Weekly market wrap

The Fed and Bank of Canada keep rates on hold as higher tariffs loom

Key takeaways

- This past week, both the U.S. Federal Reserve (Fed) and Bank of Canada (BoC) kept their interest rates on hold at the July meetings. The Fed kept the fed funds rate at 4.25% to 4.5%, while the BoC held rates at 2.75%. While neither central bank indicated that a rate cut was imminent, they did leave the door open to future cuts if economic conditions warranted. Markets are now pricing in higher probabilities of rate cuts in both the U.S. and Canada by year-end.

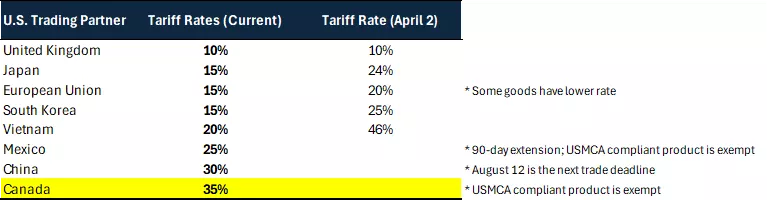

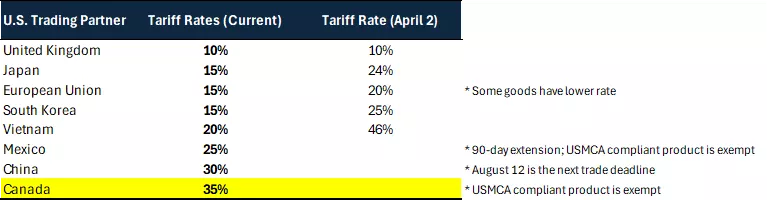

- The U.S. administration also confirmed its tariff stance with many trading partners ahead of its August 1 trade deadline. In some cases, trade deals were reached, including with Japan and the European Union, and in other cases, including Canada, no deal was reached but new tariff rates were assigned to trading partners. For Canada, the tariff rate increased from 25% to 35%, however all USMCA-compliant goods remain exempt from this tariff, which may include upwards of 90% of Canadian exports to the U.S.

- Overall, after a nice rally in U.S. and Canadian stock markets, investors face increasing walls of worry in higher tariffs rates and softer labour markets and economic growth. However, the likelihood of central-bank rate cuts has also increased, combined with corporate earnings growth that may reaccelerate next year, which may offer a better backdrop as we head into 2026.

The Federal Reserve and Bank of Canada keep interest rates on hold for now, but the odds of rate cuts have increased

The Federal Reserve kept rates on hold at its July meeting, leaving the fed funds rate at 4.25% to 4.5%. Notably, for the first time since 1993,1 there were two dissenting votes out of the 11 that called for the Fed to cut rates rather than keep them on hold. Similarly, the BoC kept its policy rate on hold at 2.75%, after cutting rates five times this cycle already.

In the U.S., Fed Chair Jerome Powell highlighted a key point behind the Fed's decision. He noted that tariff uncertainty remains. And while we are getting more clarity on tariff rates as the U.S. confirms more deals, the impacts of the tariffs on inflation and the economy are still unknown. And this may take some time to show up and could be "slower than expected" to emerge in the data.

