Weekly market wrap

Geopolitics Distracts, Fundamentals Drive: A Case for Diversification

Key Takeaways

- Last week brought another barrage of geopolitical headlines, as President Trump threatened to raise tariffs on a host of European trade partners.

- This flare-up was fortunately short-lived, and markets quickly turned their attention back to bread-and-butter economic data and earnings reports.

- On this note, this week's central-bank meetings will be in focus, with the Fed and Bank of Canada both expected to leave rates unchanged.

- Meanwhile, a flurry of earnings reports should provide the latest litmus test on the profitability of AI companies, while also highlighting the extent to which we are seeing a pick-up in earnings across a broader swath of companies.

- The prospect of improving growth, falling interest rates, and strong corporate profitability should help drive a broadening in market leadership this year, supporting the case for a diversified portfolio.

Greenland storm proves short-lived

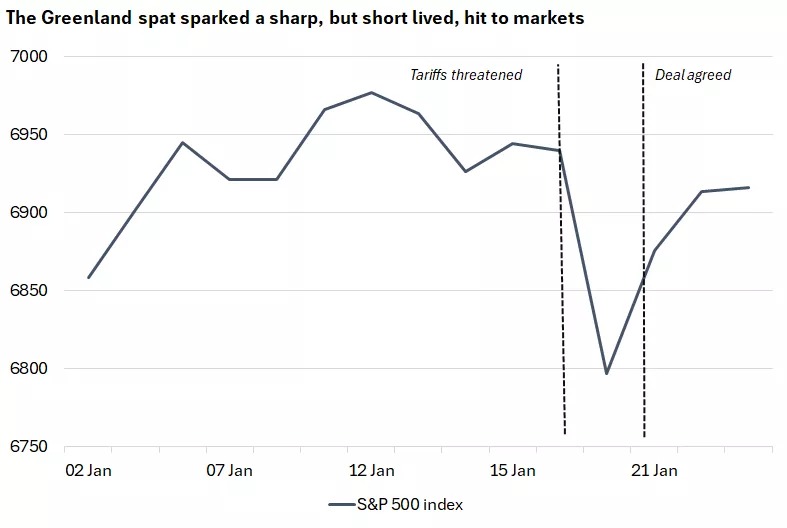

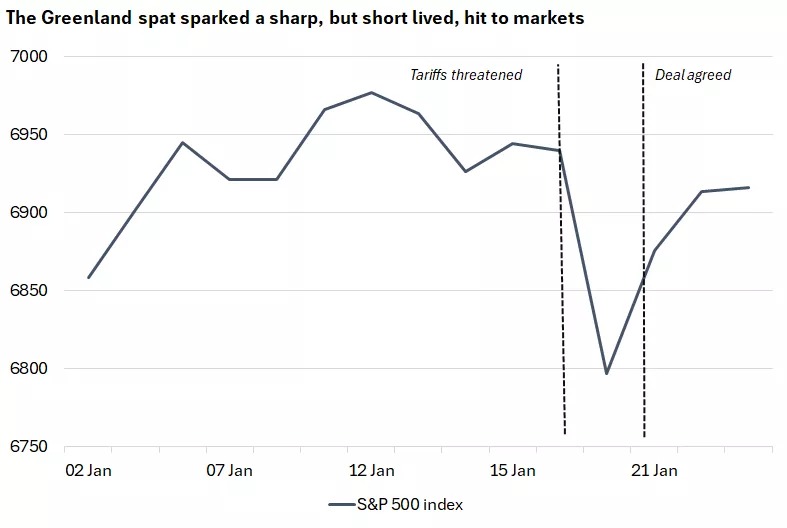

President Trump's push to acquire Greenland escalated last week. The president threatened to raise tariffs on eight European trading partners by 10% on February 1 unless a deal was in place to buy the island, with this penalty to increase to 25% by June*.

The news hit markets hard as investors questioned the short-term implications for growth and inflation, and longer-term geopolitical ramifications around NATO and global security*.

The S&P 500 index registered its largest single-day drop since the 'liberation day' tariff announcements in April last year, with assets that would typically benefit from a risk-off move - U.S. government bonds and the U.S dollar - also selling off*. This represented a brief return to the "sell-U.S." narrative that we saw at times in 2025*.

