U.S. Government shutdowns and the markets – 3 things to know

Political divisions in Washington have once again led to a government shutdown, with the current fiscal year ending on September 30 and no full-year funding agreement in place. The shutdown began on October 1 as Congress failed to pass a stopgap measure, called a continuing resolution, or the necessary appropriations bill to keep federal agencies funded.

The House recently passed a seven-week stopgap measure to extend funding through November 21. However, resistance in the Senate over healthcare cuts that were passed in the administration's new tax bill earlier this summer is stalling progress.

Since no agreement was reached, nonessential parts of the federal government have begun to shut down, furloughing workers and halting some services until funding is restored. While the situation remains fluid, here are three key insights on how the shutdown could affect the economy and financial markets:

1. Shutdown Realities: What stalls and what keeps moving – A shutdown does not affect the government's ability to pay its debt to bondholders and therefore does not have a direct impact on the government’s borrowing costs or creditworthiness. Treasury interest payments and Social Security continue to be paid, but millions of federal employees go unpaid during the shutdown.

Importantly, furloughed workers are guaranteed backpay once funding resumes, thanks to the Government Employee Fair Treatment Act of 2019. Contractors, however, are not guaranteed compensation, and businesses that rely on government contracts may see lost revenue.

One notable difference from previous budget standoffs is that the White House Budget Office has directed federal agencies to prepare for the potential permanent elimination of positions in programs where discretionary funding lapses and misaligns with the President’s priorities. This move is viewed as a strategic pressure tactic aimed at encouraging Senate passage of the stopgap bill already passed by the House.

Here is a general overview of the impact of the shutdown on different government functions. For more detail and questions, please visit the websites of the respective agencies.

| What won't be affected | What will be affected |

|---|---|

| Treasury interest payments | Government employee pay delays, furloughs and layoffs. |

| Medicare, Medicaid and Social Security payments | The Food and Drug Administration could be forced to delay food and safety inspections |

| U.S. Postal Service | National parks and monuments |

| IRS operations, but some services could be limited and tax refunds can be delayed | The Securities and Exchange Commission (SEC) and the Commodities and Futures Trading Commission (CFTC) |

| Federal Aviation Administration (FAA) and TSA, but employee absences could lead to travel delays | Federal Emergency Management Agency (FEMA) |

| Military veterans' benefits | The EPA would pause plans and permit reviews |

| Food stamps and similar aid programs | Government data collection and reporting (example: monthly jobs report delay) |

| Law Enforcement | Small Business Administration would not be able to issue any new loans |

| Source: Committee for a Responsible Federal Budget, Edward Jones. | |

2. Effects are disruptive but temporary - Shutdowns have been a regular occurrence in recent history but have not lasted long. Since 1976 there have been 20 government shutdowns lasting for a day or more. The most recent one in December 2018 lasted 35 days, setting a record as the longest in U.S. history1.