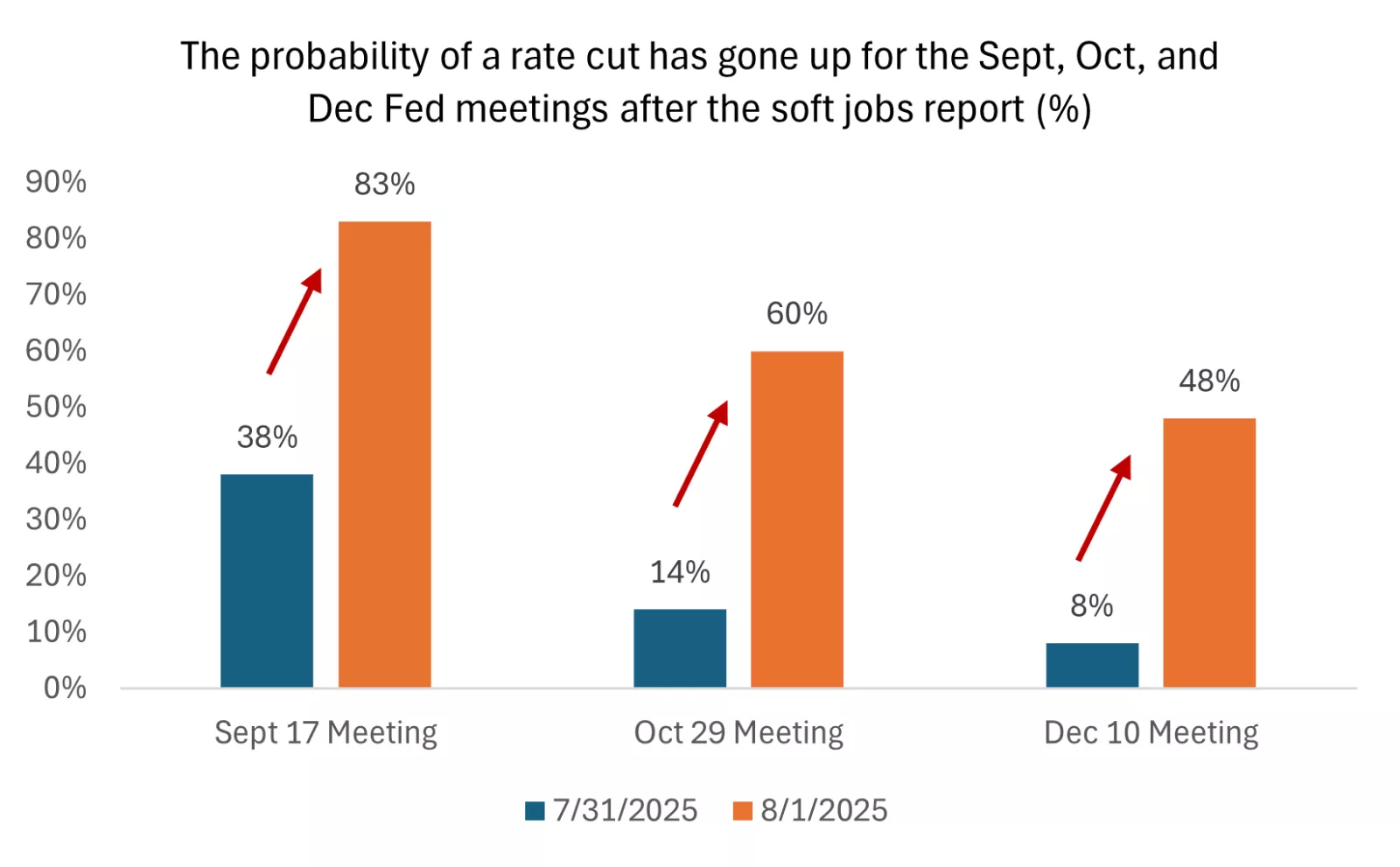

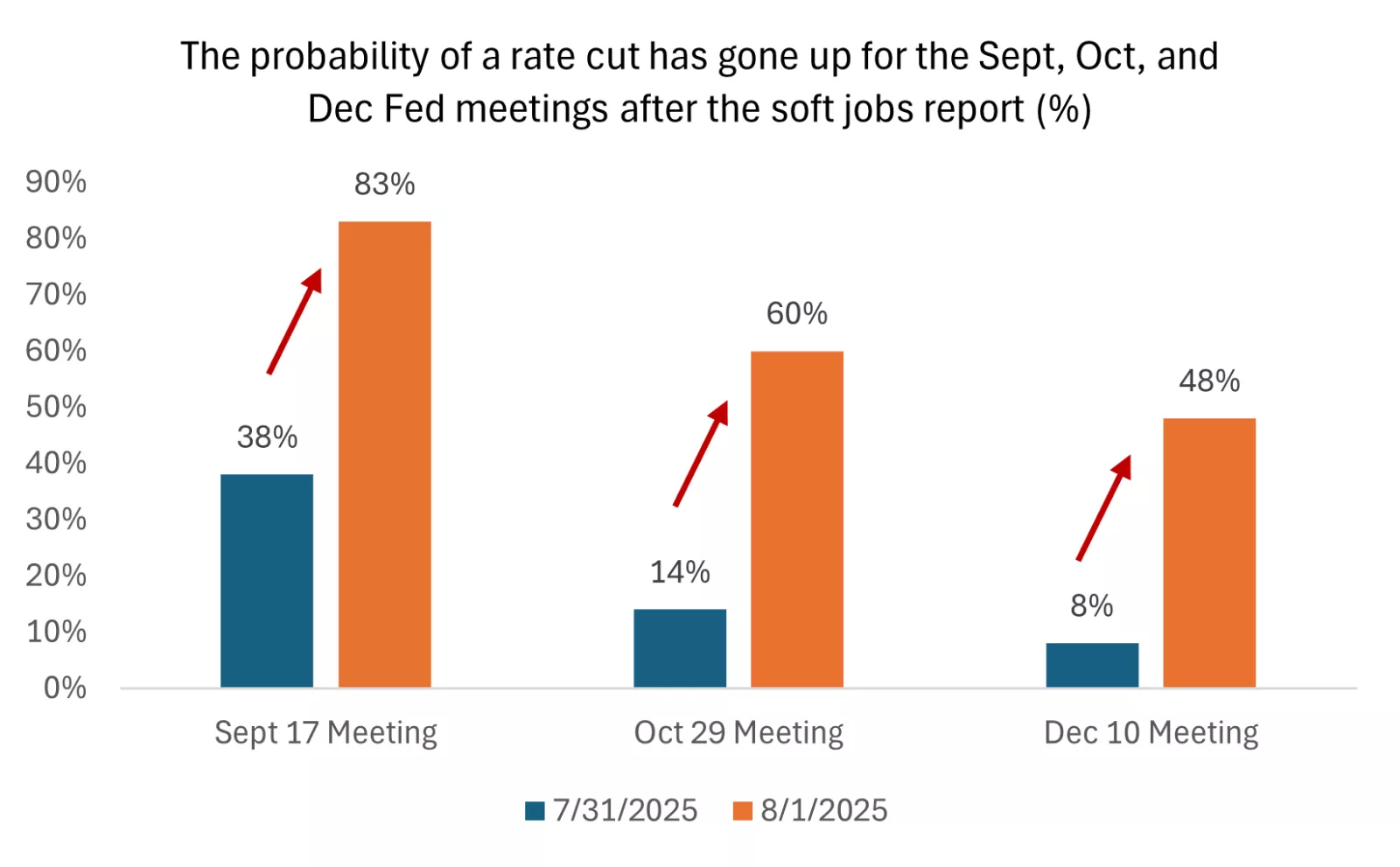

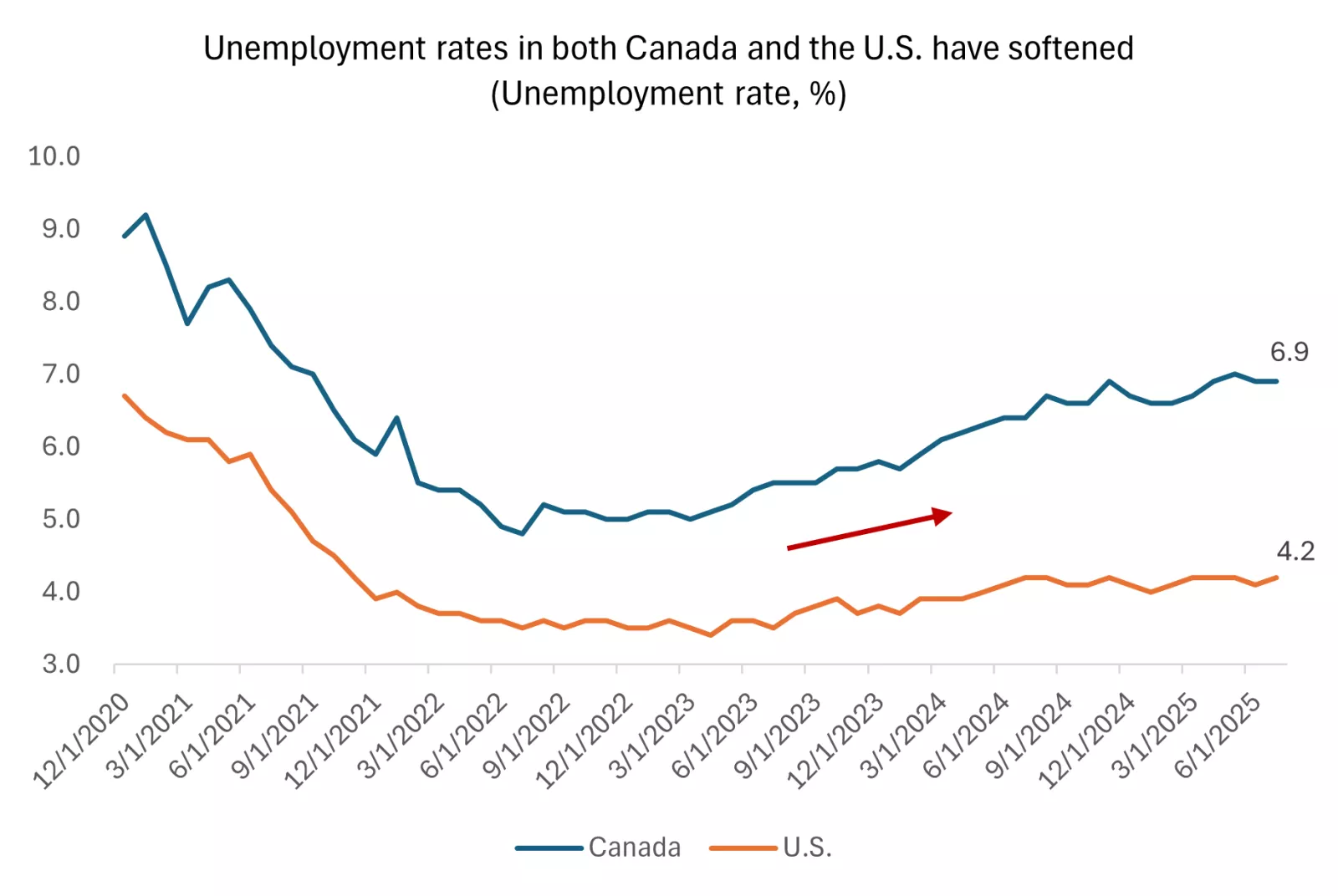

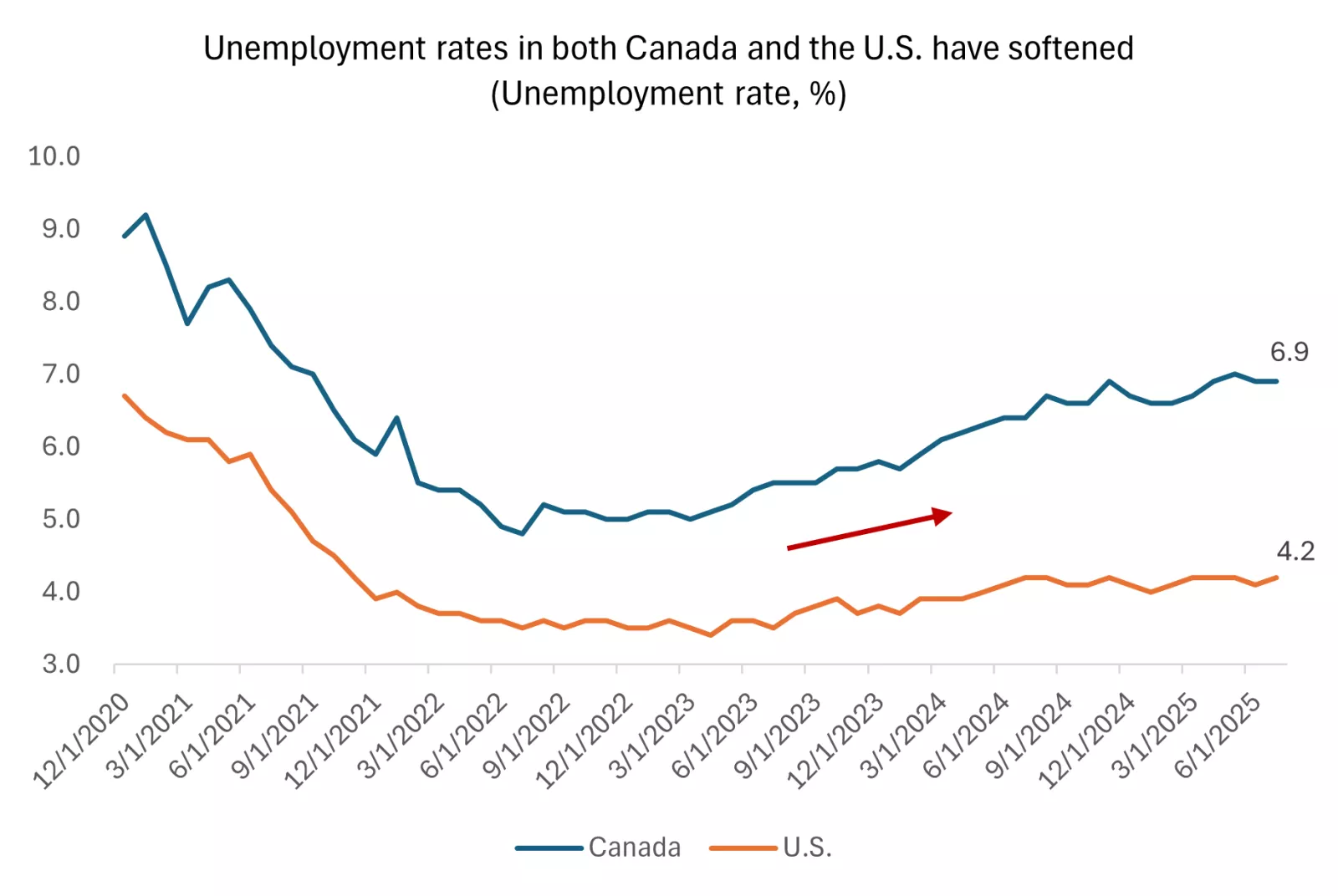

In Canada, the BoC also highlighted economic resilience and uncertainty around trade as key factors on why it held interest rates steady. However, in both economies, the jobs market seems to be softening as unemployment rates creep higher. In the U.S., the July jobs report paints a picture of a clearly slowing labour market, in our view, with jobs growth slowing meaningfully over the past three months (see section below). In fact, after the jobs report, markets are now pricing in about an 80% chance that the Fed cuts rates in September, well above the 38% probability after the Fed meeting, according to CME FedWatch.

This chart shows that the market probability of a Fed rate cut has gone up for the September, October, and December Fed meetings after the U.S. jobs report released on 8/1/25.

