Don't fear the bear

When stock prices begin falling dramatically, you may become concerned and feel like your only option is to sell to limit losses. We disagree.

What is a bear market?

A bear market is defined as a prolonged stock market decline, usually 20% or more, almost always triggered by unexpected events or economic conditions. So, investors can frequently be caught off guard and react to media reports of uncertainty and worst-case scenarios.

When stock prices begin falling dramatically, you may become concerned and feel like your only option is to sell to limit losses. We disagree. As a long-term investor, your success or failure may be determined by your actions during a stock market decline, and selling may reduce, rather than raise, your chances of success.

It’s unlikely you’ll ever meet a real bear in everyday life. However, as the table below shows, if you’re a long-term investor, you’ll almost certainly experience many bear markets. When investing, we recommend you keep the following in mind: Stock market declines are common, occur without warning and end unexpectedly. But they can also present opportunities for long-term investors to buy quality investments.

Declines in the Canadian stock market since 1973

| Dip (5% or more) | Moderate correction (10% or more) | Severe correction (15% or more) | Bear market (20% or more) | |

| Number of occurrences | 177 | 55 | 28 | 15 |

| Mean number of occurrences per year | About 3.5 per year | About 1 every year | About 1 every 2 years | About 1 every 3 years |

Source: MSCI Canada Index, FactSet, Edward Jones calculation: 1/1/1973 - 12/31/2025. Past performance does not guarantee future results. Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Despite many pullbacks along the way, the S&P TSX Composite Index has had an average annual return of 9.7%, including dividends, since 1960.1 So, instead of worrying about the timing of the next bear market, prepare your portfolio today with an appropriate mix of quality investments so you can stay invested in both bear and bull markets over time.