The quick emergence of a deal to address U.S. security interests in Greenland, while seemingly not impacting local sovereignty, helped equity markets rebound*. This turnaround highlights the importance of not overreacting to the barrage of geopolitical headlines at present, although there were some important signals from the short-lived spat, in our view.

This chart shows a sharp decline in the S&P 500 after President Trump threatened tariff increases, with this drop partly reversing after a deal was reached to avert these hikes.

This chart shows a sharp decline in the S&P 500 after President Trump threatened tariff increases, with this drop partly reversing after a deal was reached to avert these hikes.

The U.S dollar was a big loser, with its sell-off persisting even after a tentative agreement on Greenland was announced*. The greenback finished the week 1.2% lower against a trade-weighted basket of currencies, its worst week since last June*.

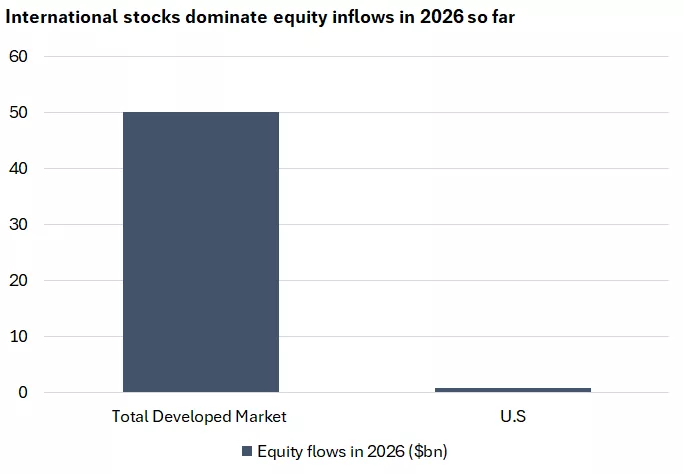

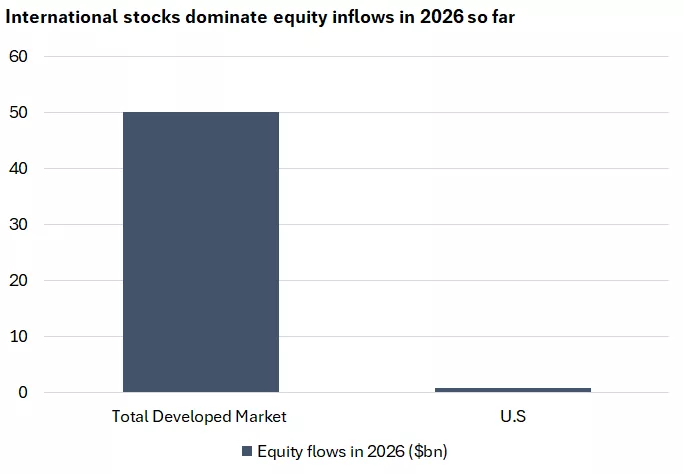

These moves underline the sensitivity of this currency to policy volatility, in our view. While market speculation over a fire sale of U.S. assets looks overblown to us, there are signs of international investors diversifying portfolios*. Fund flows into Europe and Japan have so far this year significantly outpaced those into U.S. listed equities, which account for less than 2% of the inflows into developed market equities in total this year*.

This chart shows that the U.S has accounted for less than 2% of flows into international developed markets in 2026 so far.

This chart shows that the U.S has accounted for less than 2% of flows into international developed markets in 2026 so far.

While we continue to see value in holding U.S large-cap equities, we recommend investors look more broadly to positions in international developed small- and mid-cap equities and emerging-market equities too in order to help diversify portfolios and help take advantage of potential broadening international earnings growth.

Gold meanwhile was the big 'winner' from this week's headlines. A spike in prices took the rally in this precious metal to 15% year-to-date, adding to the 65% gain last year*. We think small allocations to gold can help add some useful diversification benefits to portfolios, helping explain its appeal during the uptick in policy and geopolitical uncertainty over the past year. However, we are mindful of the significant rise in prices seen over a short period of time*, which makes us more cautious on the near-term outlook. Canadian equities can offer an alternative means of gaining exposure to surging gold prices through gold miners in the materials sector.