This chart shows that the market probability of a Fed rate cut has gone up for the September, October, and December Fed meetings after the U.S. jobs report released on 8/1/25.

Tariff rates are rising, and this likely means higher goods inflation

With the August 1 tariff deadline behind us, the U.S. administration has outlined trade deals and tariff rates with many of its trading partners. These tariff rates range from 10% to 41%, and according to the Yale Budget Lab, the average tariff rate in the U.S. will go from around 2.4% at the start of the year to about 18.3%, the highest since 1934.

For Canada, the tariff rate moves from about 25% to 35%. However, keep in mind that the goods that are USMCA-compliant are exempt from this tariff rate, and analysts point to about 90% of Canadian exports to the U.S. being USMCA-compliant. This may put the average tariff rate for Canada closer to 5% or lower. Nonetheless, trade uncertainty in the economy remains elevated and could weigh on consumer and corporate spending.

This chart shows the average tariff rates imposed by the U.S. on its largest trading partners, compared to what they were on April 2.

This chart shows the average tariff rates imposed by the U.S. on its largest trading partners, compared to what they were on April 2.

In the U.S., while tariffs had already been elevated over the past several months, moving rates higher and maintaining them at these rates will likely mean higher goods inflation and softer consumption in the months ahead. Corporations that had built inventories ahead of tariffs will likely start to work these down and need to replenish at higher rates. And those companies and supply-chain partners that had been willing to absorb some of the tariff costs through lower profit margins may not be as willing to do so indefinitely. Thus, goods prices are likely to rise, and demand may fall in certain categories. Discretionary spending overall may come down as well.

However, in our view, as the Fed alluded to, the tariff impact should be a one-time shift higher in prices, and then the impact on inflation may stabilize. In addition, keep in mind that the U.S. CPI inflation basket is largely based on services, not goods. In fact, services make up about 64% of the basket, while goods make up about 36%. In Canada, services make up about 57% of the CPI basket. So while tariffs may push up goods inflation, if services inflation continues to show signs of moderation – as it has in recent months in the U.S. and Canada – the overall inflation impact may be more modest.

