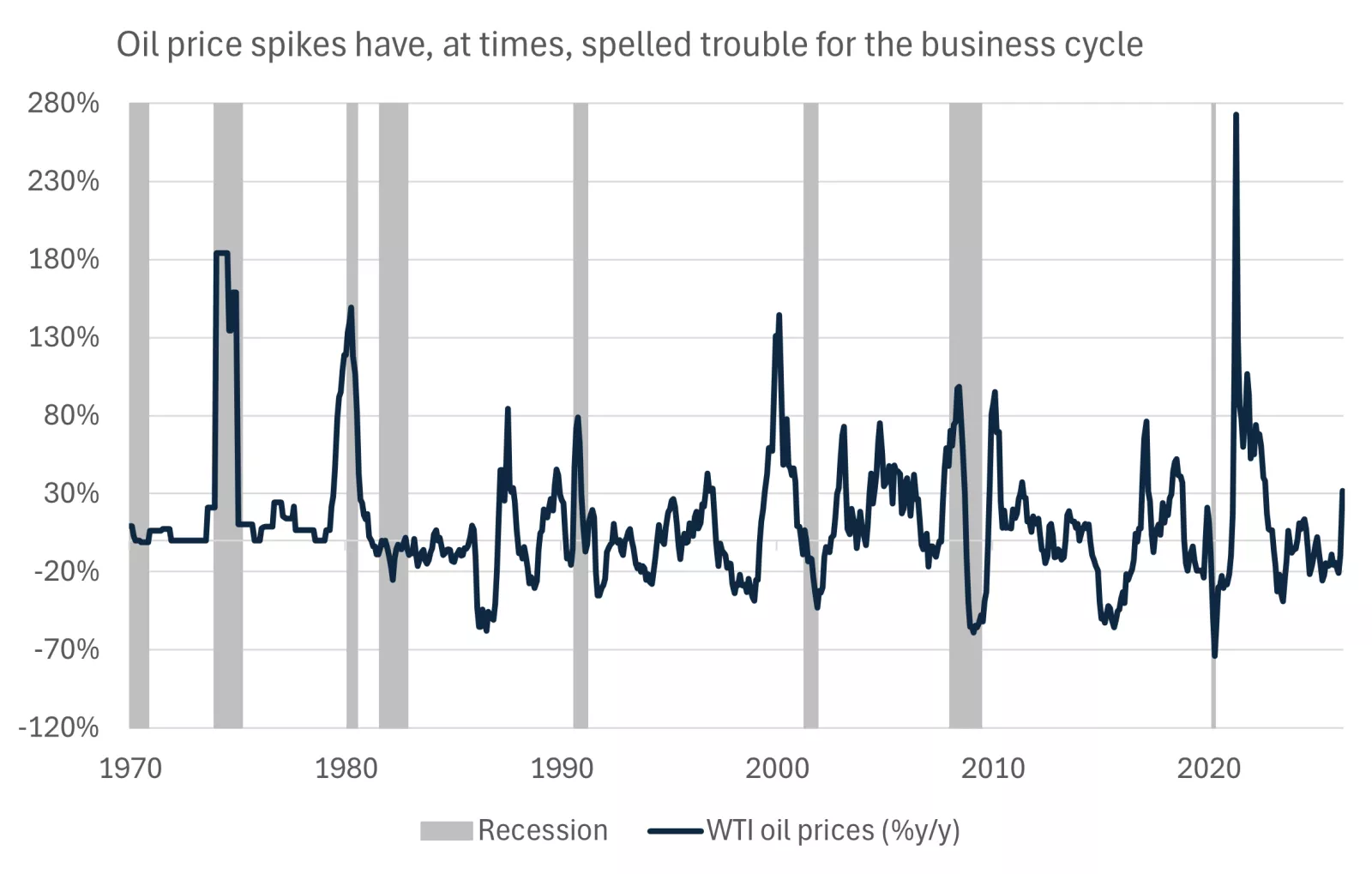

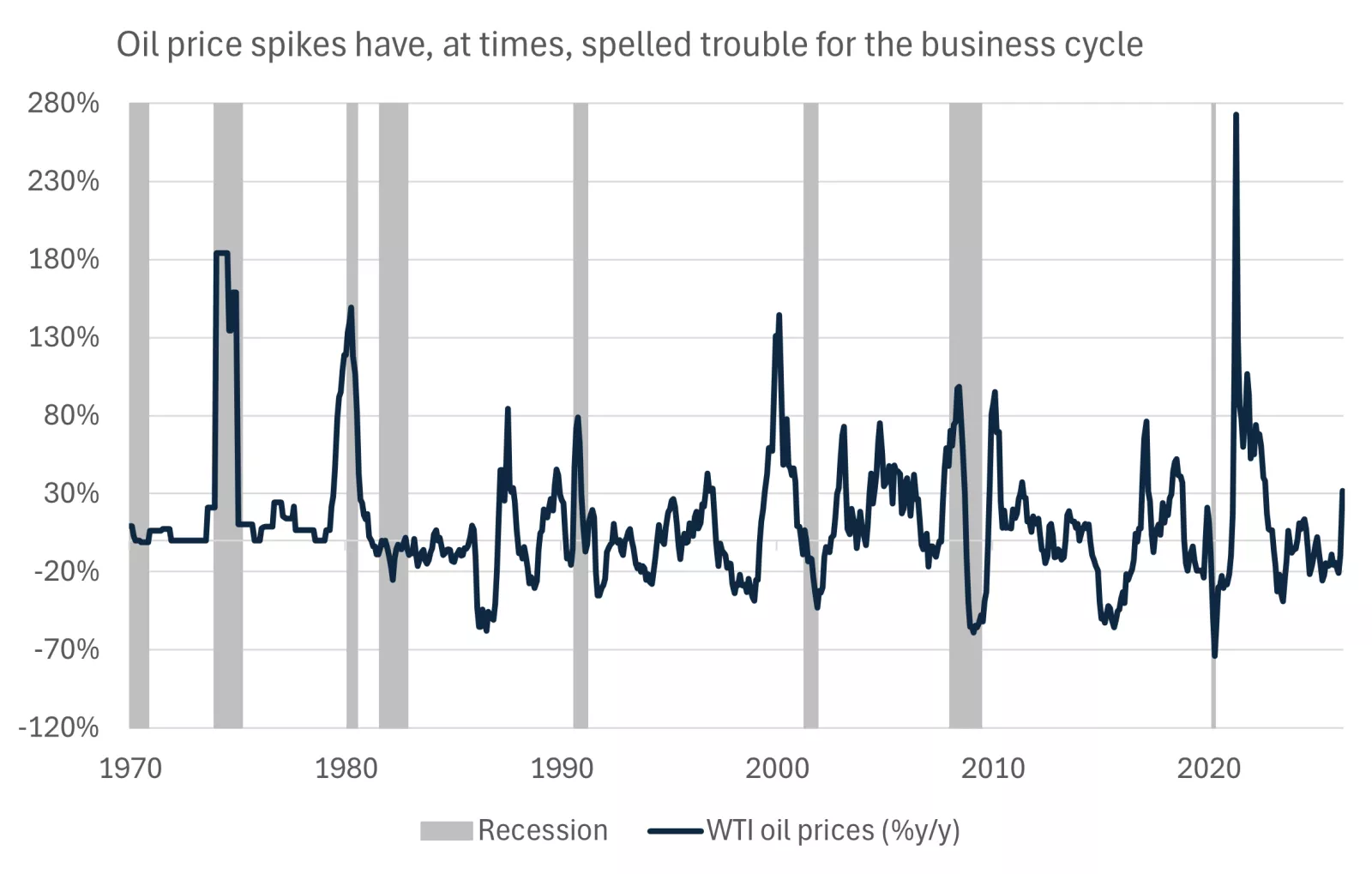

Oil price shocks have in the past proved dangerous for economies and markets. Crises in the 1970s will spring to mind for many, with tensions in the Middle East sparking oil price spikes accompanied by recessions, while 1990 provides a more recent example.

This chart shows that spikes in oil prices over the past 50 years have, at times, been associated with recessions.

This chart shows that spikes in oil prices over the past 50 years have, at times, been associated with recessions.

However, the relationship between the U.S. economy and oil prices has changed in recent decades alongside rising domestic energy production and lower oil intensity. We wrote about this in a recent Market Pulse article, which also discusses the broader market implications of geopolitical shocks.

The upshot is that we think it would take a large and sustained rise in oil prices to derail the U.S. economy. To help test this empirically, we built a recession probability model using 50 years of data to help quantify the risk of a downturn given the oil price spike and broader conditions in the U.S. economy*.

With oil trading around $90 per barrel, the model points to a moderate 15% chance of a recession in the near term, up just 6 percentage points after last week's oil price spike*. Should oil prices rise further to $125 this risk rises to 30%, while it would take a spike in prices to $150 per barrel to reach the 50% mark.*

Recession probability models are useful tools, but they are by no means perfect when predicting the future. However, these signals appear to align with the experience of recent energy price spikes that have not interrupted business cycles and the pullback in equity markets seen so far does not look consistent with a profit recession, in our view.

