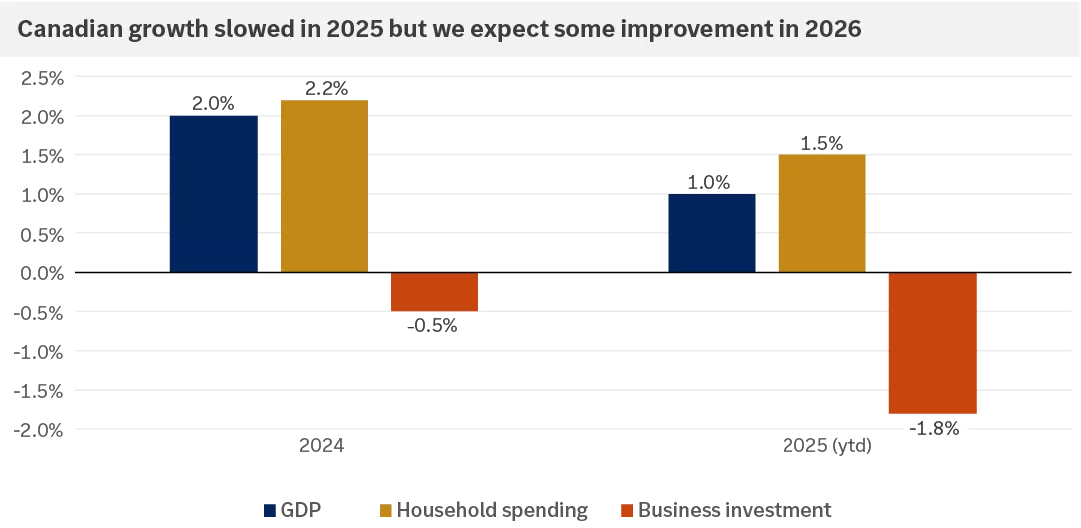

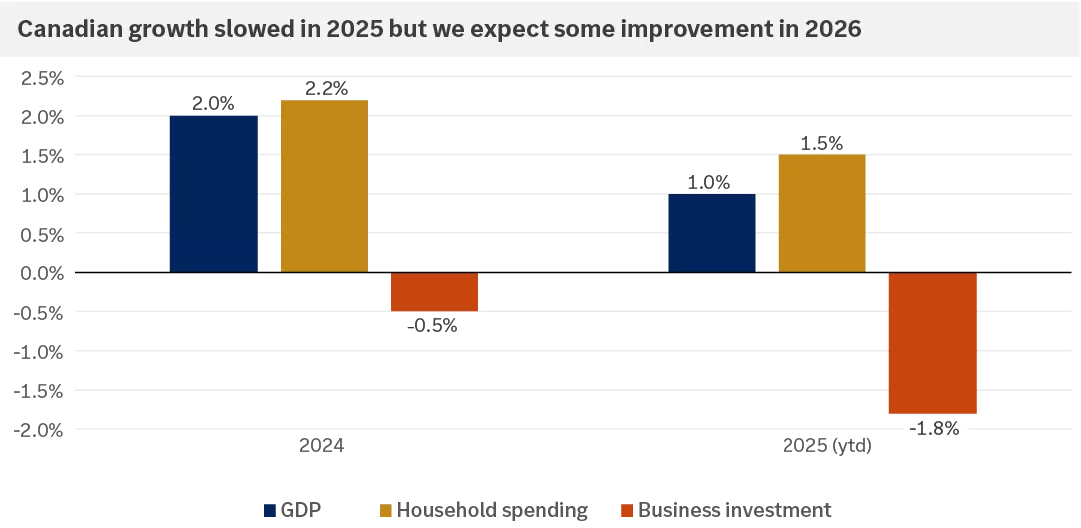

The economy struggled in 2025 in the wake of a trade war with the United States. A fading drag from this dispute should help activity rebound in 2026, especially with the recently passed budget set to boost growth and interest rates at more supportive levels.

President Trump's threats to deliver significant tariff hikes on closely integrated US-Canada trade prompted large swings in activity over 2025 and even sparked concerns of a potential recession. The worst fears around tariffs were not realized as large segments of trade under the Canada-United States-Mexico Agreement (CUSMA) are excluded from these potentially harmful increases. Still, tariffs have increased materially in some sectors and growth has slowed to a meagre 1% annualized so far in 2025.

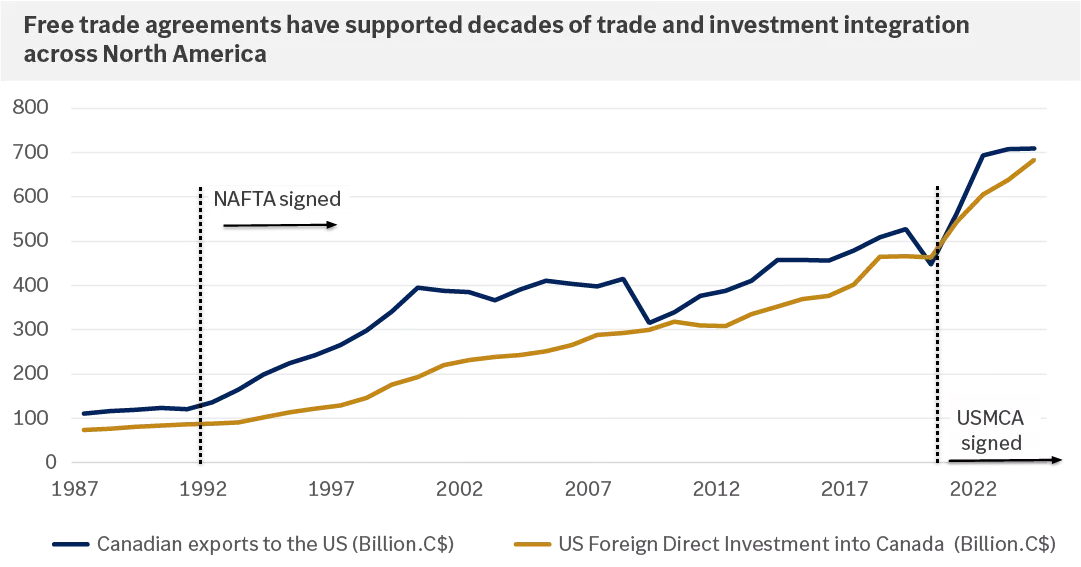

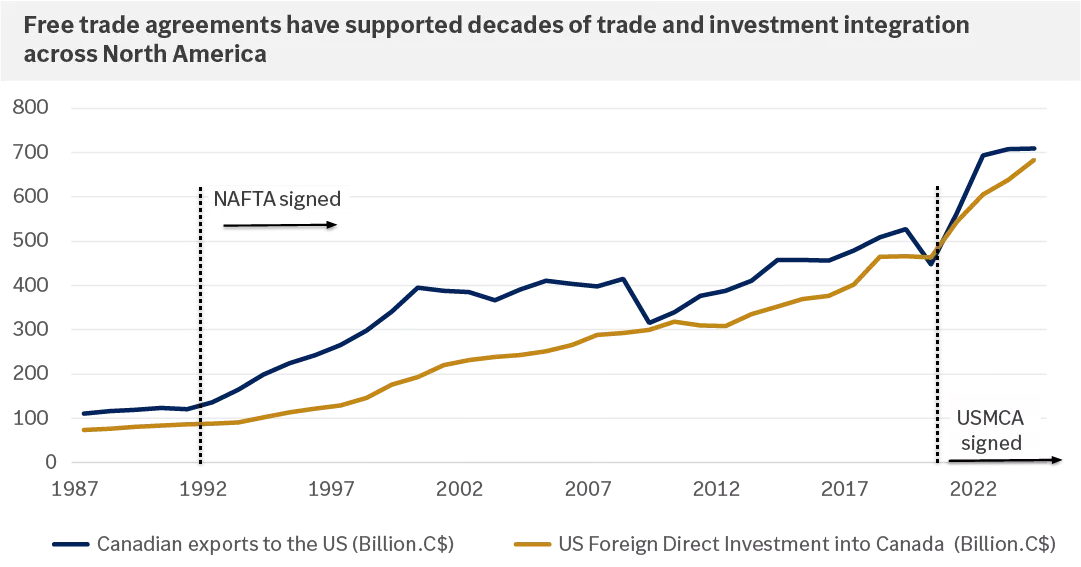

CUSMA is scheduled for review in 2026, and President Trump has already threatened to walk away from the free trade deal he signed during his first term. While grandstanding is to be expected, we think the agreement that underpins closely integrated North America supply chains will remain in place, and we could even see these ties deepen in strategic sectors.

