Markets stall, but there's strength in strategy

What you need to know

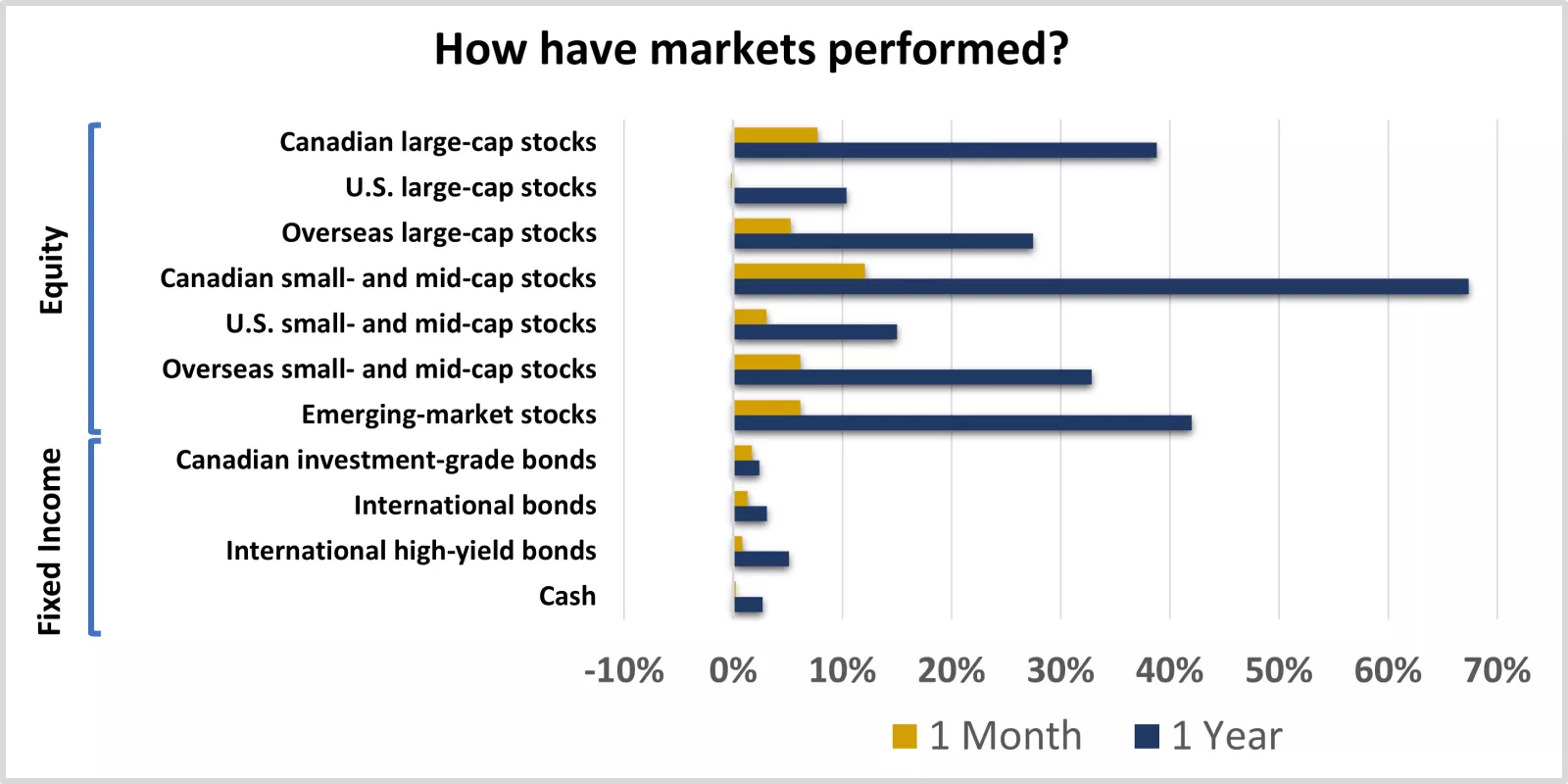

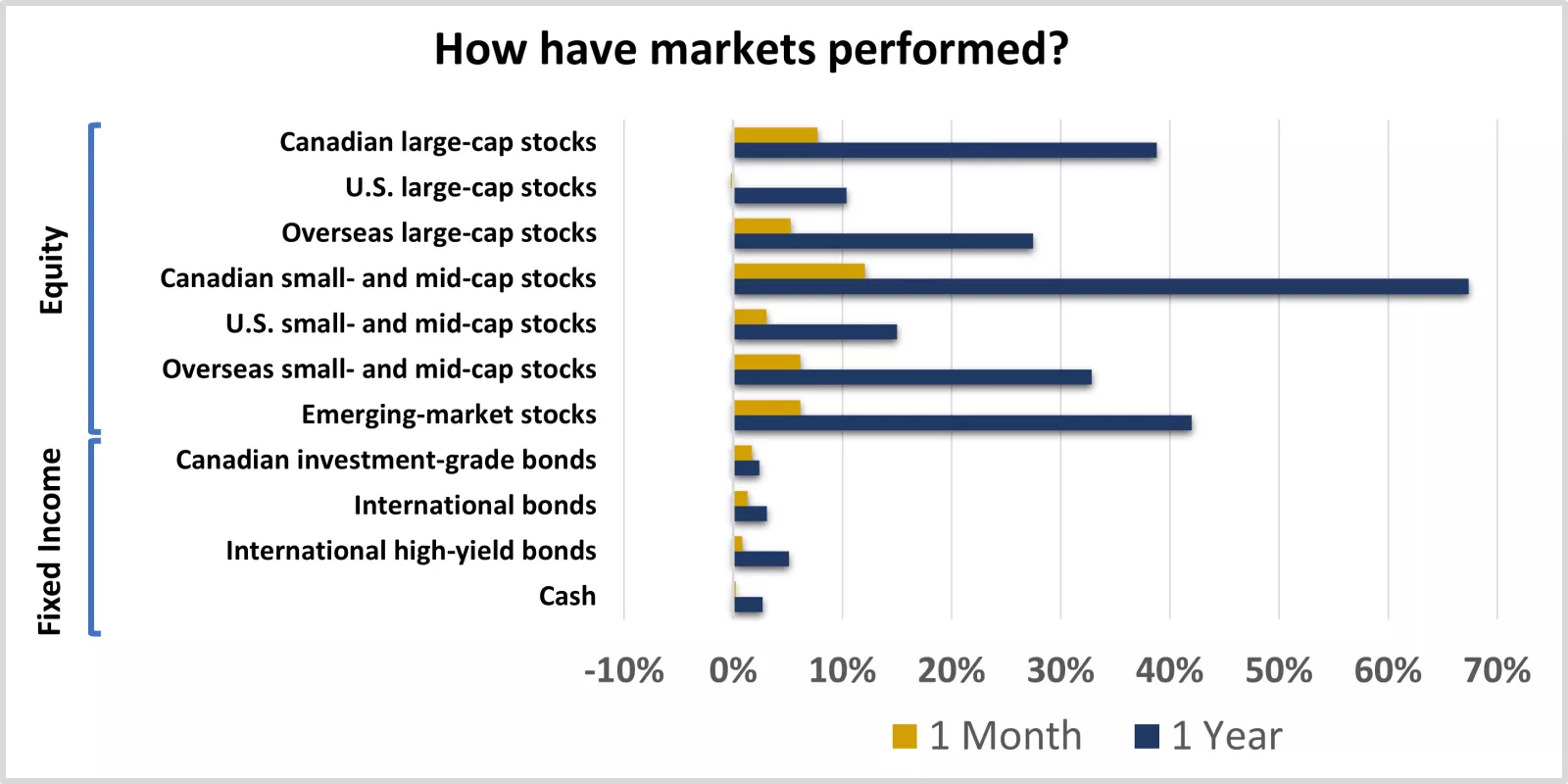

- Markets had a strong start to 2026, with Canadian and overseas stocks extending their lead over U.S. markets as the tech-heavy S&P 500 stalled through February.

- Outside of U.S. tech, a broad set of stocks produced solid gains, and bonds were higher too, before markets weakened into March as investors weighed potential impacts of the conflict in the Middle East.

- The potential for market volatility can feel stressful, but there's strength in a proactive, well-diversified, goal-focused investment strategy built to help you navigate uncertainty according to your risk and return objectives.

- Pause to remember why you're investing since your financial goals—not headlines—should guide your strategy, then review your portfolio for alignment with an opportunistic mindset.

- We believe the global outlook remains constructive over the next one to three years, and we favor a mix of quality and cyclical stocks across regions to help manage risk and capture broad opportunities.

Portfolio tip

Plan proactively by having a goal-focused portfolio strategy in place that accounts for market declines, helping you remove emotions when times feel uncertain.

This chart shows the performance of equity and fixed-income markets over the previous month and year.

This chart shows the performance of equity and fixed-income markets over the previous month and year.

Where have we been?

Markets had a strong start to 2026, then rising geopolitical tensions added a layer of uncertainty. A wave of headlines and uncertainty related to global relations, trade and tariff policy, central bank developments, and the potential growth of or disruption from artificial intelligence had caused some market some angst. Though, 2026 began with a solid backdrop—strong corporate earnings growth, steady global economic momentum, and lower interest rates—that helped offset some of these concerns, helping markets deliver a strong start to the year through February.