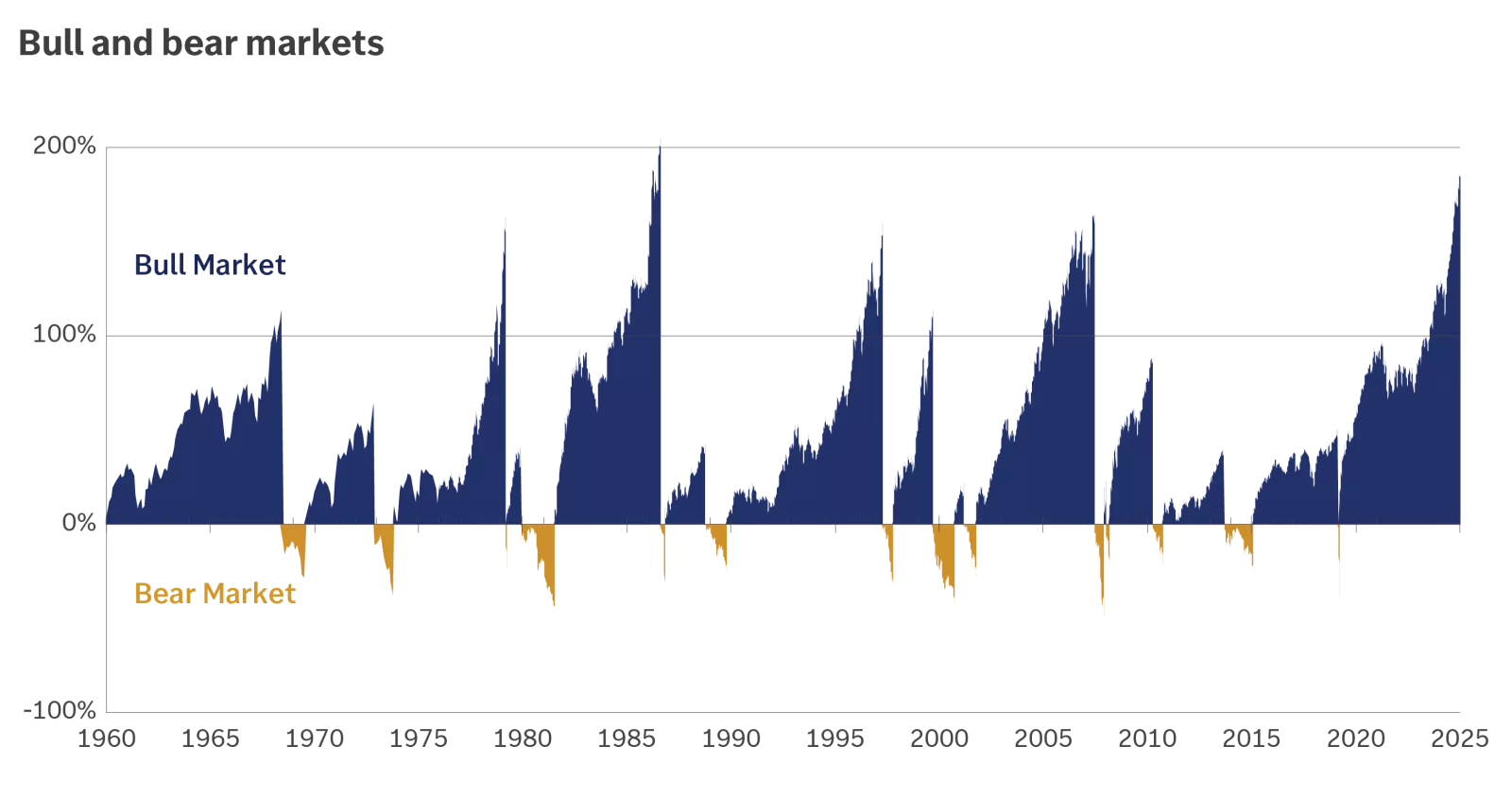

What bull and bear markets look like

The chart below shows bull and bear markets in the TSX since 1960. The green-shaded areas above the 0% line are bull markets, and the red-shaded areas below it are bear markets — a decline of more than 20%. You’ll notice that bear markets are shorter than bull markets. On average, bear markets last about 8 months, with an average loss of about 32%.2 Bull markets, on average, last three to four years, with an average gain of about 92%. Bear markets eventually come to an end, which is one reason we recommend you stay calm and keep a long-term perspective.

This chart shows that bear markets in the TSX since 1960 have been shorter on average than bull markets.

This chart shows that bear markets in the TSX since 1960 have been shorter on average than bull markets.

Understanding market declines: Points vs. percentage

News outlets frequently cite market declines in points instead of a percentage, which can make pullbacks seem more severe. For example, a headline might read: “The TSX fell by 300 points.” Based on a TSX index level of 32,000, a 300-point decline represents only a 1.2% decline in the index — a meaningful drop but perhaps not as severe as the headline suggests. In the past, a 300-point move in the TSX represented a larger percentage change. For example, a 300-point drop in 2015, when the Dow was around 15,000, equated to nearly a 2.0% loss.

Keeping your emotions in check

Bear markets are usually frightening. Stock market declines can be dramatic, and it may seem like there’s no end in sight. You’ll hear predictions about how much lower stocks could go. But in many bear markets, the rebound has occurred unexpectedly — usually when the outlook appeared bleak. While it may feel difficult in bear markets, we recommend trying to stay calm and ignoring extreme predictions of doom and gloom.

During the most recent bear market, the S&P/TSX Composite declined 37% from its high in February 2020 — at the time, the quickest bear market in history. In contrast, the average bear market decline has been 31.5% since 1977. This bear market was harsh but historically short — it lasted 32 days, far shorter than the average of 8 months. While you might think it’s prudent to prepare for another severe bear market like the one in 2020, instead realize that such extreme bear markets are infrequent. Only three of the 14 bear markets since 1960 have had declines of 40% or more. In addition, severe bear markets tend to be followed by sharp rebounds. In two of the 3 cases, when stocks dropped 40% or more, they rebounded by more than 33% during the first year of the upswing, with the other rebounding nearly 20%.3 Whether they’re severe or mild, long or short, bear markets tend to recover just as abruptly as they start. Since no one knows when the stock market will begin to rebound, and each recovery is generally accompanied by predictions that it won’t last, our advice is to stay invested, so you don’t have to decide when to get back into the market. Investors who reinvest dividends or are able to add to their investments during bear markets tend to be even better positioned for any rebound because they’ve added to their investments when prices were down.

Don’t try to outrun a bear

During and immediately after market declines, it’s tempting to sell quality investments in hopes of avoiding further declines. Investments promising to “hedge” market risk and other alternatives often become popular after poor stock market performance.