A ratified CUSMA, and more stable U.S. tariff policy, should help alleviate some of the uncertainty around this trade relationship which has weighed on activity. Additionally, the decision to reverse Canadian reciprocal tariffs on U.S. exports has lessened fears that these could push inflation higher or weigh on corporate profitability.

Alongside a, hopefully, more stable trade relationship we should also see fiscal policy provide an uplift to growth. The 2025 budget launched a swathe of strategic investments in housing, infrastructure and defense, only partially offset by tighter limits on departmental spending and headcounts. The upshot should be some uplift to growth, even if it takes time for some of the investment spending to kick into gear. Finally, Bank of Canada easing delivered in 2025 should provide modest support over 2026, consistent with the lags we might expect around interest rate cuts.

All told, we expect GDP growth to rebound back to 2% by the end of next year.

The charts shows how Canadian growth slowed in 2025 compared to Canadian growth in 2024.

The charts shows how Canadian growth slowed in 2025 compared to Canadian growth in 2024.

The labour market has been a weak spot in Canada through much of 2025.

In part, this reflects the fallout from this year's trade war with the United States. Employment in sectors with a high sensitivity to exports south of the border fell by more than 5% in 2025, with layoffs reported in the hardest hit sectors such as steel, aluminum and autos.

Outside these sectors we have seen less distress, but still clear signs of sluggishness. Private sector employment is up over the year, albeit by less than in 2024, with business surveys suggesting that concerns over the outlook and weak growth are discouraging hiring.

Meanwhile, public sector employment has lagged the private sector slightly, and this gap is likely to widen in coming years with the recent budget aiming to cut government headcount, in part to help fund rising public investment.

In 2026, we would expect private hiring to pick up, (hopefully) helped by an easing in trade policy uncertainty, and an accompanied improvement in Canadian growth. In fact, we may already be seeing signs of this turnaround. The economy added 180,000 jobs cumulatively between September and November, the strongest seen in more than a year.

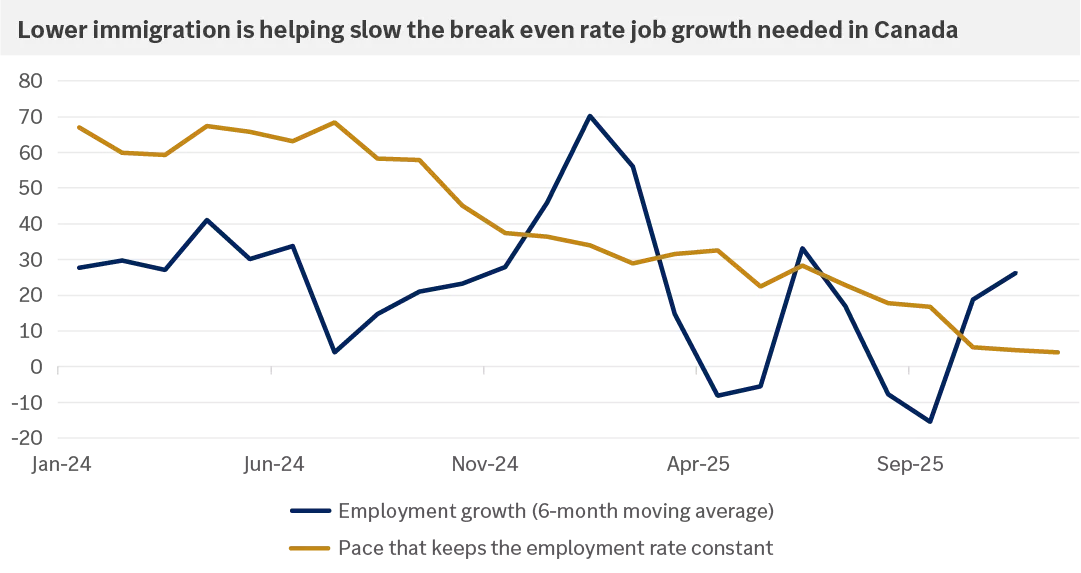

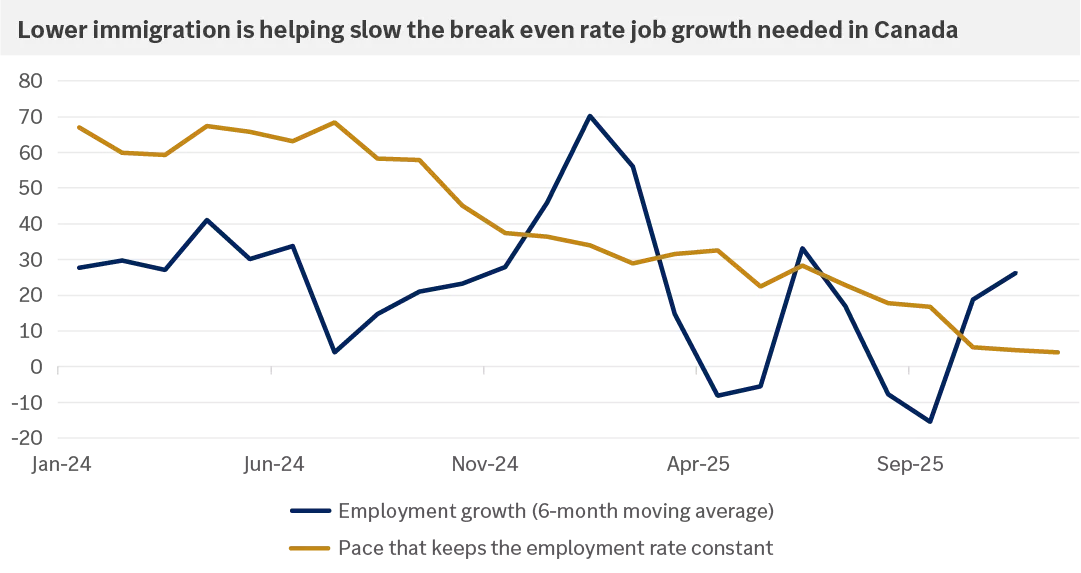

If we are right that this improvement has legs, then we will have already seen the peak in Canadian unemployment rates. Headline unemployment reached a concerning 7.1% over the summer but has since fallen back to 6.5%. An ongoing slowdown in immigration and labour force growth means that we only need modest employment gains of around 5,000 per month to keep unemployment rates stable. Any sustained improvement in hiring beyond this replacement rate could help push unemployment lower through 2026.

The chart depicts how, from January 2024 through the Fall of 2025 on 6-month moving average, lower immigration is helping slow the break even rate job growth needed in Canada by comparing the employment growth and the pace of that keeps the employment rate constant.

The chart depicts how, from January 2024 through the Fall of 2025 on 6-month moving average, lower immigration is helping slow the break even rate job growth needed in Canada by comparing the employment growth and the pace of that keeps the employment rate constant.