However, rising geopolitical tensions added a layer of uncertainty heading into March. Markets weakened as investors weighed potential impacts of the conflict in the Middle East, such as the potential for rising energy prices and affordability concerns, with the situation remaining fluid.

Canadian and overseas stocks had extended their lead over U.S. markets. With rising oil prices benefiting Canada's large energy sector and surging precious metals prices benefiting Canada's sizeable materials sector, Canadian stock markets had built on their recent gains, extending their leadership position. Together, these sectors make up over 50% of the Canadian large-cap stock market, and they returned more than 20%, year-to-date through February.

Overseas markets were also among the leaders. Expansionary fiscal policies and looser monetary policies abroad contributed to their leadership through February. Emerging-market stocks, whose large tech sector continued to deliver gains, were up over 14%. Overseas developed-market stocks aren't far behind, posting around 10% gains prior to weakening amid the rising tensions in the Middle East.

Within the U.S., a meaningful market rotation was taking place. Following a multi-year period of above-average returns, it was no surprise to see the S&P 500 taking a pause in the first two months of the year—markets don't always move in a straight path higher. Through the last trading day in February, the index was essentially flat.

Tech-heavy sectors—information technology, consumer discretionary, and communication services—have powered market gains in recent years, fueled by strong profits and growth optimism surrounding artificial intelligence (AI). But over the first two months of 2026, these sectors fell amid growing concerns around elevated valuations, the potential pay off from large capital spending, business disruptions. That shift weighed on the tech-heavy S&P 500.

In contrast, a strong fundamental backdrop and a market rotation toward more value-oriented stocks propelled cyclical and defensive sectors higher. Consumer staples, industrials, materials, utilities, and energy all climbed more than 10%, in U.S. dollar terms, before the geopolitical uncertainty trimmed some of the gains. U.S. small- and mid-cap stocks—often more economically sensitive and value-tilted than U.S. large caps—have also trended higher amid the economy's position of strength.

Interest rates were drifting lower, driving the total return from bonds higher for bondholders. The 10-year Canadian government bond yield slipped toward 3.1% in February on softer economic growth, before rising in early March. Therefore, bondholders have benefited on two fronts: ongoing interest income and rising bond prices as interest rates declined. Together, these forces helped lift total returns in bond markets, before weakening into March.

What do we recommend going forward?

Strengthen your strategy by proactively establishing your game plan for potential market volatility. Headlines and the potential for market volatility can cause stress when it comes to investing. But having a strategy in place that accounts for market declines can help you stay proactive and remove emotion when times feel uncertain. We suggest these steps:

- Revisit your goals. Pause for a moment to remember why you're investing in the first place. Your financial goals—not headlines or geopolitics—should guide your strategy, giving purpose to your investments.

- Define your strategy. Balance risk and reward by selecting the stock-bond mix that aligns with your goals and investment objectives, which will help you navigate the market fluctuations that will occur on your journey. And diversify. Why? Because market leaders rotate, as this year has shown. Set strategic target allocations across our recommended asset classes to spread risk and create a solid foundation for your portfolio.

- Review your portfolio with an opportunistic mindset. Ensuring your portfolio allocations are aligned with your strategy helps keep you focused on your goals no matter the market narrative. What's more, downturns may provide opportunities to rebalance into quality investments at better prices, including in areas that have already appeared attractive.