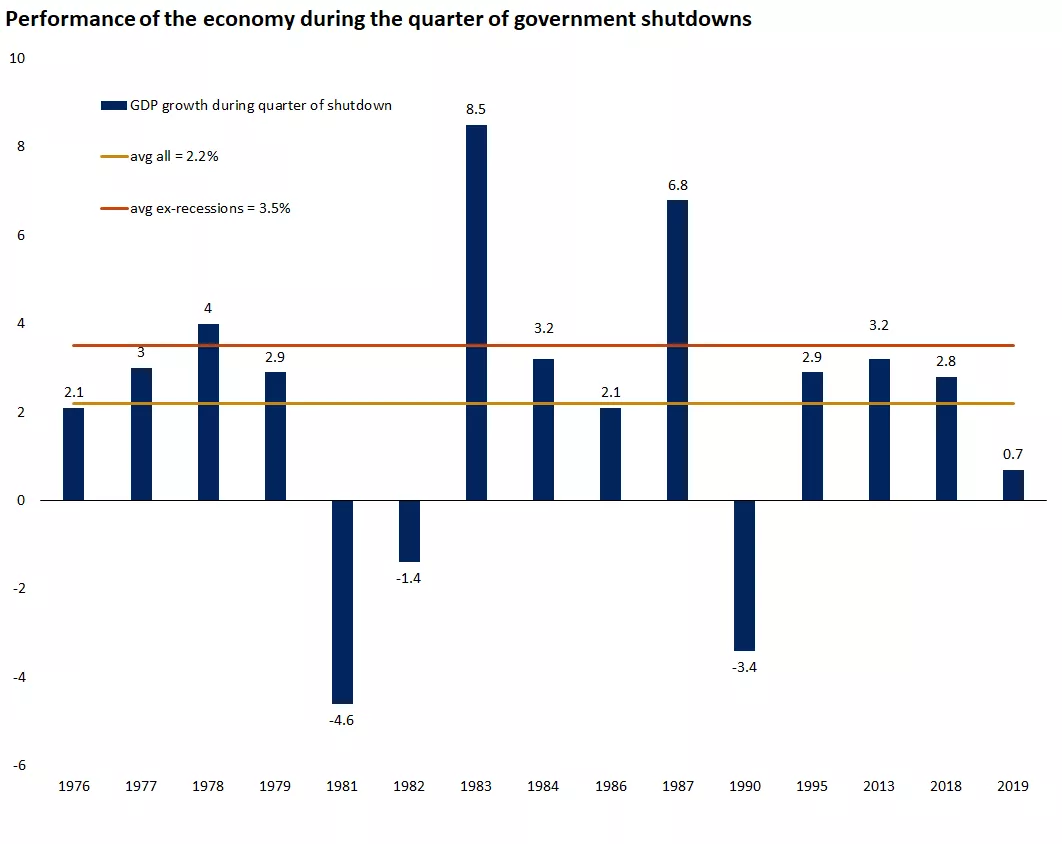

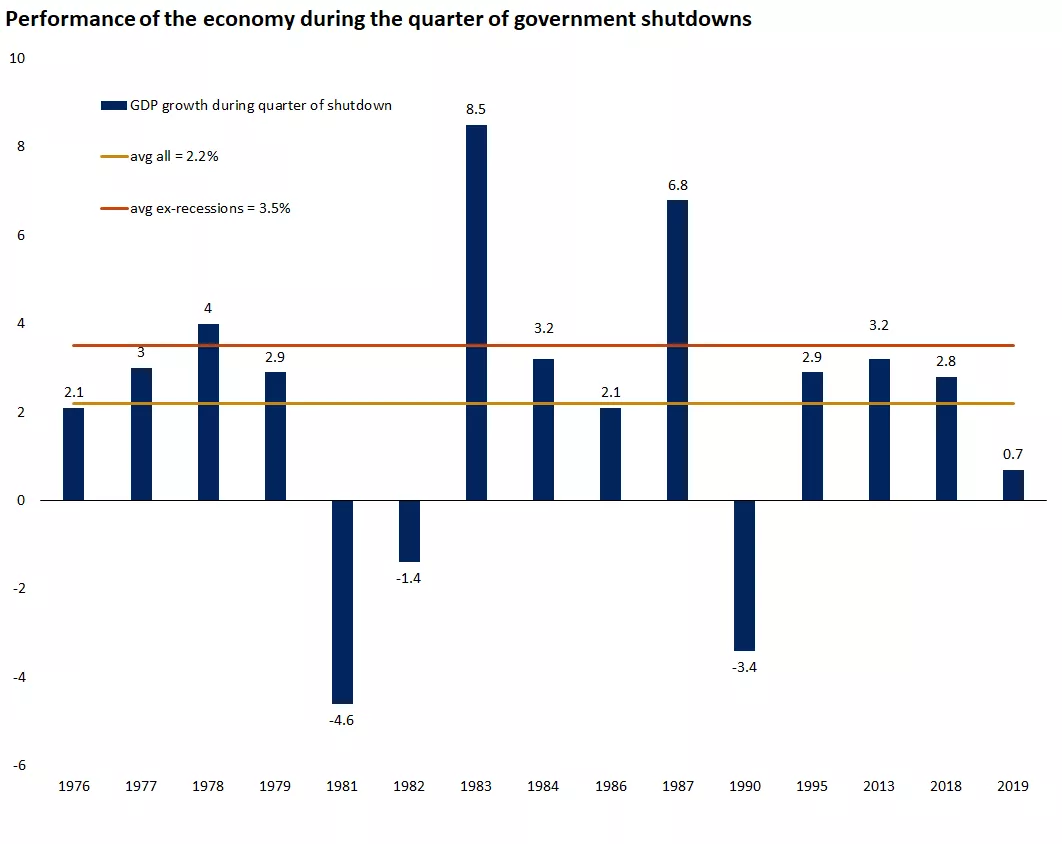

From an economic standpoint, we would expect a short-term slowdown in growth around the shutdown period but a quick recovery in activity in the subsequent months. In other words, a shutdown would displace or delay spending and economic activity, not eliminate it. The longer the disruption the bigger the impact, but the economic damage would likely be minimal in the context of the $30 trillion U.S. economy2.

For perspective, during the most recent shutdown, the Congressional Budget Office estimated that roughly 0.4% was shaved off quarterly GDP over the five-week period, and other estimates based on the experience from the last decade point to a potential loss of 0.1%-0.2% from quarterly GDP growth for each week of closures.