Turning our lens to Canada, the oil and gas sector accounts for around 6% of GDP and more than a quarter of exports with this sector likely boosted by higher global prices. Some of these benefits will likely be offset by higher inflation, which weighs on household purchasing power and corporate margins in non-energy sectors. However, the Bank of Canada finds that higher oil prices generate a net positive effect on growth, in contrast to many other developed and emerging economies with smaller energy sectors.

We think this should make us more confident that the Canadian economy should avoid a recession, although growth remains subdued in the face of broader trade policy uncertainty ahead of the renegotiation of the CUSMA trade deal this year.

A dilemma for central banks

While we don't think the oil price shock is large enough to upend U.S. growth, we do think it will show up in inflation in coming months.

Higher global oil prices typically feed rapidly into energy price inflation, which accounts for around 6% of the U.S. consumer price index (CPI) basket. Households will notice this first in higher gas prices, but we will also likely see these dynamics seep into broader energy costs, and indirectly via higher input costs for firms.

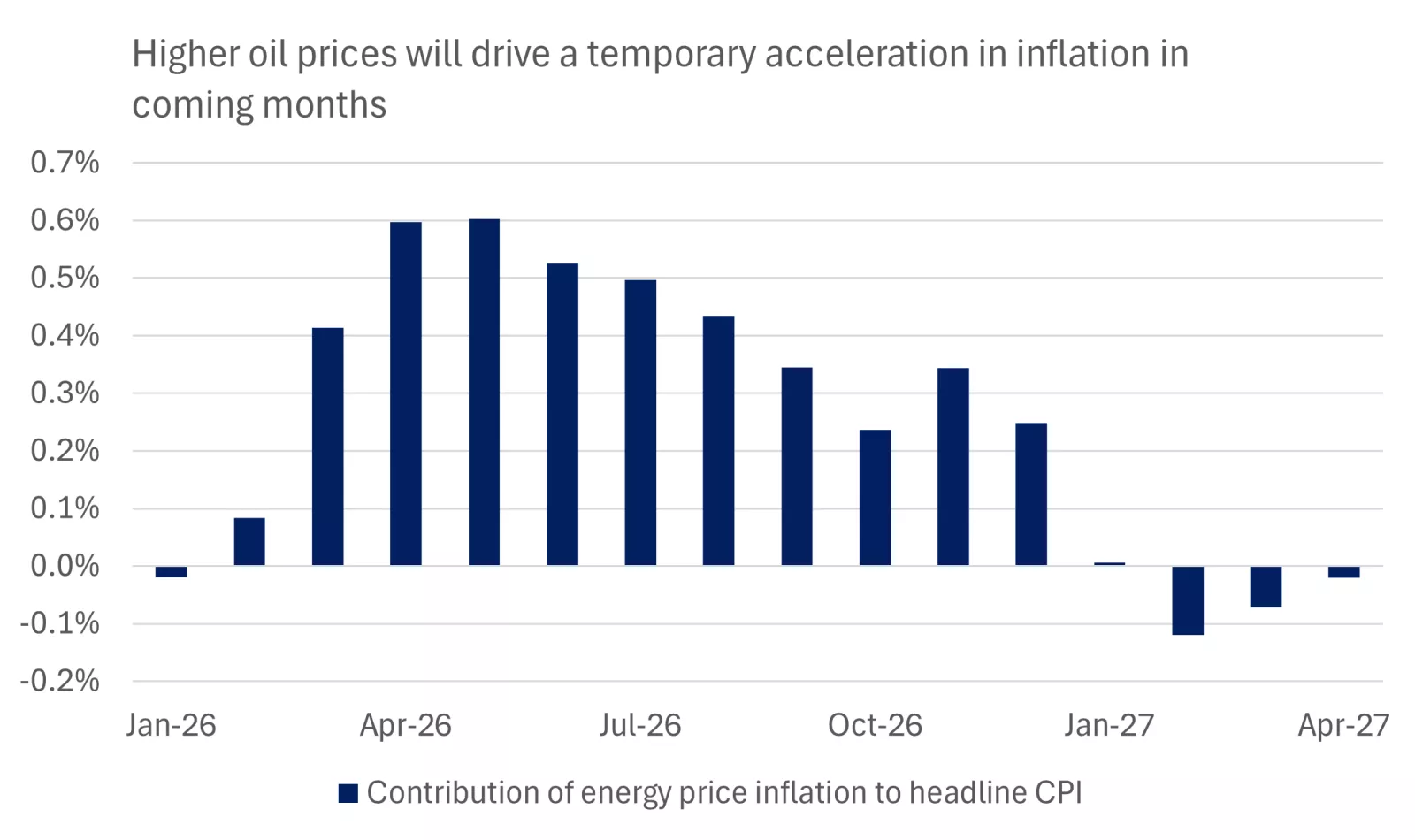

We think the size and persistence of this impulse will depend on how large and sustained the shock to oil prices proves. Markets currently expect WTI to slowly fall back from the current spot price of around $90 to $74 per barrel in the second-quarter and $67 by the end of the year. Based on this profile, we could see energy prices push headline U.S. CPI back above 3% in year-over-year terms, before this impulse potentially starts to fade through the rest of 2026.