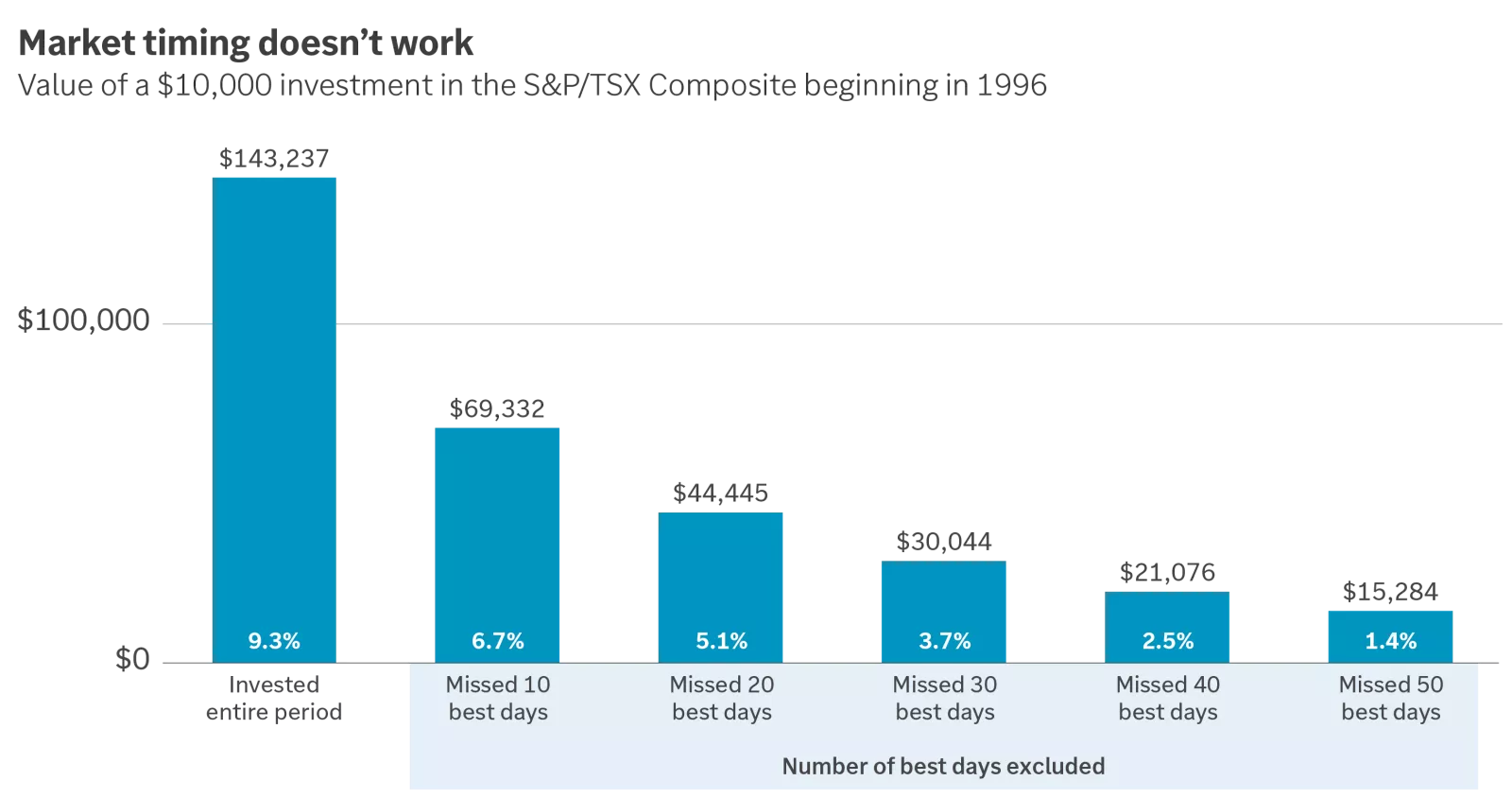

You should avoid jumping into or out of the stock market. Instead, we believe investing is about time in the market rather than timing the market. By trying to time the market, you risk missing out on some of the best days, weeks and months. We believe the timeless strategy of staying invested and consistently reviewing your portfolio to ensure it is closely aligned to your individual goals will give you the best potential to achieve success. The chart below illustrates how returns can be reduced if you miss some of the best days in the market.

This chart shows how returns can be reduced how if you miss some of the best days in the market.

This chart shows how returns can be reduced how if you miss some of the best days in the market.

Many will argue that if you had missed just a handful of the worst days, returns would have been just as good. This might be true, but predicting the worst days is just as difficult as predicting the best ones, and they frequently occur near each other. Staying invested can help ensure you don’t experience the worst while missing the best.

Using the bear market to your advantage

Bear markets provide long-term investors with the opportunity to buy quality investments at a lower price. The price you pay for an investment matters. Why? Generally, the lower the price you pay for a quality investment, the higher your potential investment return over time. This advice also holds true for market dips and corrections. Rebalancing your portfolio back to its target mix of investments (also called your asset allocation) is a way to use bear markets to your advantage.

If you’re taking income from your investments, it’s still possible to use a bear market to your advantage by rebalancing to help reduce its impact. While it can be difficult, consider temporarily reducing your income slightly by delaying spending so you leave more invested while prices are low. This can help your investments recover during the following rebound.

Bear market survival checklist

During a bear market, consider the following:

- Stay the course. Stock market declines are normal and frequent — they are not a reason to sell quality investments.

- Bear markets are typically short.

- Bear markets have historically been followed by bull markets.

- Bear markets can present opportunities for investors to buy quality investments at lower prices.

- Quality investments typically have what it takes to bounce back. Lower-quality investments may not recover when the bear market ends.

Talk with an Edward Jones financial advisor today about a portfolio review to help ensure your portfolio is well-positioned for any direction the market may head.

Prepare, don’t predict

We’re not predicting what will happen. However, by owning quality investments in appropriate amounts and diversifying them, you can be better prepared to weather periodic bear markets. Diversification does not ensure a profit or protect against loss in a declining market.

Important information:

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates, and investors can lose some or all of their principal.

1 Morningstar Direct. S&P/TSX Composite Index; 1/3/1977 - 12/31/2025. Past performance does not guarantee future results. Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

2 Bear markets since 1977. Bear market defined as a peak to trough of 20% or more in the S&P/TSX Composite.

3 Sources: Edward Jones calculations, Morningstar Direct, Factset, S&P/TSX Composite; 1/3/1960 - 12/31/2025. Past performance does not guarantee future results.