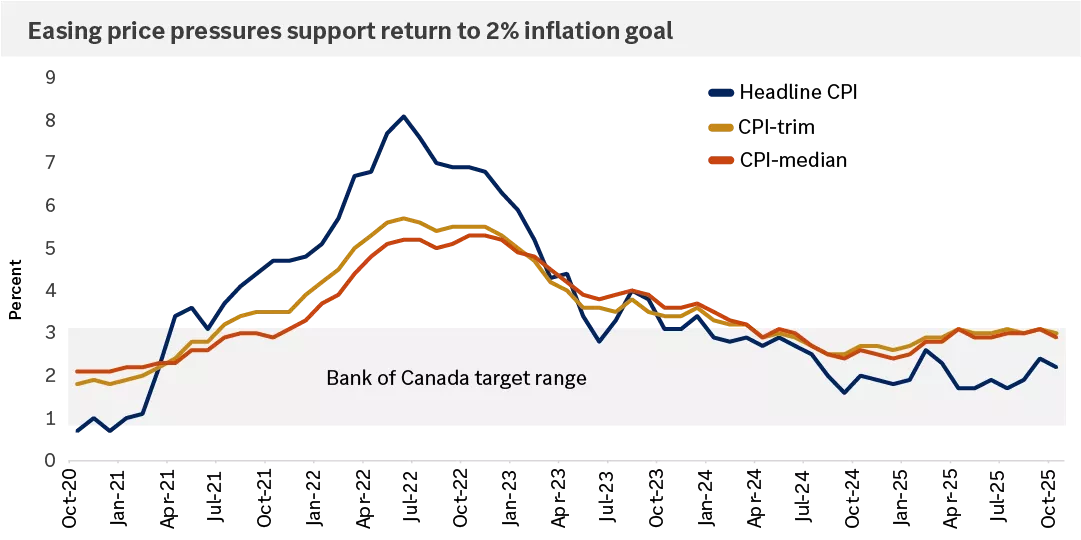

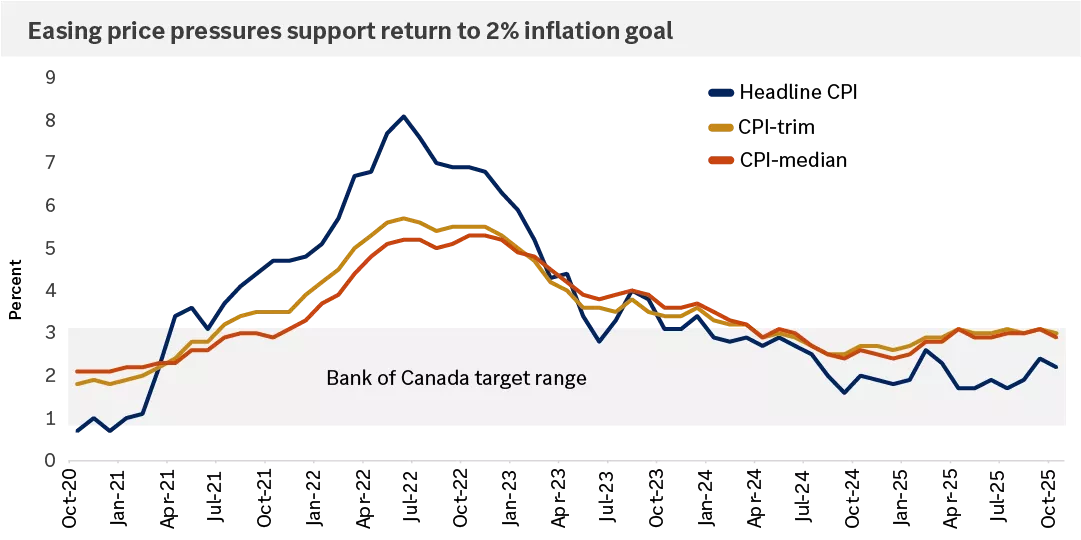

Canada’s consumer price index (CPI) made notable progress in 2025, moving back within the Bank of Canada’s 1% - 3% target range. Headline inflation1 averaged near 2%, supported by lower energy prices. However, core inflation2 remained around 3%, as wages and service costs cooled more slowly. We expect easing pressures across goods and services to bring core inflation down to roughly 2% by late 2026.

On the goods side, the government’s rollback of counter-tariffs on U.S. imports should reduce upward price risks. In services, labour market slack is likely to normalize wage growth to pre-pandemic levels, while slower immigration may temper rent increases. Encouragingly, business surveys show few firms reporting shortages and planned price hikes for the coming year align with a gradual moderation in core inflation.

In the U.S., we expect inflation to remain above the Federal Reserve (Fed)’s target through 2026, supported by stable economic growth and lingering price pressures. However, we do not anticipate a major reacceleration and assume that headline inflation will likely remain in the 2.5% - 3.0% range and show modest improvement by year-end compared to 2025.

Tariffs have contributed to a pickup in goods prices, a trend likely to persist early in the year before fading by mid-2026. Absent another major trade escalation, we see tariffs as a one-off increase and a temporary driver of inflation for both Canada and the U.S.

Services inflation, which accounts for 75% of the core CPI basket, remains sticky but on a gradual path of moderation. A slowdown in home prices and rents suggests further downside in shelter inflation. Beyond housing, services inflation is heavily influenced by the labour market. While softening conditions — rising unemployment, fewer job openings and slower quits — should keep wage growth muted, structural constraints, such as lower immigration and an aging population, may keep wages above pre-pandemic levels. Longer term, productivity gains from AI could act as a disinflationary force, though this may simply offset pressures from high government spending and deglobalization.

This chart shows the path of Headline consumer price index (CPI), CPI-trim, and CPI-median since 2020 and the Bank of Canada target range.

This chart shows the path of Headline consumer price index (CPI), CPI-trim, and CPI-median since 2020 and the Bank of Canada target range.