This chart shows the impact on headline U.S CPI from higher energy price inflation, based on market futures for oil.

This chart shows the impact on headline U.S CPI from higher energy price inflation, based on market futures for oil.

Typically, a central bank would likely look through this type of inflation, arguing that it has nothing to do with economic fundamentals. However, with price growth having run above the central bank's 2% target for five years, there might be some nervousness at the Fed that the latest impulse could risk inflation settling more permanently above target.

This dynamic helps explain why markets are now pricing fewer rate cuts this year and next, despite Friday's payrolls disappointment. We don't think that the energy-price-driven spike in oil will stop the Fed from easing entirely, and we continue to expect one or two more rate cuts. However, these might be delayed until later in 2026 or into 2027 as the central bank waits to see clearer signs of fading price pressures before cutting rates.

In Canada, the debate has shifted away from potential interest rate cuts to a possible interest rate hike in the face of a similarly worsening inflation outlook. Markets are now pricing in around an 80% chance that we see a rate hike from the Bank of Canada by the end of 2026.

We remain skeptical that we will see tightening this year, unless higher oil prices generate large effects on domestic growth and inflation. Instead, we expect rates to remain unchanged at 2.25%, a level at which they are providing moderate stimulus as the economy adjusts to a new trading relationship with the U.S.

The big picture

There looks to be few near-term signals of a step-down in the conflict in Iran, with President Trump indicating that the U.S. will not negotiate until it had received an unconditional surrender. We think this adds to the risk that we see further volatility in coming days and weeks as investors continue to struggle to price the extent of disruption to global energy markets.

However, looking through this noise, we remain constructive on the outlook. Corporate profitability has been rising and broadening, tax cuts and fiscal stimulus are starting to filter through the U.S. and Canadian economies, and AI investment remains a tailwind, with tentative signs emerging that this is starting to lift productivity growth.

There is a risk, as always, that a deeper and more prolonged geopolitical conflict could leave a bigger imprint on economies and markets. But, historically, these type of shocks have tended to be more short-lived. For longer-term investors staying invested through disruptions has typically proved the best strategy, and we think this will be the case moving forward.