Finally, there are potentially longer-term geostrategic implications from the spat between the U.S. and its NATO allies. Prime Minister Carney outlined a new strategy in a high-profile speech at Davos, in which 'middle powers', nations like Canada, and European, Latin American and Asian countries, build and deepen their economic, military and diplomatic ties*. Carney argued this was needed in response to a rupture of the global order over recent decades as the so-called 'great powers' drift away from a rules-based system*.

This echoes aspects of the Carney policy agenda already in train, including higher defense investment and a push to broaden Canada's trade relationships, which are overwhelmingly orientated towards the U.S.*. The prime minister recently visited China in a bid to improve diplomatic relations and lift reciprocal trade restrictions, and has pushed to strengthen ties with Mexico and will visit India this spring*.

A long-term reorientation of Canadian trade relationships would likely lessen its dependence on U.S. trade and open opportunities to faster-growing segments of the global economy, in our view. However, it will likely take time, with more than three-quarters of exports currently moving south of the border as part of deeply integrated North American supply chains, highlighting the continued importance of this year's renegotiation of the CUSMA agreement*.

Fundamentals back in the spotlight

It didn't take long for headlines around Greenland to be replaced with a more familiar focus on economic and corporate fundamentals last week.

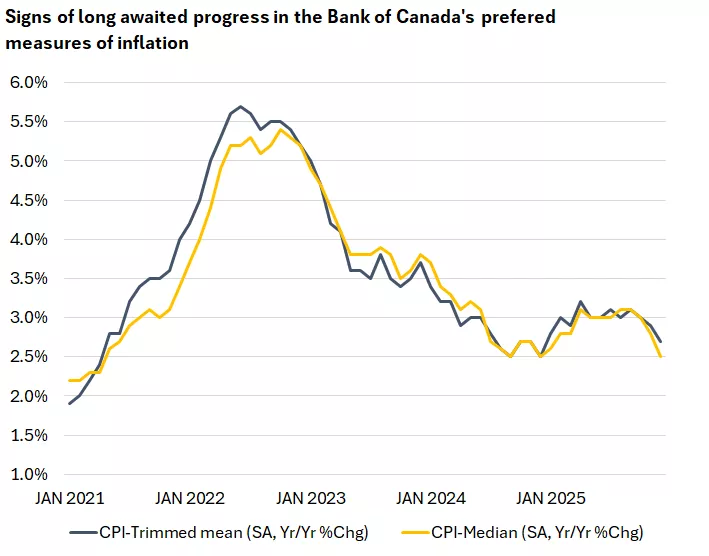

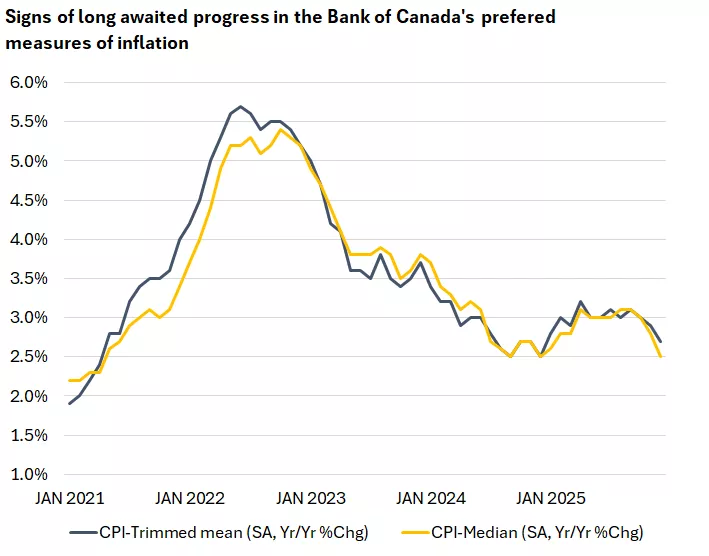

In Canada we saw retail sales rebound, but through the monthly volatility in spending we see still subdued consumer spending*. However, there was some better news on the inflation front. While headline CPI increased to 2.4% year-over-year*, this bump looks like noise to us. Instead, the stronger signal, in our view, comes from a slowdown in core inflation, and particularly the Bank of Canada's trimmed mean and median measures, suggesting greater progress in bringing underlying price pressures under control*.

This chart shows the Bank of Canada core CPI trimmed mean and median inflation measures which both showed a sharp slowdown in price pressures towards the end of last year.

This chart shows the Bank of Canada core CPI trimmed mean and median inflation measures which both showed a sharp slowdown in price pressures towards the end of last year.