This chart shows U.S. GDP growth in the quarter during a government shutdown.

This chart shows U.S. GDP growth in the quarter during a government shutdown.

3. Markets tend to look through the noise and focus on the fundamental drivers – The uncertainty that a potential government shutdown introduces can lead to a short-term uptick in volatility, especially after a long stretch of strong returns. But as history has shown, government shutdowns have had little lasting impact on equity performance. Stocks were positive half the time during the government closures and were higher in most cases three and six months later2. More broadly, market performance tends to be driven more by the outlook for economic growth, earnings and interest rates rather than the political landscape.

As the fourth quarter begins, momentum remains strong, with the S&P 500 hitting 10 new highs in September alone helped by growing corporate profits and expectations for lower rates ahead3. The Federal Reserve (Fed) has just restarted its easing cycle boosting investor sentiment. However, Fed policy is not on a predetermined path as policymakers evaluate employment and inflation trends.

A recent disruption has been the shutdown of agencies that publish critical economic data like inflation and employment, leaving markets and the Fed in the dark, especially at this increasingly data-dependent stage of the cycle. But given most Fed officials' view that policy remains restrictive, we expect the direction of travel for rates will be lower.

S&P 500 returns around government shutdowns

| Start date | End date | Duration | During shutdown | 3 months later | 6 months later |

|---|---|---|---|---|---|

| 9/30/1976 | 10/11/1976 | 11 | -3% | 2% | -4% |

| 9/30/1977 | 10/13/1977 | 13 | -3% | -5% | -3% |

| 10/31/1977 | 11/9/1977 | 9 | 1% | -2% | 4% |

| 11/30/1977 | 12/9/1977 | 9 | -1% | -5% | 7% |

| 9/30/1978 | 10/18/1978 | 18 | -2% | -2% | 0% |

| 9/30/1979 | 10/12/1979 | 12 | -4% | 5% | -1% |

| 11/20/1981 | 11/23/1981 | 3 | 0% | -8% | -6% |

| 9/30/1982 | 10/2/1982 | 2 | 1% | 15% | 25% |

| 12/17/1982 | 12/21/1982 | 4 | 1% | 11% | 25% |

| 11/10/1983 | 11/14/1983 | 4 | 1% | -6% | -5% |

| 9/30/1984 | 10/3/1984 | 3 | -2% | 1% | 9% |

| 10/3/1984 | 10/5/1984 | 2 | 0% | 0% | 10% |

| 10/16/1986 | 10/18/1986 | 2 | 0% | 11% | 20% |

| 12/18/1987 | 12/20/1987 | 2 | 0% | 9% | 8% |

| 10/5/1990 | 10/9/1990 | 4 | -2% | -1% | 19% |

| 11/13/1995 | 11/19/1995 | 6 | 1% | 8% | 11% |

| 12/15/1995 | 1/6/1996 | 22 | 0% | 6% | 7% |

| 9/30/2013 | 10/17/2013 | 17 | 3% | 7% | 8% |

| 1/19/2018 | 1/22/2018 | 3 | 1% | -5% | 0% |

| 12/21/2018 | 1/25/2019 | 35 | 10% | 11% | 14% |

| Average | 0.0% | 2.6% | 7.5% | ||

| % of time positive | 50% | 60% | 70% | ||

| Source: Congressional Research Service, Morningstar, Edward Jones. Past performance does not guarantee future results. | |||||

The bottom line

- Concerns about a government shutdown may trigger some volatility after a period of market calm. But while shutdowns introduce headlines of furloughed workers and disruptions to government services, history has shown that the impact is typically short-lived, and we don't expect a shutdown to alter the outlook for the economy and financial markets.

- In our view, the combination of a growing economy, rising corporate profits and declining interest rates supports a positive outlook for stocks. This won't eliminate bouts of volatility along the way, but against this backdrop, we'd view market pullbacks, particularly any weakness spurred by government-shutdown anxiety, as a compelling buying opportunity. We continue to favor U.S. large-cap stocks with high exposure to AI. However, given these stocks’ multiyear outperformance, investors may consider using any pullbacks to deploy fresh capital into underrepresented areas in portfolios that have catch-up potential, such as U.S. mid-caps and cyclical sectors.

- It’s always a good idea to review and fortify your emergency cash situation even if a shutdown doesn’t materialize. Don't let political uncertainties disrupt important decisions around your long-term financial strategy.

Angelo Kourkafas, CFA

Investment Strategist

Source: 1. Congressional Research Service, 2. Bloomberg, 3. Source: Congressional Research Service, Morningstar, Edward Jones

Important Information:

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss in declining markets.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent in international investing, including those related to currency fluctuations and foreign political and economic events.