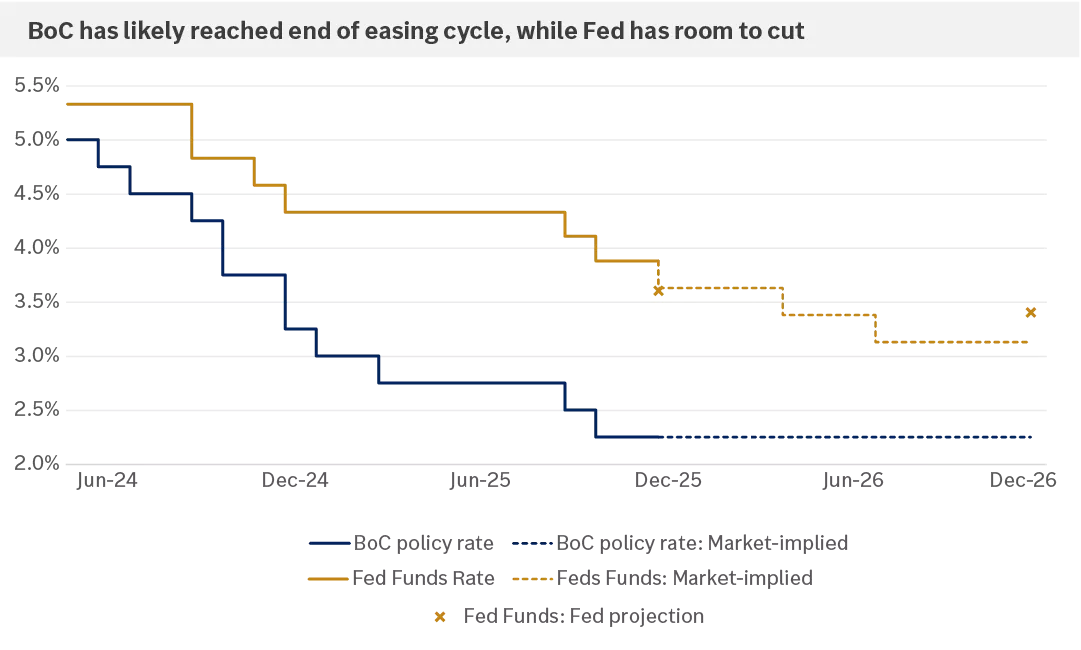

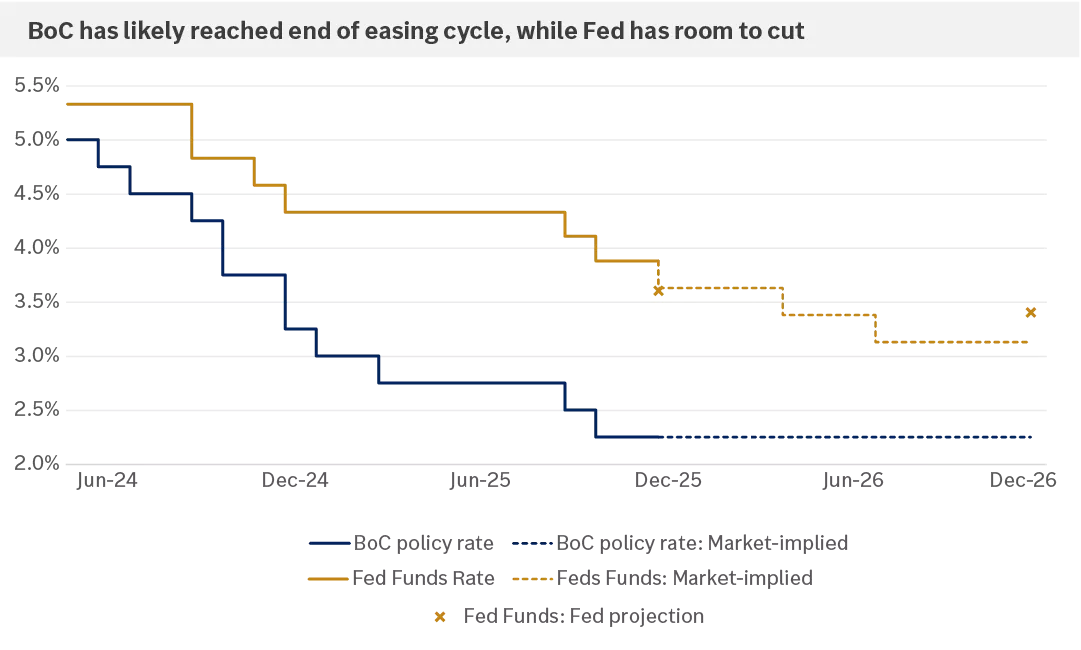

With the Bank of Canada's (BoC) policy rate at the lower end of its own 2.25%‒3.25% estimate for neutral interest rates, we believe the BoC is at the end of its easing cycle. While core Consumer Price Index (CPI) inflation remains elevated to start the year, we expect it to cool toward the 2% target. The BoC's inflation-control range allows CPI to fluctuate between 1% and 3% if needed, providing flexibility to keep rates low in support of the labour market and broader economy.

In the U.S., CPI inflation slowing toward 2.5%‒3.0% should enable the Federal Reserve (Fed) to continue its rate-cutting cycle in 2026, narrowing the gap between U.S. and Canadian short-term yields. Importantly, this easing reflects a cooling labour market and moderating inflation rather than an economic downturn. However, ongoing economic resilience and inflation remaining above target suggest the Fed easing cycle may be shallow from here.

In 2025, the Fed concluded its balance sheet reduction program, known as quantitative tightening (QT). This step should help enhance liquidity by stabilizing bank reserves — deposits by banks at the Fed, widely regarded as among the highest-quality and most liquid assets in the banking system. We expect the Fed to resume expanding its balance sheet in 2026, to ensure adequate reserves, serving as another source of policy easing.

The Fed's preferred inflation gauge — core personal consumption expenditure (PCE) — typically runs slightly below CPI inflation, partly because it assigns a smaller weight to shelter, where prices have risen faster historically. PCE also adjusts for changes in consumer behaviour more quickly, such as substitution for cheaper goods and services as prices rise. Consequently, core PCE could drift closer to 2.5% next year, with a neutral policy rate around 0.75%‒1% above U.S. inflation.

While not our belief, upside risks to this outlook include lingering inflation becoming entrenched or even accelerating — potentially spurred by tariffs feeding through to goods prices or higher wages pressuring services inflation — which could slow the pace of Fed rate cuts. Conversely, a sharper labour-market slowdown could prompt both central banks to move more aggressively.

Cash yields have fallen to the low-2% range alongside BoC rate cuts. Some Canadians remain overweight in cash-like investments, including money market funds, which attracted significant inflows in recent years due to elevated yields. Cash offers important benefits, such as funds for unexpected expenses, short-term savings goals and everyday spending. However, holding too much cash can pose the risk of lower long-term returns. After evaluating how much cash you need through your financial plan, speak with your advisor to determine where to reinvest any excess cash — in a way that aligns to your personal financial goals.

This chart shows the Bank of Canada policy rate and federal funds rate since 2024 and market-implied expectations and Fed projections through 2026.

This chart shows the Bank of Canada policy rate and federal funds rate since 2024 and market-implied expectations and Fed projections through 2026.