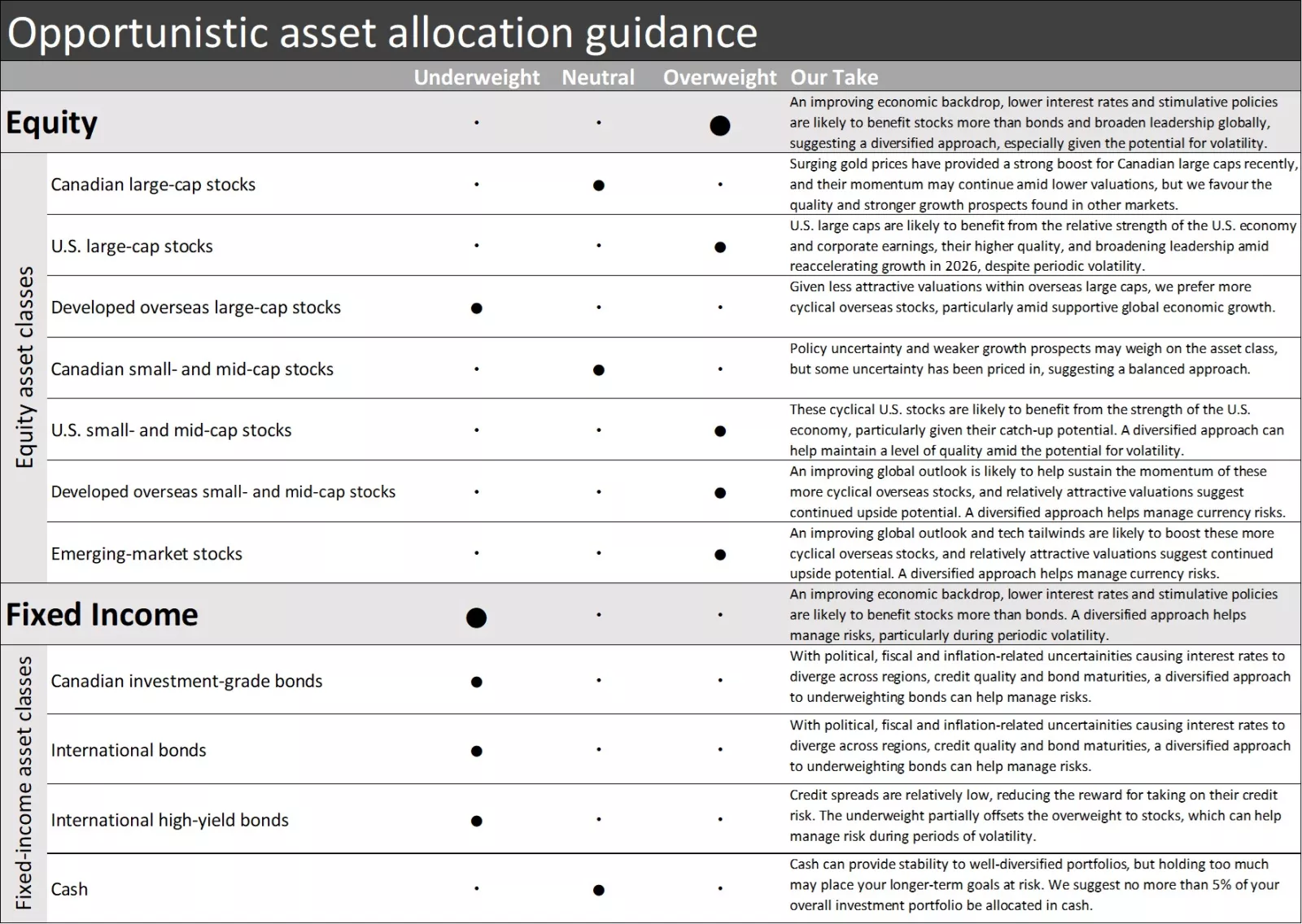

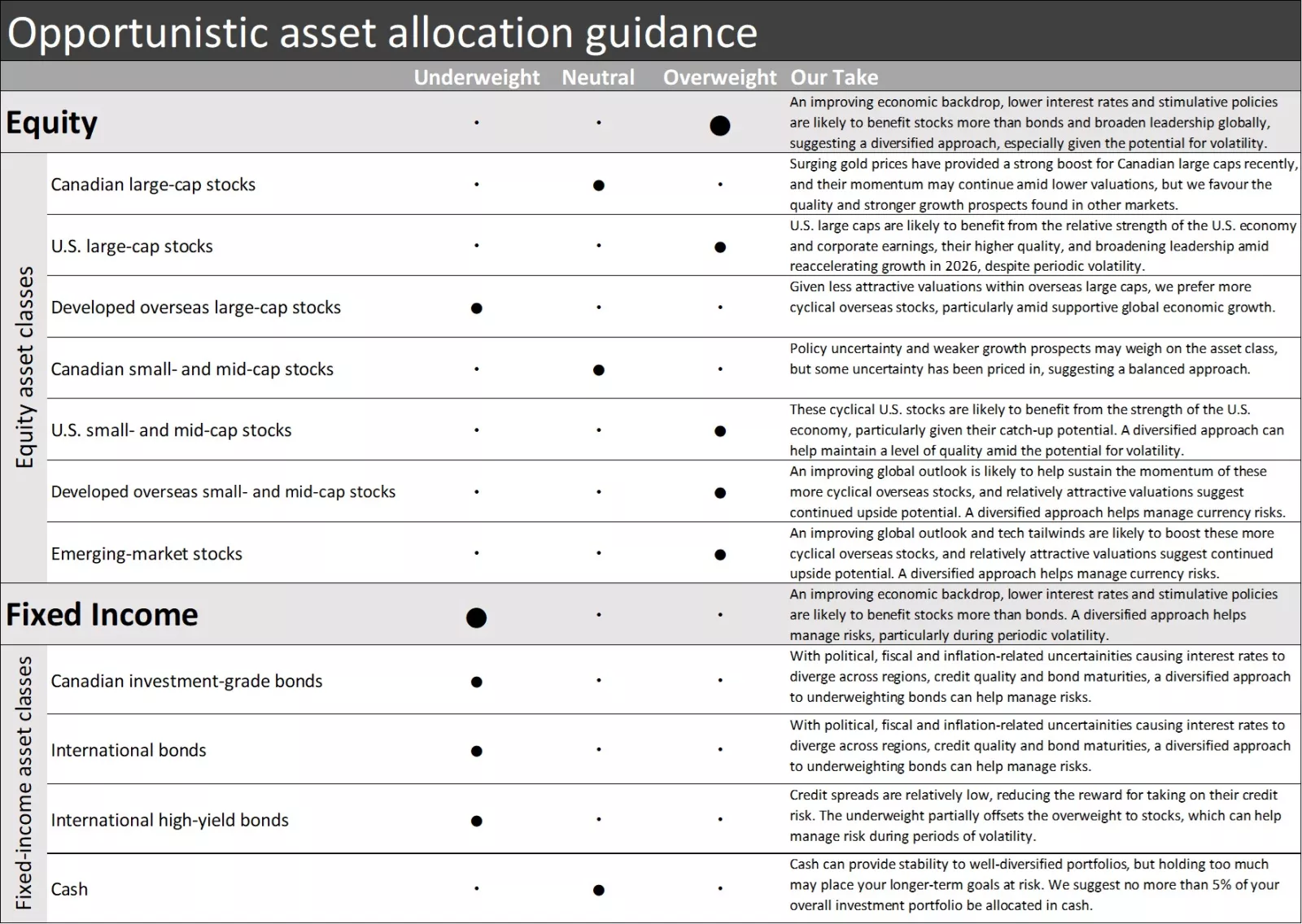

We believe the global outlook remains constructive over the next one to three years, and we favor a mix of quality and cyclical stocks across regions to help manage risk and capture broad opportunities.

- Within overseas allocations, consider a mix of cyclical stocks. While geopolitical risks remain, we believe overseas stocks are a key equity holding over the long term, offering growth to protect spending power against inflation, dividend income potential, and diversification benefits.

Overseas developed-market stocks provide exposure to the United Kingdom, Eurozone, and Japan. In these markets, we favour small- and mid-cap stocks over large caps for their relative valuations and more cyclical nature, which we expect to benefit from increasingly supportive monetary and/or fiscal policies.

Emerging-market stocks have led markets recently and continue to offer relatively attractive valuations. The asset class may benefit from fiscal support, its substantial technology exposure, and the potential for an additional Federal Reserve rate cut or two later this year.

- Within the U.S., consider overweighting a mix of small-, mid- and large-cap stocks to help balance quality and cyclical exposures. We also view a diversified set of U.S. stocks as a core equity holding, offering growth to protect spending power and helping to further spread risks, and we believe solid fundamental growth drivers for U.S. stocks remain intact.

While periodic volatility may occur, we expect lower interest rates, supportive tax policy, the AI-related infrastructure buildout, and steady labour markets and consumer spending to help U.S. stock momentum regain steam over the course of the year.