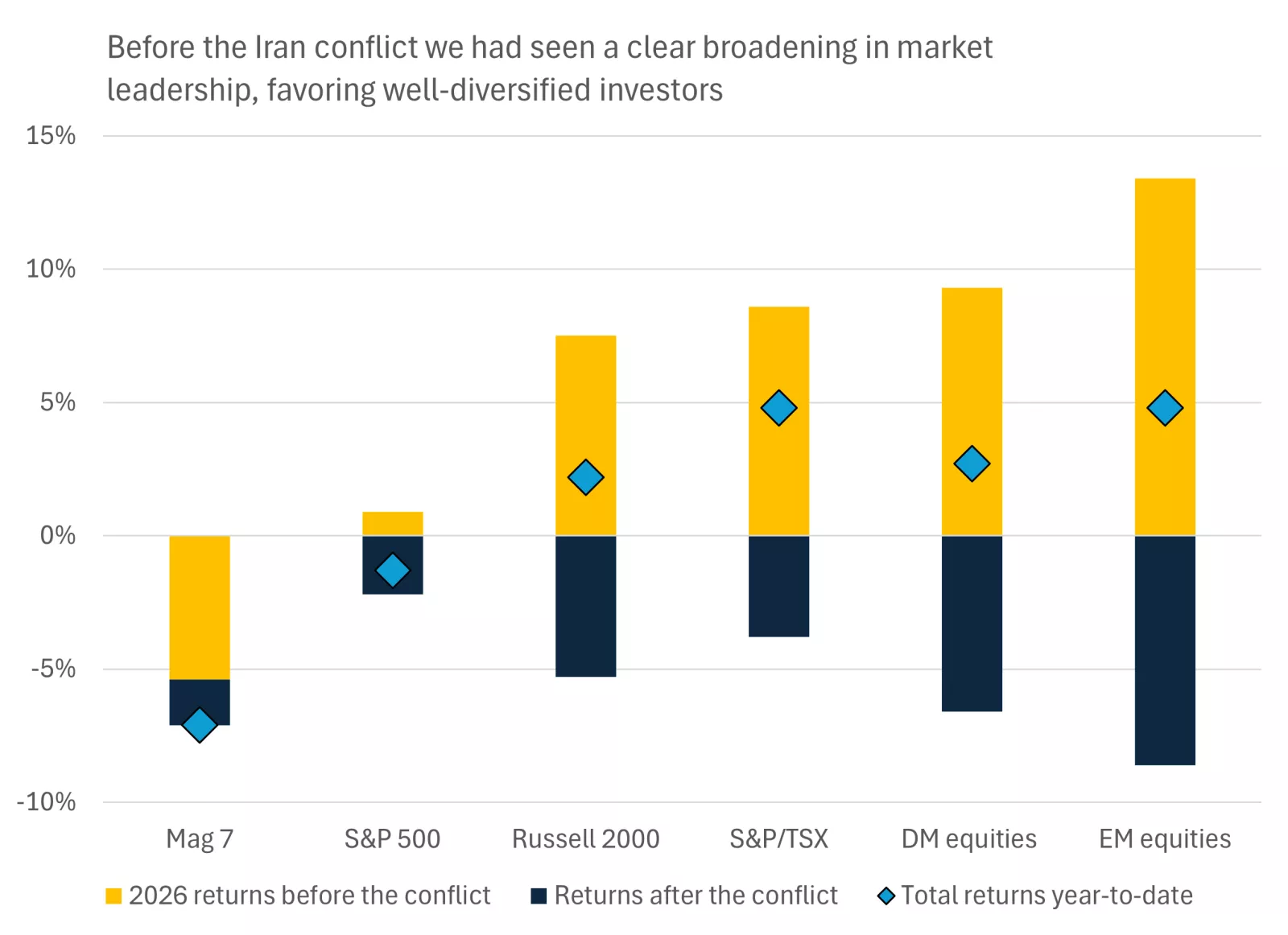

Importantly, we think investors should target well-diversified portfolios to help spread risk and tap into the broadening in market leadership that had been emerging before this shock. Recent volatility could even be an opportunity to invest in areas in which you are underexposed or rebalance portfolios at cheaper valuations.

This chart shows the performance of major equity markets this year, with the outperformance of small cap, international and emerging market stocks having narrowed after the Iran shock.

This chart shows the performance of major equity markets this year, with the outperformance of small cap, international and emerging market stocks having narrowed after the Iran shock.

Your financial advisor can help align this guidance with your own circumstances, to help keep you on track towards your long-term goals.

James McCann

Senior Economist, Investment Strategy

Weekly market stats

| INDEX | Close | Week | YTD |

|---|---|---|---|

| TSX | 33,084 | -3.7% | 4.3% |

| S&P 500 Index | 6,740 | -2.0% | -1.5% |

| MSCI EAFE* | 2,964.26 | -6.8% | 2.5% |

| Canada Investment Grade Bonds* | -1.7% | 0.5% | |

| 10-yr GoC Yield | $3.41 | 0.3% | 0.0% |

| Oil ($/bbl) | $91.42 | 36.4% | 59.2% |

| Canadian/USD Exchange | $0.74 | 0.3% | 0.7% |

Sources for all data not cited: Bank of Canada, Bloomberg, FRED, Bureau of Labor Statistics (BLS)

Sources for data cited: *Bloomberg, FRED, Edward Jones calculations

Source: FactSet, March 8, 2026. Bonds represented by the Bloomberg Canada Aggregate Bond Index. Past performance does not guarantee future results. *Source: Morningstar Direct, March 8, 2026.

The week ahead

Important economic data for the week ahead includes employment data in Canada, as well as CPI and PCE inflation data, housing data, and GDP for the U.S.

James McCann

Senior Economist

Thought Leader In:

- Economic issues impacting the lives of everyday Americans.

- The effects of government spending, taxes and regulation changes on our clients.

- Building diversified portfolios to help investors reach their long-term financial goals.

“The economic, political and policy landscape is shifting dramatically, making it ever more challenging for our clients to navigate their personal finances. In this environment, it's our deep, research-driven insights that can help clients stay on track to reach their financial goals."

James McCann

Senior Economist

Important information :

The Weekly Market Update is published every Friday, after market close.

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Investors should understand the risks involved of owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent to international investing, including those related to currency fluctuations and foreign political and economic events.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.