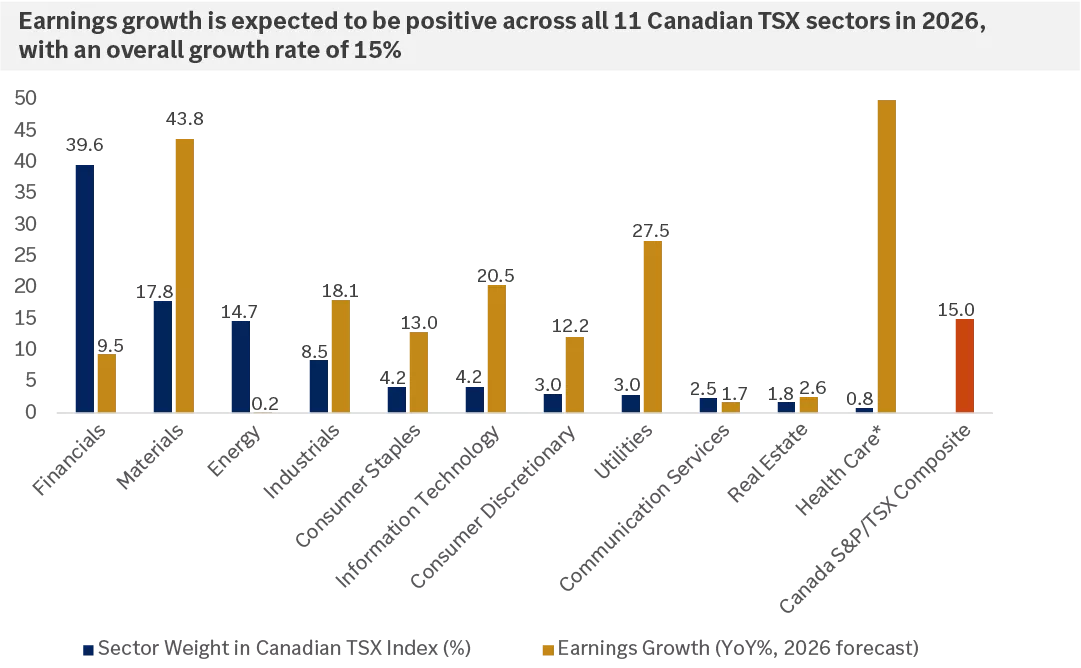

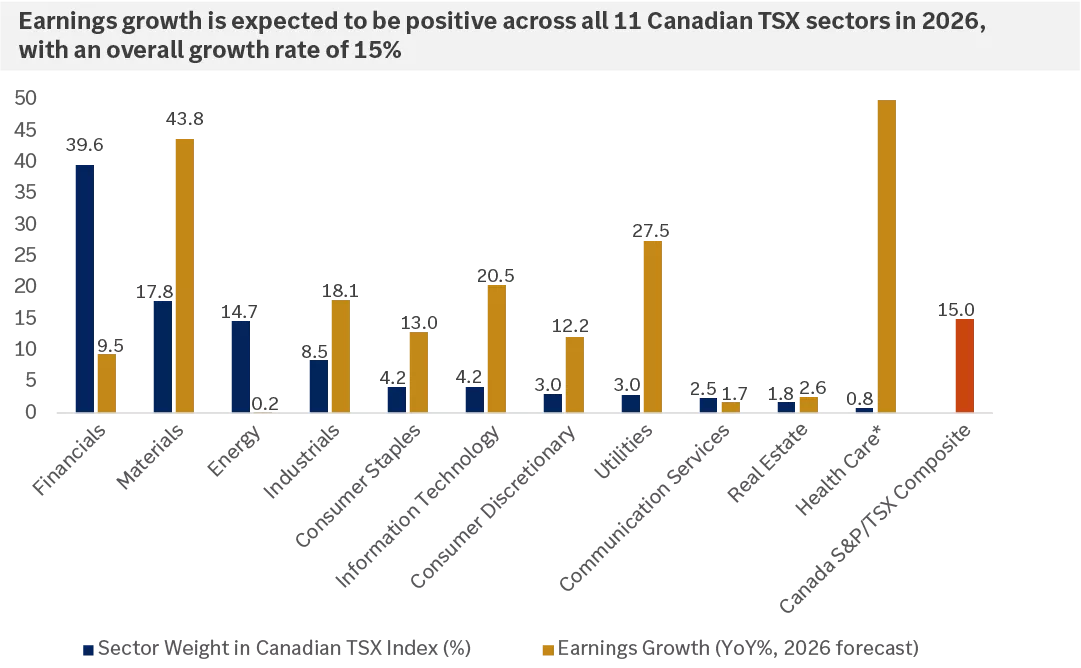

Canadian equity markets moved higher for the third year in a row in 2025, driven by an impressive run in the materials sector, which was up over 85% for the year. In the U.S., stock markets also saw gains for a third year, largely driven by the technology and artificial intelligence (AI) sectors. Notably, equity markets were able to overcome the volatility we saw early in April of 2025, when tariff uncertainty wreaked havoc on both Canadian and U.S. stocks.

We believe the reason for the positive returns was largely driven by robust earnings growth, both in Canada and the U.S. In Canada, the materials sector earnings grew around 65% year-over-year, driven by a rise in gold and commodity prices broadly, while in the U.S., mega-cap technology firms delivered substantial upside to earnings growth in 2025 and reaffirmed strong outlooks for 2026. The key question for investors now is whether stock markets can deliver positive gains for a fourth year.

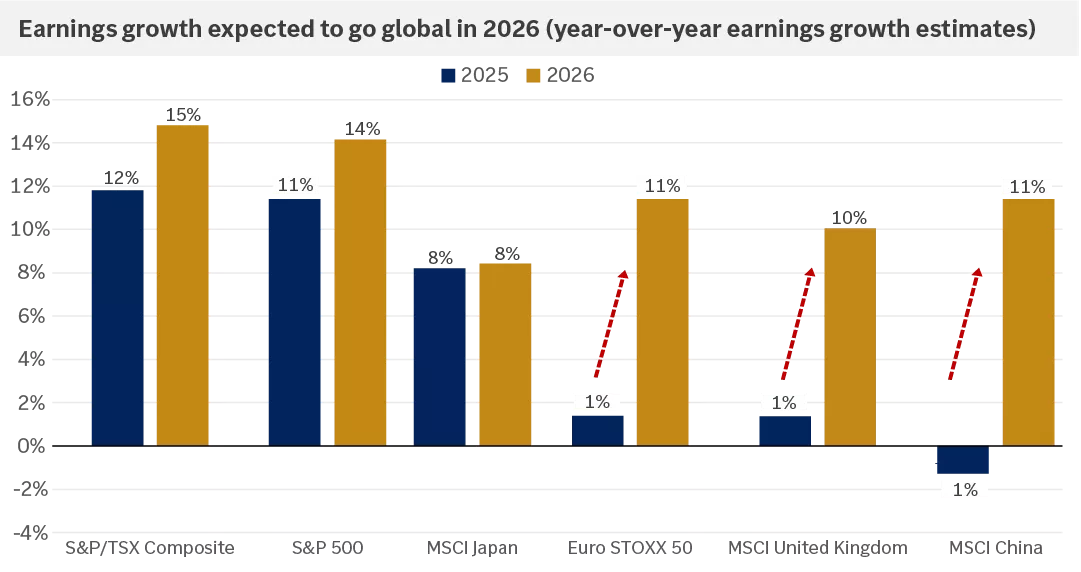

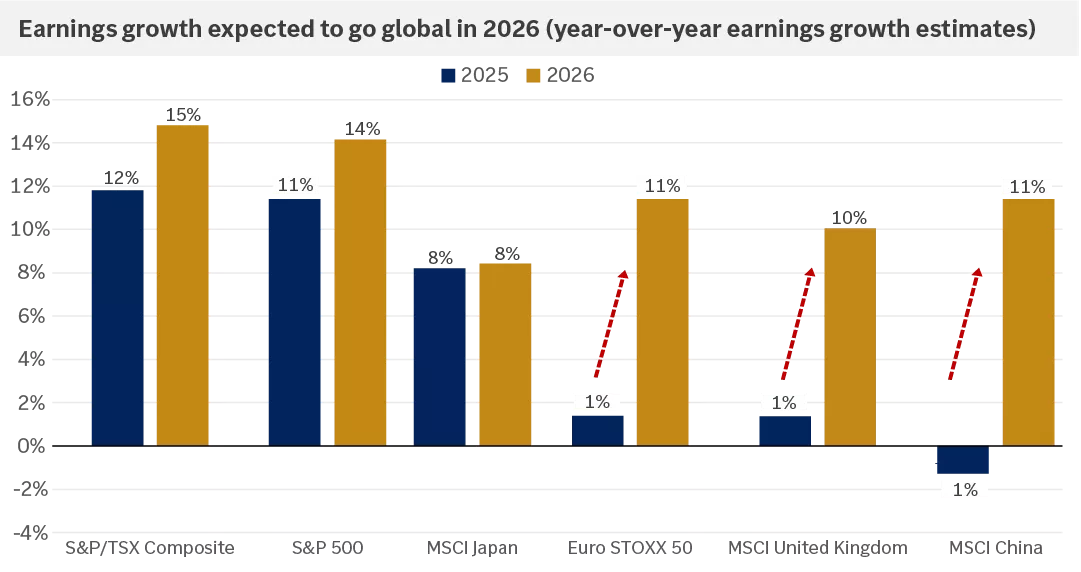

In our view, the answer lies largely in the earnings outlook for 2026. Keep in mind that stock market returns tend to be driven by two key factors: earnings growth and valuation expansion. Given that both Canadian and U.S. markets have seen rising equity multiples in 2025, driven in part by central banks lowering interest rates, we think the scope for valuation expansion in 2026 remains muted. Thus, earnings growth will have to do most of the heavy lifting to support stock market returns.

The good news is that we believe both Canadian and U.S. stocks can deliver double-digit earnings growth in 2026. For both the Canadian TSX and S&P 500, all eleven sectors are expected to have positive earnings growth in the year ahead. In Canada, sectors beyond materials and technology are forecast to see double-digit growth, including industrials and utilities. And in the U.S., both tech and non-tech parts of the market are also expected to deliver solid earnings, including sectors like industrials and financials.

How do we think about portfolio positioning in this backdrop? In our view, given where we are in this cycle, the case for diversification in equity markets is more compelling in 2026. We favour U.S. large-cap stocks, which are exposed to artificial intelligence (AI), alongside U.S. midcap stocks, which are more weighted towards cyclical sectors and have scope for catch-up, especially as the Federal Reserve potentially continues to lower interest rates. We also recommend looking globally, both at emerging-market stocks, which can do well in a rate-cutting cycle and offer exposure to a global technology theme, as well as in developed overseas small and mid-cap stocks, which have relatively favourable valuations. Finally, among Canadian equities, we remain overweight in the materials, industrials, and energy sectors, all of which we think have favourable outlooks and earnings growth profiles in 2026.