Large caps tend to offer higher quality and greater tech exposure, while small and mid caps provide more cyclical exposures and tend to carry lower valuations. Therefore, overweighting a mix of these can help uphold the quality of a portfolio while capturing tech tailwinds and the market leadership-broadening impacts of key growth drivers as they play out over 2026.

For investors seeking income and stability, bonds still matter, despite our underweight view overall. While equities present compelling opportunities given our constructive outlook, maintaining appropriate bond allocations remains essential for generating income, managing volatility, and enhancing diversification. When managing your bond portfolio, consider:

- Overweighting longer-term Canadian investment-grade bonds. Given our expectation for the Bank of Canada to remain on pause in the near term and 10-year government yields to fluctuate in the 3% - 3.5% range, we believe the yield advantage of longer-term bonds can help enhance the return potential for a bond portfolio.

- International exposure. With interest rates diverging across regions, adding global bond allocations alongside Canadian bonds can help manage credit and interest rate risks, improving diversification. Therefore, we believe international bond allocations can help reduce overall portfolio volatility. International high-yield bonds may also help to enhance income potential, given their additional yield to help compensate for higher credit risk.

We're here for you

Staying disciplined, goal-focused, and diversified are key to creating a proactive game plan to navigate headlines and the potential for market volatility, but you don't have to build your strategy alone. Talk with your financial advisor about strengthening the foundation of your portfolio. Together, you can identify adjustments designed to help you stay on track even during times that may feel the most uncertain.