The jobs data appears to be a meaningful downshift, especially for the U.S. economic narrative

Prior to last week's U.S. jobs report, the narrative was that inflation was ticking higher but seemed contained, and the U.S. labour market looked resilient. The July jobs report, however, highlights that the U.S. labour market has been weaker than the data had indicated.

The July jobs report indicated a total of 73,000 new jobs were added, well below estimates of 104,000. Perhaps most importantly, the last two months of data were revised sharply lower, subtracting about 260,000 jobs from the totals. This brings the average job gains of the last three months to 35,000, well below the 127,000 average of the prior three months. The unemployment rate ticked higher from 4.1% to 4.2%, still well below historical averages, although labour-force participation dropped to 62.2%, the lowest since November 2022.1

Similarly in Canada, the unemployment rate is hovering around 6.9%, above its recent lows, and the Canadian labour-force participation rate is now around 65.4%, below pre-pandemic levels. 1

This chart shows that Canadian and U.S. unemployment rates have moved higher from recent lows.

This chart shows that Canadian and U.S. unemployment rates have moved higher from recent lows.

In our view, the downshift in the labour data indicates that the U.S. and Canadian economies may be entering a softer growth patch. A cooling labour market, combined with higher tariff rates, may put some pressure on the consumer and household consumption. However, we also believe that the central banks are now more likely to cut interest rates, as reflected by markets as well. While growth may slow in the coming quarters, we do not see a recession on the horizon, and as we head toward 2026, we could see a rebound as interest rates move lower and as corporate earnings growth improves.

We recommend staying diversified and up in quality, and staying invested

After a nice run in financial markets, with the S&P 500 and Canadian TSX both up over 20% since their April 8 lows, we may experience volatility as markets digest higher tariffs and a softer jobs market. In our view, investors can use these bouts of volatility to consider rebalancing portfolios, diversifying across equities and bonds, and adding quality investments at better prices. Keep in mind that we are also in the midst of the second-quarter earnings season, and thus far over 80% of S&P 500 companies have beaten earnings expectations – which means corporate earnings growth remains on track to be positive this year.1 In addition, we are likely to see the Federal Reserve cut interest rates once or twice this year, and the BoC perhaps cut rates one additional time, all of which should be supportive of market sentiment, in our view.

In this backdrop, we continue to favour U.S. large-cap and mid-cap equities. From a sector perspective, we prefer having exposure to growth and value sectors, including consumer discretionary, financials and health care. And within investment-grade bonds, we see value in extending duration, which can still allow you to lock-in relatively higher yields and can offer the potential for price appreciation if central banks lower rates. Finally, remember that your financial advisor can help ensure you remain on track to meet your personal long-term financial goals, even as we climb walls of worry in the months ahead.

Mona Mahajan

Investment Strategist

Sources: 1. FactSet

Weekly market stats

| INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

| TSX | 27,020 | -1.7% | 9.3% |

| S&P 500 Index | 6,238 | -2.4% | 6.1% |

| MSCI EAFE* | 2,606.40 | -3.1% | 15.2% |

| Canada Investment Grade Bonds | 0.9% | 0.7% | |

| 10-yr GoC Yield | 3.36% | -0.1% | 0.1% |

| Oil ($/bbl) | $67.30 | 3.3% | -6.2% |

| Canadian/USD Exchange | $0.73 | -0.6% | 4.3% |

Source: FactSet, 8/1/2025. Bonds represented by the Bloomberg Canada Aggregate Bond Index. Past performance does not guarantee future results.*Source: Morningstar Direct, (8/3/2025).

The Week Ahead

Important economic releases this week include jobs data in Canada and ISM PMI data in the U.S.

Mona Mahajan

Mona Mahajan is responsible for developing and communicating the firm's macro-economic and financial market views. Her background includes equity and fixed income analysis, global investment strategy and portfolio management.

She regularly appears on CNBC, Bloomberg TV, The Wall Street Journal and Barron's.

Mona has an MBA from Harvard Business School and bachelor's degrees in finance and computer science from the Wharton School and the School of Engineering at the University of Pennsylvania.

Important information :

The Weekly Market Update is published every Friday, after market close.

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Investors should understand the risks involved of owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent to international investing, including those related to currency fluctuations and foreign political and economic events.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.