This chart shows earnings growth is expected to be positive across all 11 Canadian TSX sectors in 2026, with an overall growth rate of 15%

This chart shows earnings growth is expected to be positive across all 11 Canadian TSX sectors in 2026, with an overall growth rate of 15%

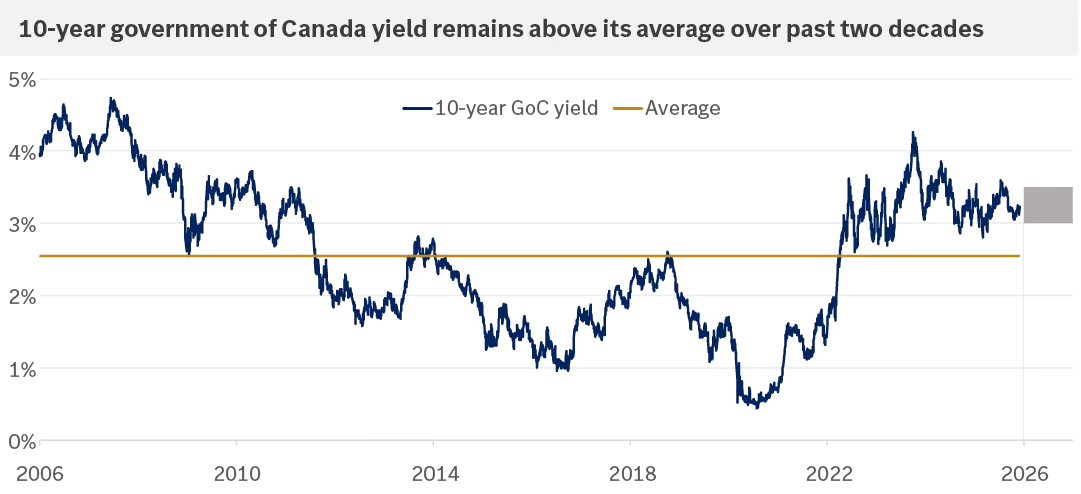

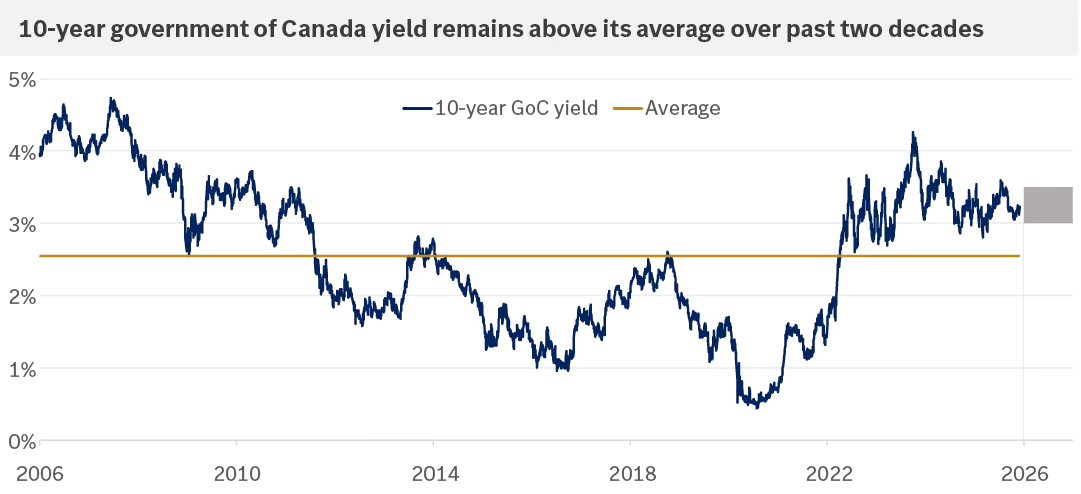

With the Bank of Canada (BoC) likely holding its policy rate in the 2.0%‒2.5% range and the Federal Reserve (Fed) cutting toward 3.0%‒3.5%, a positive yield curve should keep intermediate-term bond yields above these levels. We expect the benchmark 10-year Government of Canada (GoC) yield to remain largely within the 3.0%‒3.5% range.

Although 10-year yields may temporarily overreach , we would expect them to drift back toward these ranges. Treasury bill purchases by the BoC and Fed should help anchor the short end of both yield curves near central bank policy rates, likely limiting upside pressure on yields. Conversely, resilient economic growth, budget deficit concerns, and inflation risks typically drive yields higher, making a sustained drop unlikely, in our view.

Despite pulling back from recent peaks as the BoC and Fed cut rates, 10-year GoC yields remain attractive — above their average over the past two decades, shown in the chart below. Since GoC bonds serve as the benchmark for most Canadian investment-grade bonds, elevated yields should provide a foundation for solid returns ahead, with most of the contribution coming from income rather than price appreciation.

On the credit side, credit spreads — the excess yield above GoC bonds to compensate for default risk — have tightened below historical averages. We see little room for further narrowing, and any potential widening could drive yields higher and bond prices lower. Resilient growth could provide a stable backdrop for credit conditions, allowing investment-grade credit spreads to remain relatively contained.

Canadian investment-grade bonds offer a yield advantage of more than 100 basis points (1.0%) on average over cash. Since yield is a key driver of fixed-income returns, this sets the stage for bonds to outperform cash again in 2026 as they have in 17 of the past 23 years. For perspective, since 2002, Canadian investment-grade bonds have generated annualized returns of 3.9%, compared with 1.9% for cash.

This chart shows the 10-year Government of Canada yield and its average since 2006, as well as our expectations for 2026.

This chart shows the 10-year Government of Canada yield and its average since 2006, as well as our expectations for 2026.

2025 was a strong year for overseas equities, with markets in Germany, France, the United Kingdom, and Japan all reaching new all-time highs.3 We anticipate that 2026 will be another favourable year for global economies and markets, underscoring the importance of diversification. While the robust performance of 2025 may be challenging to replicate, we believe there are compelling reasons to remain optimistic about overseas stocks in 2026.

Eurozone economies are beginning to benefit from the European Central Bank’s (ECB) rate-cutting cycle, as evidenced by rising loan demand and improving business activity surveys.3 Furthermore, fiscal stimulus measures announced by Germany in the spring are expected to bolster economic activity in the eurozone’s largest economy throughout 2026. With the sharp rally in European equities during 2025 largely valuation-driven, we see potential for earnings growth to play a more prominent role in supporting equity markets this year.

In the United Kingdom, persistently high inflation has prompted a cautious approach to monetary easing by the Bank of England (BoE). However, with signs of labour market softening, the BoE may have room to continue easing policy in 2026, potentially supporting economic activity. Similar to the eurozone, the U.K. economy has shown signs of strengthening loan demand, and survey-based indicators of business activity have improved.3

Turning to Japan, despite demographic headwinds and U.S. auto tariffs, economic activity remained resilient in 2025, and could be further supported in 2026 by a pro-growth policy agenda under Japan’s new government.3 Notably, corporate governance reforms implemented over the past decade appear to be bearing fruit, with Japanese company profit margins reaching a 20-year high in 2025.4

Taken together, we believe developed overseas stocks merit an allocation within diversified portfolios. In our view, the combination of economic momentum in the eurozone, improving profitability among Japanese corporations, the potential for accelerating earnings growth, and relatively attractive valuations — particularly among small- and mid-cap companies — supports the case for another year of positive returns in 2026.

Within emerging markets, economic activity in China has been subdued, with a battered property sector dampening consumer confidence and loan demand.3 Additionally, U.S. trade policy has contributed to sluggish manufacturing activity in the world’s second-largest economy, and trade tensions between the U.S. and China are likely to persist in 2026.

Nevertheless, we view emerging-market stocks as a means of gaining exposure to the artificial intelligence (AI) race at relatively attractive valuations. Additionally, emerging-market stocks have historically performed well in the periods following Federal Reserve interest rate cuts, which we believe creates a constructive backdrop for 2026.

This chart shows earnings growth estimates for 2025 and 2026 for the S&P/TSX Composite, S&P 500, MSCI Japan, Euro STOXX 50, MSCI U.K. and MSCI China Indices. Strong earnings growth across each of these regions is expected in 2026.

This chart shows earnings growth estimates for 2025 and 2026 for the S&P/TSX Composite, S&P 500, MSCI Japan, Euro STOXX 50, MSCI U.K. and MSCI China Indices. Strong earnings growth across each of these regions is expected in 2026.

After a mostly uninterrupted 15-year bull market, the U.S. dollar came under pressure in 2025, particularly against the euro. Political and fiscal uncertainty, combined with a narrowing yield advantage relative to other developed markets and increased currency hedging by foreign investors contributed to the U.S. dollar’s decline. However, the sharp fall early in the year reignited debate over whether the U.S. dollar is at risk of losing its status as the global reserve currency. In our view, the U.S. dollar’s central role in global trade and finance is unlikely to change in the foreseeable future.