If you don’t have a financial advisor, we invite you to meet with an Edward Jones financial advisor to discuss what matters most to you, and the steps you can take to build a personalized portfolio based on your needs.

Strategic portfolio guidance

Defining your strategic investment allocations helps to keep your portfolio aligned with your risk and return objectives, and we recommend taking a diversified approach. Our long-term strategic asset allocation guidance represents our view of balanced diversification for the fixed-income and equity portions of a well-diversified portfolio, based on our outlook for the economy and markets over the next 30 years. The exact weightings (neutral weights) to each asset class will depend on the broad allocation to equity and fixed-income investments that most closely aligns with your comfort with risk and financial goals.

Diversification does not ensure a profit or protect against loss in a declining market.

Within our strategic guidance, we recommend these asset classes:

Equity diversification: Canadian large-cap stocks, U.S. large-cap stocks, developed overseas large-cap stocks, Canadian small- and mid-cap stocks, U.S. small- and mid-cap stocks, developed overseas small- and mid-cap stocks, emerging-market stocks.

Fixed-income diversification: Canadian investment-grade bonds, international bonds, international high-yield bonds, cash.

Within our strategic guidance, we recommend these asset classes:

Equity diversification: Canadian large-cap stocks, U.S. large-cap stocks, developed overseas large-cap stocks, Canadian small- and mid-cap stocks, U.S. small- and mid-cap stocks, developed overseas small- and mid-cap stocks, emerging-market stocks.

Fixed-income diversification: Canadian investment-grade bonds, international bonds, international high-yield bonds, cash.

Opportunistic portfolio guidance

Our opportunistic portfolio guidance represents our timely investment advice based on current market conditions and a shorter-term outlook. We believe incorporating this guidance into a well-diversified portfolio may enhance your potential for greater returns without taking on unintentional risks, helping to keep your portfolio aligned with your risk and return objectives. We recommend first considering our opportunistic asset allocation guidance to capture opportunities across asset classes. We then recommend considering opportunistic equity sector and Canadian investment-grade bond guidance for more supplemental portfolio positioning, if appropriate.

Our opportunistic asset allocation guidance is as follows:

Equity —overweight overall; underweight — Developed overseas large-cap stocks; neutral — Canadian large-cap stock and Canadian small- and mid-cap stocks; Overweight — U.S. large-cap stocks, U.S. small- and mid-cap stocks, developed overseas small- and mid-cap stocks, and emerging-market stocks.

Fixed income —underweight overall; underweight – Canadian investment-grade bonds, international bonds, and international high-yield bonds; neutral — Cash.

Our opportunistic asset allocation guidance is as follows:

Equity —overweight overall; underweight — Developed overseas large-cap stocks; neutral — Canadian large-cap stock and Canadian small- and mid-cap stocks; Overweight — U.S. large-cap stocks, U.S. small- and mid-cap stocks, developed overseas small- and mid-cap stocks, and emerging-market stocks.

Fixed income —underweight overall; underweight – Canadian investment-grade bonds, international bonds, and international high-yield bonds; neutral — Cash.