We think this will be good news for the Bank of Canada, which meets next week. The central bank has argued that at current levels interest rates are providing modest support to the Canadian economy, and Governor Macklem is likely to view signs of cooling price pressures as justification for leaving these settings in place*. We think the bank of Canada will hold interest rates steady at 2.25% through the whole of this year.

In the U.S, a raft of macroeconomic data pointed to a solid economic backdrop last week, with initial unemployment insurance claims continuing to come in at low levels, consumer confidence moving to a five-month high, and consumer-spending data pointing to another impressive gain through the end of 2025*.

For the Fed, set to meet this week, these data will likely help provide encouragement that the economy remains in solid shape, despite the deceleration in the labour market seen over the past year. The central bank had already hinted at its intention to stay on hold in January, following three consecutive rate cuts through the second half of 2025, and we think a cut this week would be a huge surprise*.

With policy widely expected to be on hold*, investors will likely be listening carefully for hints as to the path for interest rates from here. We suspect the central bank will keep its card close to its chest at this juncture, preferring to wait until it sees more labour-market and inflation data before signaling next steps. We think Fed Chair Powell is likely to underline this data dependence in his press conference, but subtle hints around the FOMC's views on growth and inflation will be important to gauge.

We continue to think the direction for interest rates remains lower. Most FOMC members were inclined to lower rates further in 2026 back in December, based on their interest-rate forecasts, especially with the level of rates at present still thought to be modestly restrictive on the U.S economy**. Signs of a gradual cooling in inflation as tariff pressures fade, and a still sluggish labour market, should keep the central bank in easing mode in 2026, in our view. We think one or two 25 basis point (0.25%) cuts are most likely.

Otherwise, the earnings season has already kicked off, with around 80% of the early reporters in the S&P 500 beating profit estimates so far, similar to the rate seen in the last earnings season*. However, the release calendar will intensify this week, with high-profile U.S mega-cap technology companies – Meta, Apple, Tesla and Microsoft – all due to report*.

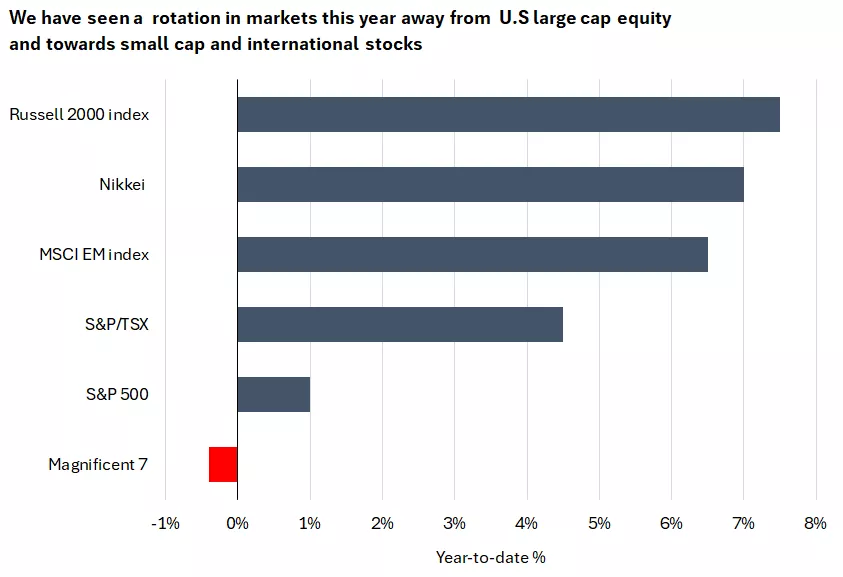

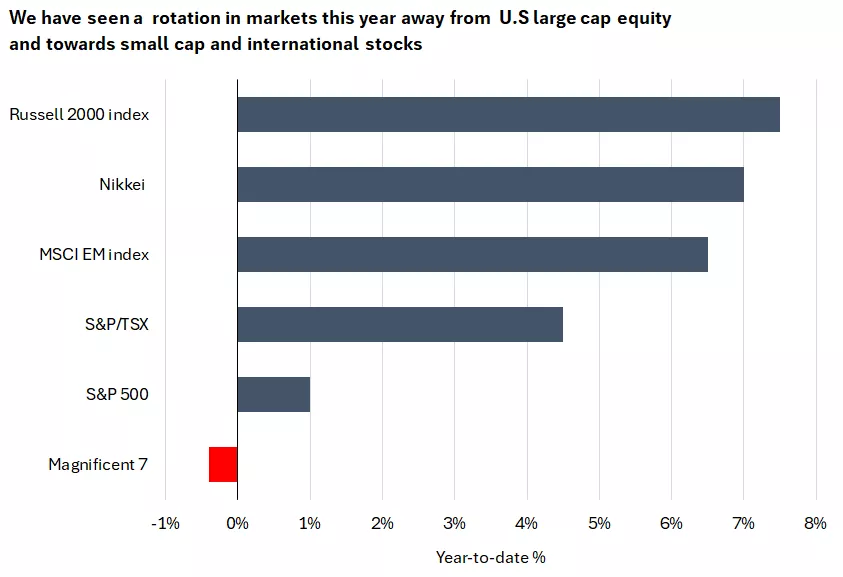

We expect these results to provide the latest litmus test of the translation of heavy AI investment into revenue growth and profits. Markets have shown signs of a rotation away from some of these names this year, with the 'Magnificent 7' stocks broadly flat on the year so far, in contrast to better performance from international stocks, other large-cap companies and significantly lagging small-cap stocks*. Still, the technology sector is expected to deliver the strongest earnings growth across the S&P 500 this year, even if the gap with other sectors is seen narrowing*.

This chart shows varied performance across equity markets through 2026 so far, with the Russell 2000 index significantly outperforming large cap stocks, particularly the mega cap technology stocks.

This chart shows varied performance across equity markets through 2026 so far, with the Russell 2000 index significantly outperforming large cap stocks, particularly the mega cap technology stocks.

Alongside a health check on the AI story, we believe it will be important to look for confirmation that an improving economic backdrop, and declining interest rates, are passing through into rising profitability across broader segments of the market. The outperformance of smaller companies and pro-cyclical sectors this year suggest that investors are becoming increasingly confident around their earnings potential, in our view*.

Bottom line – stay focused and stay diversified

In our view, last week provided another example of the importance of keeping a focus on fundamentals, despite the overwhelming barrage of geopolitical headlines.

We remain constructive on the outlook for stocks and see potential for a broadening in market leadership this year, likely helped by improving growth, lower interest rates, and strong corporate profitability.

We think a diversified portfolio looks best placed to take advantage of these cross currents, and we prefer to maintain exposure to large-cap U.S stocks and the AI theme, complementing this with mid-cap U.S. equities and international equities alongside domestic investments, to help provide access to a potential broadening in earnings growth at home and abroad.

James McCann;

Investment Strategy

Weekly market stats

| INDEX | Close | Week | YTD |

|---|---|---|---|

| TSX | 33,145 | 0.3% | 4.5% |

| S&P 500 Index | 6,916 | -0.4% | 1.0% |

| MSCI EAFE* | 2,995.99 | 0.1% | 3.6% |

| Canada Investment Grade Bonds* | -0.1% | 0.5% | |

| 10-yr GoC Yield | $3.42 | 0.0% | 0.0% |

| Oil ($/bbl) | $61.28 | 3.3% | 6.7% |

| Canadian/USD Exchange | $0.73 | 1.5% | 0.0% |

*Bloomberg

**Federal Reserve

Source: FactSet, January 23, 2026. Bonds represented by the Bloomberg Canada Aggregate Bond Index. Past performance does not guarantee future results. *Source: Morningstar Direct, January 25, 2026.

The week ahead

Important economic data for the week ahead includes a BoC meeting and interest-rate decision on Wednesday and domestic GDP for November on Friday.

James McCann

Senior Economist

Thought Leader In:

- Economic issues impacting the lives of everyday Americans.

- The effects of government spending, taxes and regulation changes on our clients.

- Building diversified portfolios to help investors reach their long-term financial goals.

“The economic, political and policy landscape is shifting dramatically, making it ever more challenging for our clients to navigate their personal finances. In this environment, it's our deep, research-driven insights that can help clients stay on track to reach their financial goals."

James McCann

Senior Economist

Important information :

The Weekly Market Update is published every Friday, after market close.

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Investors should understand the risks involved of owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent to international investing, including those related to currency fluctuations and foreign political and economic events.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.