One way to assess global confidence in a currency is by examining its share of foreign exchange reserves — assets held by central banks in non-domestic currencies. In Q2 2025, the U.S. dollar accounted for 53.3% of global foreign exchange reserves, more than twice the share held in euros, the second-largest reserve currency.5 Additionally, the U.S. dollar has remained the dominant currency for international payments, comprising approximately 50% of global transactions in 2024, up from around 30% in 2012.6 We believe the relative stability of the U.S. economy and its deep integration with global markets will support continued U.S. dollar dominance in the international financial system.

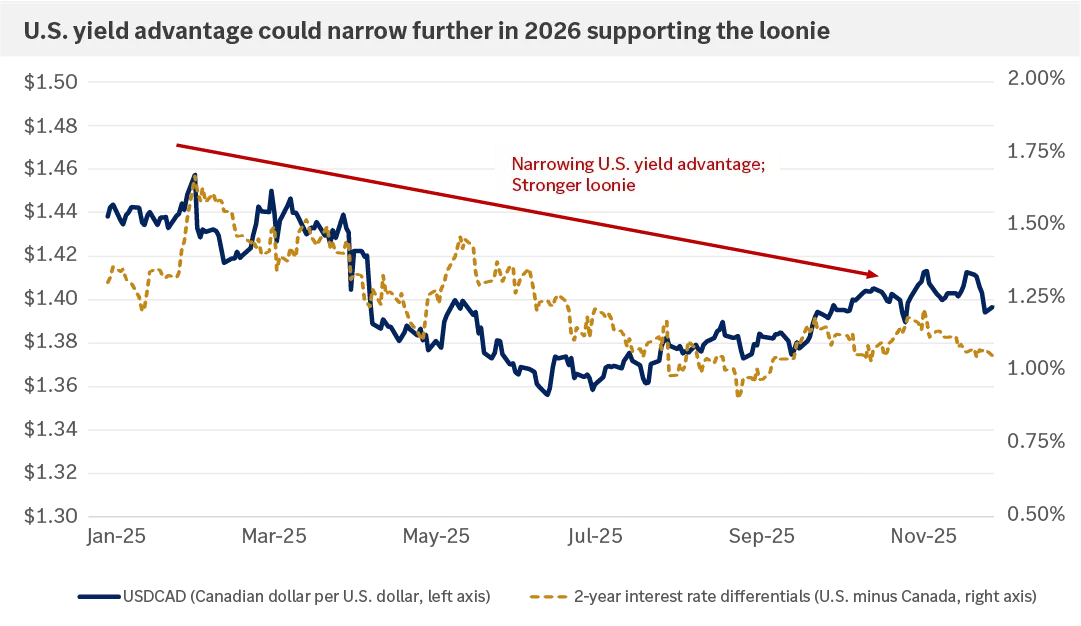

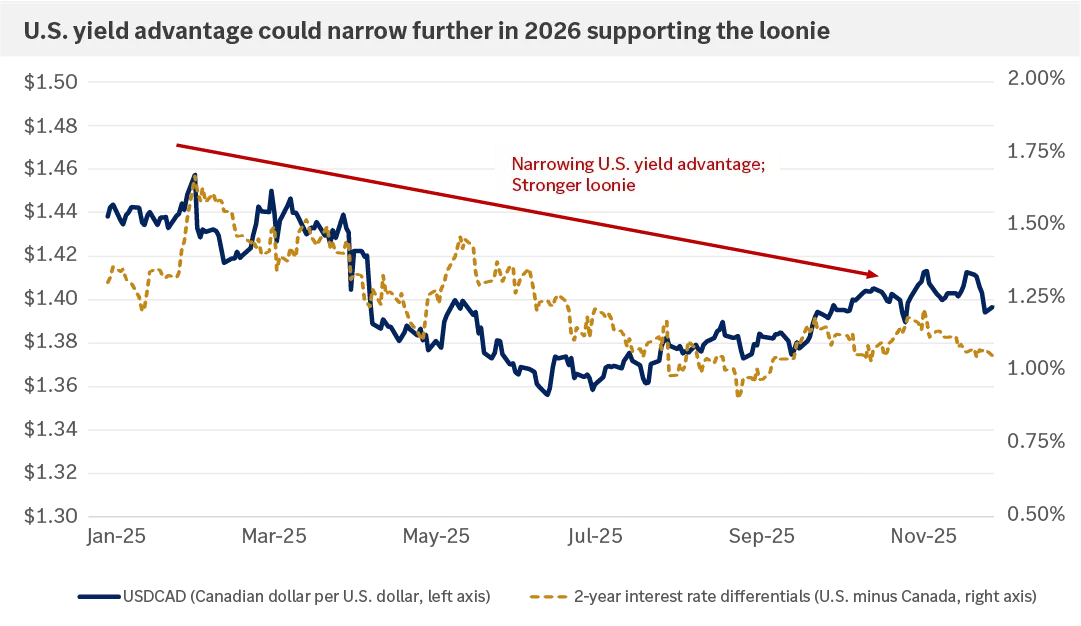

While we expect the U.S. dollar’s dominant role in global markets to persist, we see potential for a flat to weaker U.S. dollar versus the loonie in 2026. The U.S. yield advantage — across both short- and long-term maturities — narrowed relative to Canadian government bond yields in 2025. Based on our expectation for additional interest rate cuts from the Federal Reserve, and our view that the Bank of Canada has likely reached the end of its easing cycle, we anticipate the U.S. yield advantage could narrow further relative to Canada, particularly in shorter maturities, potentially supporting the loonie.

On the flip side, the opposite could hold true for the loonie when compared with overseas currencies. With the European Central Bank likely at the end of its easing cycle and signs of improving economic activity in the eurozone, we see limited scope for yields to decline there. Additionally, the Bank of Japan is expected to continue raising its policy rate in 2026. Taken together, overseas yields could rise relative to those in Canada, potentially putting downward pressure on the loonie and reinforcing the case for maintaining a globally diversified portfolio.

This chart shows the relationship between 2-year government bond yield differentials in the U.S. and Canada relative to the USDCAD exchange rate. In 2025, a narrowing U.S. yield advantage coincided with a stronger loonie.

This chart shows the relationship between 2-year government bond yield differentials in the U.S. and Canada relative to the USDCAD exchange rate. In 2025, a narrowing U.S. yield advantage coincided with a stronger loonie.

2025 was a blockbuster year in politics and policy.

While the Trump Administration in the U.S. kicked off a trade war with Canada (and other trade partners), the Liberal government delivered a remarkable turnaround to hold onto power in the April snap election, and Prime Minister Carney used this mandate to pass a budget that aims to drive significantly higher federal (and private) investment in Canada, while also shrinking parts of the federal government.

2026 should be quieter, but with the renegotiation of the Canada-United States-Mexico Agreement (CUSMA) scheduled, we can't rule out further fireworks.

Critically, this agreement has shielded the North American economy from many of the tariff increases delivered by the U.S. in 2025. Talks will continue in 2026 to address tariffs that have not been fully protected by this free trade deal, most notably in the steel, aluminum and auto sector. However, most important will be how the deal evolves during the 2026 review.

President Trump has already threatened to withdraw from the agreement he signed in 2020, similar to past threats to leave its predecessor, North American Free Trade Agreement (NAFTA). We suspect we will see more grandstanding from the U.S. around these talks. However, we are mindful that the deep integration of Canadian, U.S., and Mexican supply chains developed over recent decades provide a powerful incentive against drastic changes.

There has been talk around potentially deepening the trade agreement, to encourage higher reciprocal investment and trade across strategic sectors such as energy, autos and technology. While these ideas might be ambitious, at least largely preserving the status quo will be an important step in underpinning short- and long-term growth across the continent.

Prime Minister Carney is looking to further diversify Canada's export markets, which are currently very focused on the U.S. However, any reorientation, if successful, will take years to accomplish, highlighting the importance of stabilizing trade policy across North America next year.