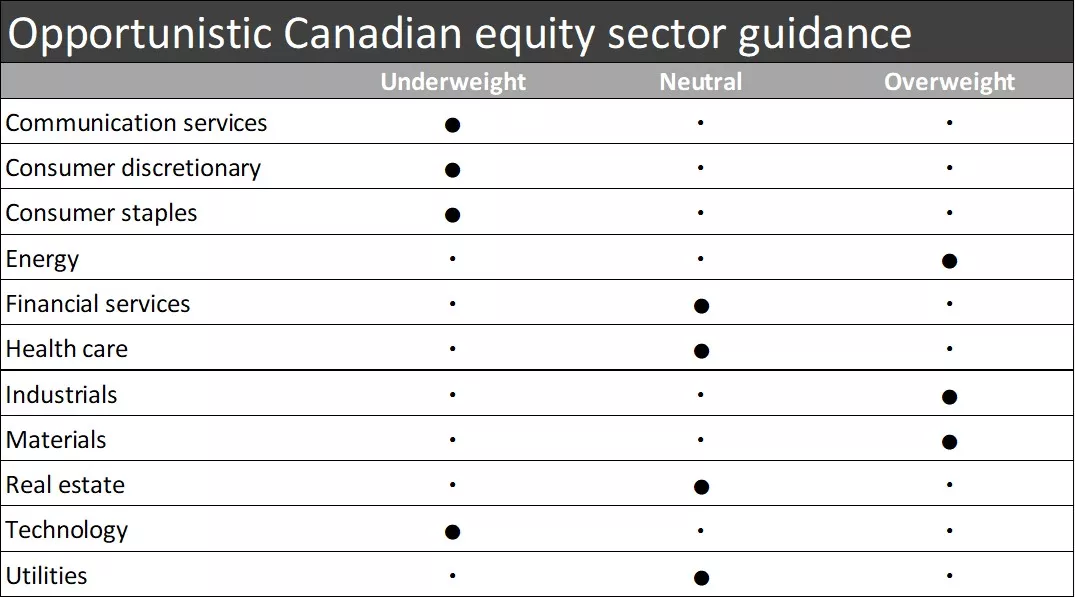

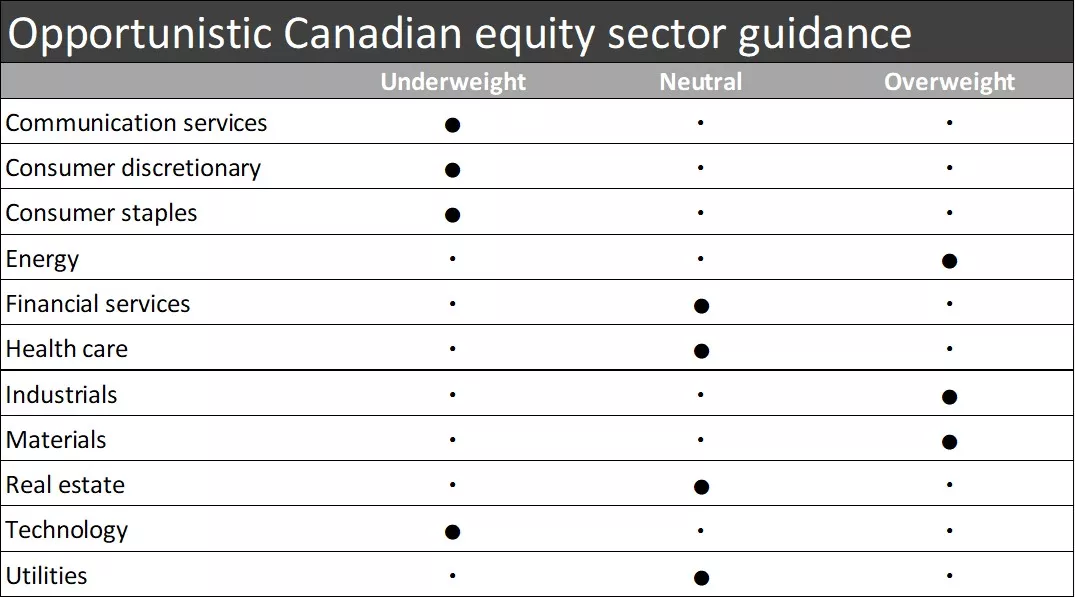

Our opportunistic Canadian equity sector guidance follows:

Overweight for energy, industrials, and materials

Neutral for financial services, health care, real estate, and utilities

Underweight for communication services, consumer discretionary, consumer staples, and financial services and technology

Our opportunistic Canadian equity sector guidance follows:

Overweight for energy, industrials, and materials

Neutral for financial services, health care, real estate, and utilities

Underweight for communication services, consumer discretionary, consumer staples, and financial services and technology