This chart shows how free trade agreements have supported decades of trade and investment integration across North America, with a noticeable increase beginning in 1992 when NAFTA was signed through 2022 with the signing of USMCA.

This chart shows how free trade agreements have supported decades of trade and investment integration across North America, with a noticeable increase beginning in 1992 when NAFTA was signed through 2022 with the signing of USMCA.

Our base case for 2026 calls for a relatively benign year: improving economic growth, modest fiscal stimulus, steady interest rates and rising corporate profits, all of which provide a supportive backdrop for financial markets. However, it is certainly worthwhile to highlight where our team sees the biggest tail risks and potentially disruptive forces for this scenario. The three biggest risks that could test market resilience in our view are artificial intelligence (AI) disappointments, renewed trade tensions with the U.S., an inflation surprise and credit stress.

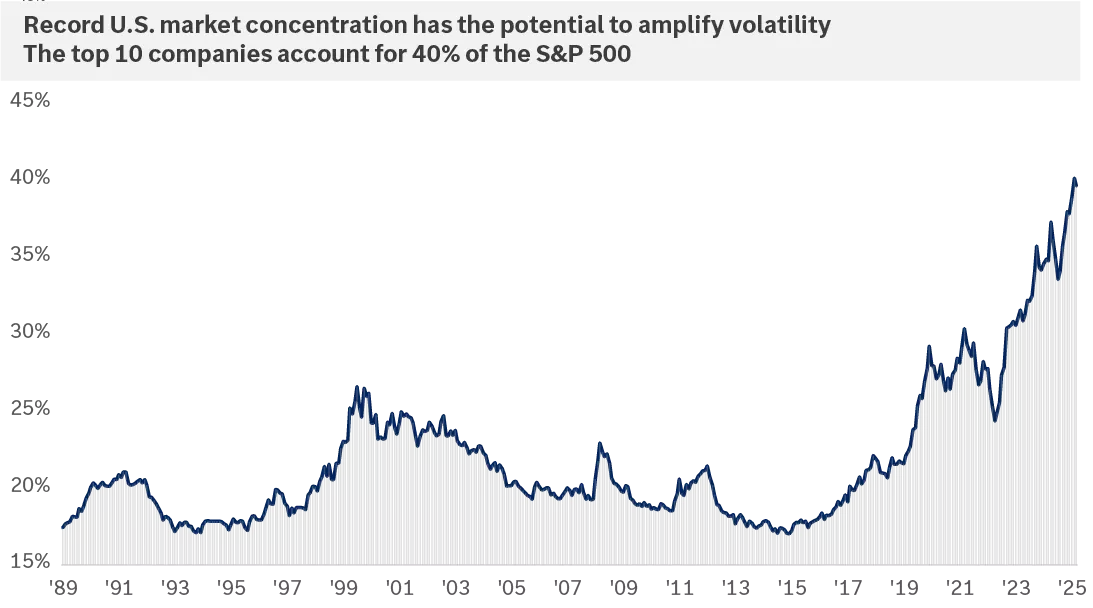

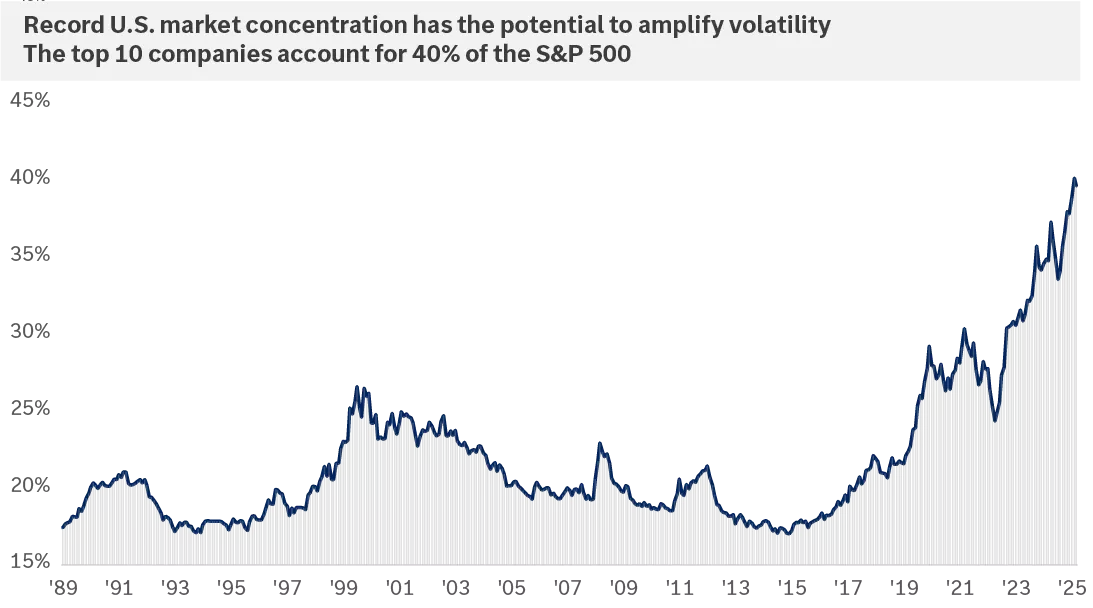

AI represents one of the most transformative technological advances in recent history and has already shaped market performance, with U.S. mega-cap technology stocks driving much of the gains for globally diversified portfolios. Yet after a historic three-year rally, with the top 10 stocks now accounting for over 40% of the S&P 500’s market capitalization, questions are emerging about whether AI can deliver sufficient productivity and profit growth to justify heavy investment.

There are a few ways the mega-cap technology companies could disappoint investors. First, if AI adoption fails to meet expectations or the growth rates of these companies slow faster than forecast, optimism could fade, weighing on tech leadership and broader equity valuations. Second, a handful of winners could emerge across the AI space, which may put pressure on the secondary and tertiary players in the industry. Finally, as noted, many mega-cap technology companies are taking on debt to finance the large rise in AI capital expenditure spending, which could weigh on margins and stock multiples over time. In our view, maintaining exposure to innovation while avoiding overconcentration is critical in the year ahead.

A key risk to domestic equities is a flare-up in trade tensions with the U.S. tied to the scheduled renegotiation of the Canada-United StatesMexico Agreement (CUSMA) in mid-2026. The U.S. remains Canada’s largest export market, and the current agreement exempts roughly 90% of Canadian exports from tariffs. While we expect these exemptions to remain in place, we cannot rule out an adverse scenario in which the U.S. withdraws from the agreement, a move that would significantly impact the Canadian economy.

Another risk to the outlook is an unexpected acceleration in inflation, as it could push the Bank of Canada back into tightening mode. Higher inflation could stem from persistent services price pressures, potentially driven by a tighter labour market and rising wages amid slowing immigration and improving economic growth. If a rise in commodity prices becomes a trigger for inflation, exposure to Canada’s energy and materials sectors can help provide a natural hedge. Conversely, if commodity prices decline, pressuring Canadian equities given their sector tilt, global equity exposure can help offset some of that risk. For investors, the best long-term guardrails against inflation remain allocations to assets that historically outpace inflation, including a diversified mix of equities and bonds.

Finally, a third potential risk to the outlook could come from stress in the credit markets, either public or private credit. Credit spreads in investment grade and high yield bonds remain tight, although they have been drifting higher. If we see a sharp rise in credit spreads, perhaps driven by concerns of defaults in parts of AI or other sectors, this could spark a broader disruption in financial markets. Similarly, private credit, which has been a rapidly growing income generating segment of private markets, also remains vulnerable if higher-for-longer rates trigger defaults. While stress in both public and private credit markets has remained contained in this cycle, an upheaval in these markets could amplify market volatility and tighten financial conditions. We continue to maintain a slight overweight to equities over bonds, and within the bond space, we recommend a diversified basket of investment grade, high yield, and international bonds alongside appropriate allocations to cash positions.

The graph shows that the top 10 companies of the S&P 500 by market capitalization now account for 40% of the index, a record concentration.

The graph shows that the top 10 companies of the S&P 500 by market capitalization now account for 40% of the index, a record concentration.