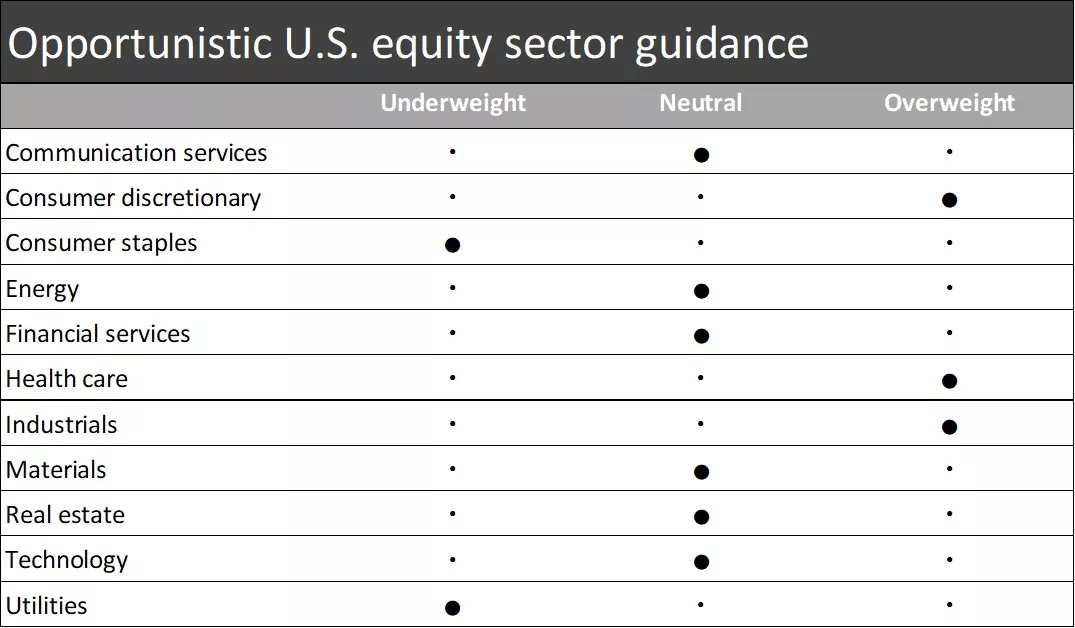

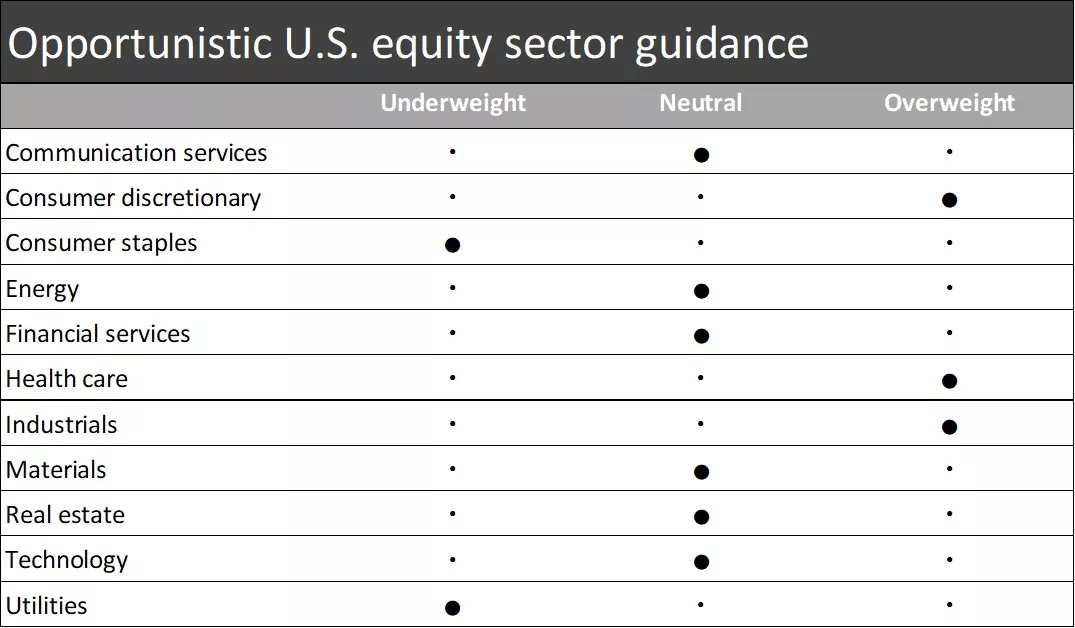

Our opportunistic U.S. equity sector guidance follows:

• Overweight for consumer discretionary, health care, and industrials

• Neutral for communications services, financial services, energy, real estate, technology and materials

• Underweight for consumer staples and utilities

Our opportunistic U.S. equity sector guidance follows:

• Overweight for consumer discretionary, health care, and industrials

• Neutral for communications services, financial services, energy, real estate, technology and materials

• Underweight for consumer staples and utilities

Our opportunistic Canadian investment-grade bond guidance is overweight in interest rate risk (duration) and neutral in credit risk.

Our opportunistic Canadian investment-grade bond guidance is overweight in interest rate risk (duration) and neutral in credit risk.

Tom Larm, CFA®, CFP®

Tom Larm is a Portfolio Strategist on the Investment Strategy team. He is responsible for developing advice and guidance related to portfolio construction, asset allocation and investment performance to help clients achieve their long-term financial goals.

Tom graduated magna cum laude from Missouri State University with a bachelor’s degree in finance. He earned his MBA from St. Louis University, is a CFA charter holder and holds the CFP professional designation. He is a member of the CFA Society of St. Louis.

Important information

Past performance of the markets is not a guarantee of future results.

Diversification does not ensure a profit or protect against loss in a declining market.

Investing in equities involves risk. The value of your shares will fluctuate, and you may lose principal. Mid- and small-cap stocks tend to be more volatile than large-company stocks. Special risks are involved in international and emerging-market investing, including those related to currency fluctuations and foreign political and economic events.

Rebalancing does not guarantee a profit or protect against loss and may result in a taxable event.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.

The opinions stated are as of the date of this report and for general information purposes only. This information is not directed to any specific investor or potential investor, and should not be interpreted as a specific recommendation or investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation.