Previous week's weekly market wrap

The Fed keeps interest rates on hold as higher tariffs and softer jobs data loom

Key takeaways:

- This past week, the Federal Reserve held its July FOMC meeting and kept the fed funds rate on hold at 4.25% to 4.5%. Fed Chair Jerome Powell noted that there was still uncertainty on what the impact of tariffs would be on inflation, and that it may take some time to fully see these effects. He did not indicate that a September rate cut was imminent, although markets are now pricing in a higher probability of a cut at the next Fed meeting.

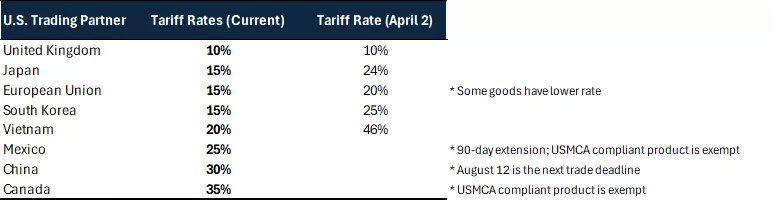

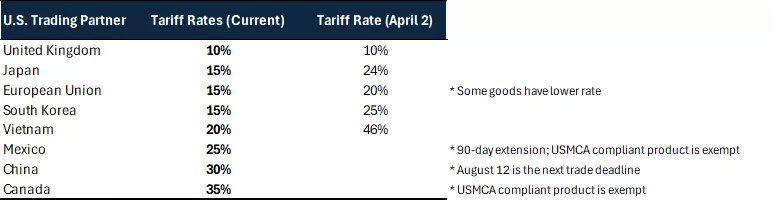

- The U.S. administration also confirmed its tariff stance with many trading partners ahead of its August 1 trade deadline. In some cases, trade deals were reached, including with the United Kingdom, Japan and the European Union, and in other cases, new tariff rates were assigned to trading partners, many 15% or higher. Overall, average tariff rates in the U.S. have likely gone up from about 2% to around 18%, according to the Yale Budget Lab, which could have a negative impact on goods prices and consumption over time.

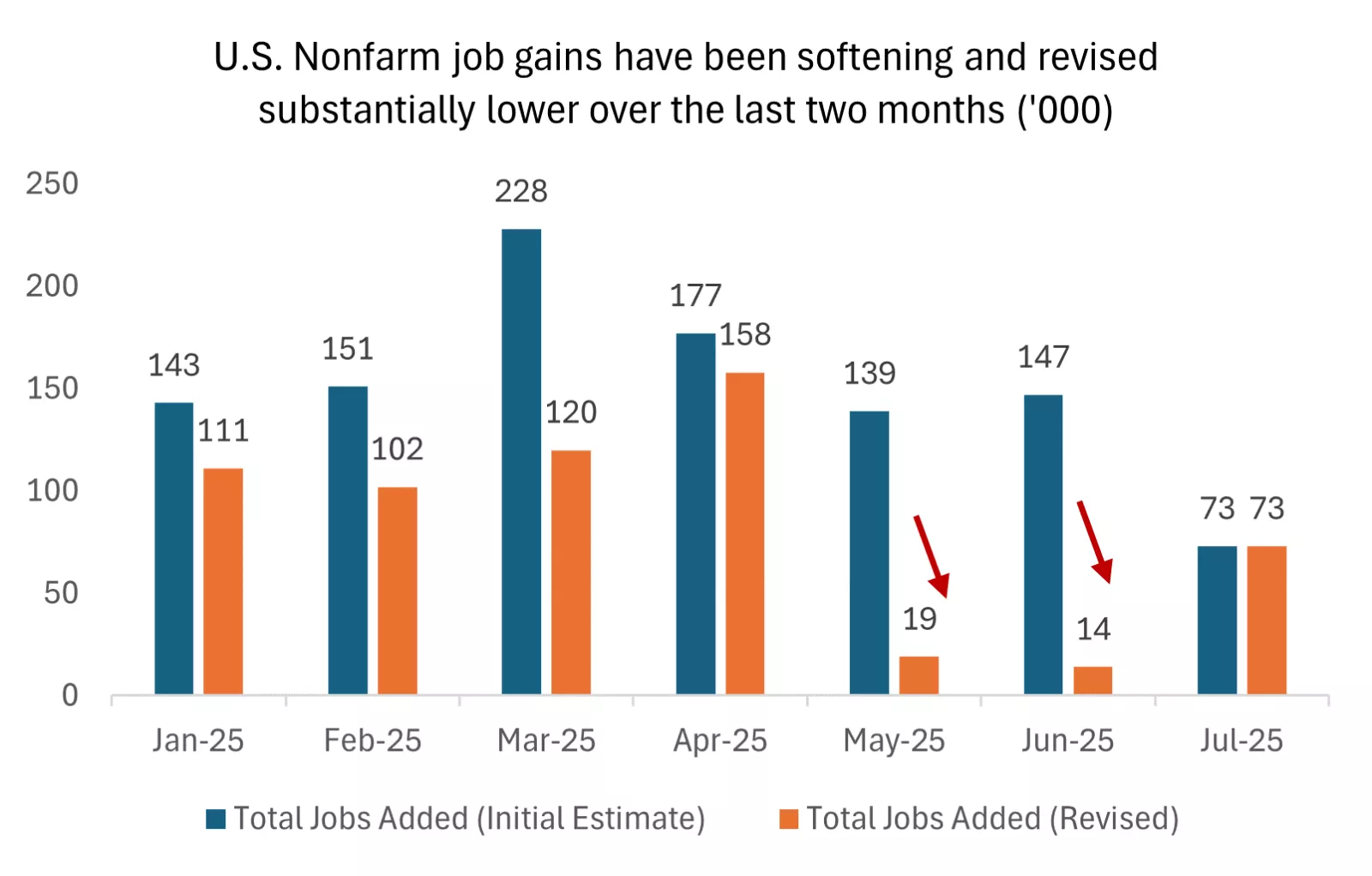

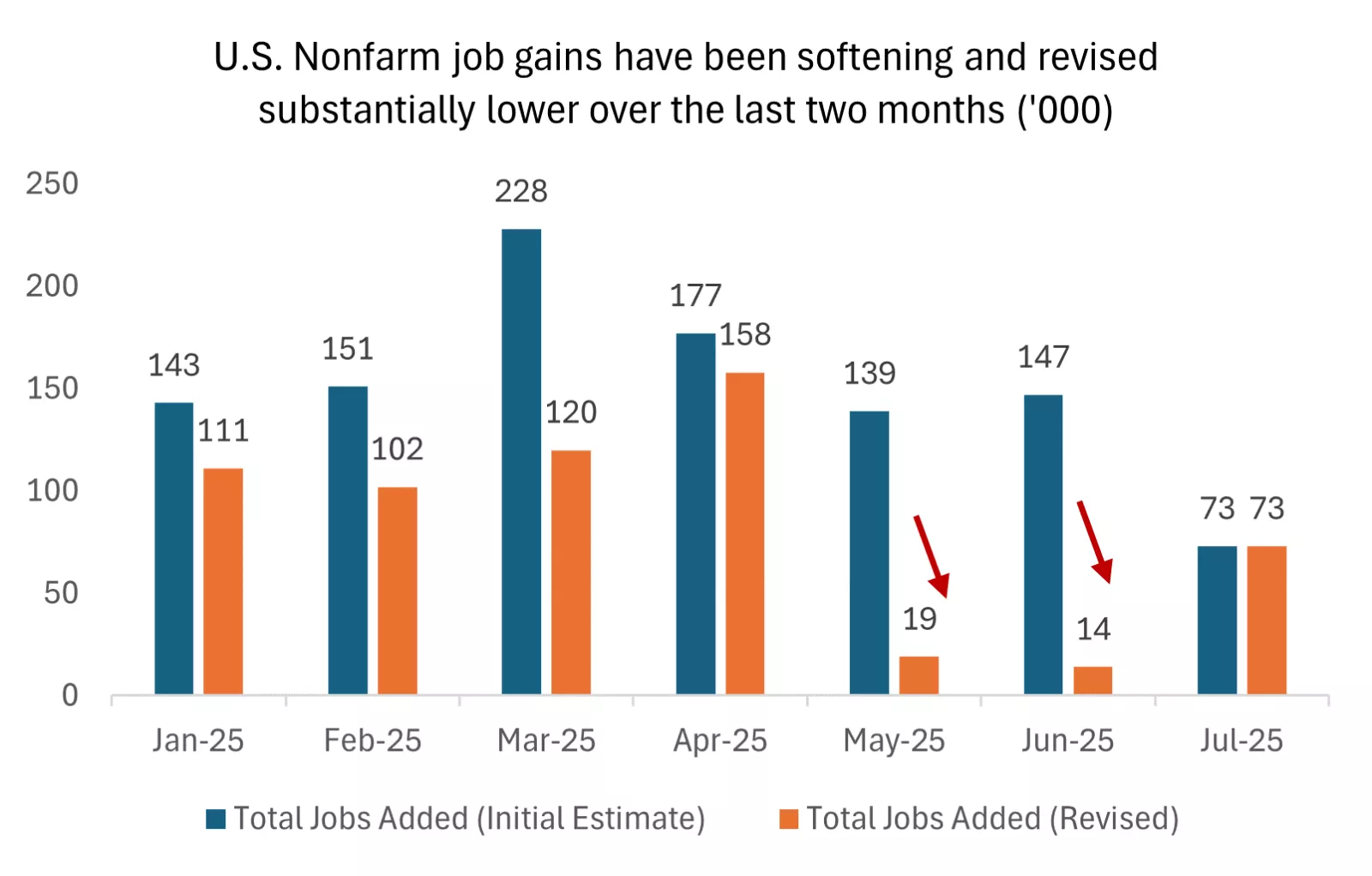

- Finally, the labor market in the U.S. showed a meaningful signal of slowdown this past week. The nonfarm jobs report showed 73,000 jobs added, below expectations of 104,000, and, notably, the prior two months of jobs added were revised sharply lower. The unemployment rate also ticked higher from 4.1% to 4.2%.

- Overall, after a nice rally in markets, investors face increasing walls of worry in higher tariffs rates and a softer labor market. However, the likelihood of Fed rate cuts has also increased, combined with some fiscal stimulus coming from the new tax bill, which may offer a better backdrop as we head into 2026.

The Federal Reserve keeps interest rates on hold for now, but the odds of a September cut have increased

The Federal Reserve kept rates on hold at its July meeting, leaving the fed funds rate at 4.25% to 4.5%. Notably, for the first time since 1993,1 there were two dissenting votes out of the 11 that called for the Fed to cut rates rather than keep them on hold.

In the press conference, Fed Chair Jerome Powell highlighted a couple of key points behind the Fed's decision. First, he noted that tariff uncertainty remains. While we are getting more clarity on tariff rates as the U.S. confirms more deals, the impacts of the tariffs on inflation and the economy are still unknown. And this may take some time to show up and could be "slower than expected" to emerge in the data. This is one reason that the Fed remains in wait-and-see mode and did not cut rates at this meeting.

Second, he noted that that the Federal Reserve's base-case scenario is still that the impact of tariffs on inflation could be a short-lived, one-time shift in the price level. However, the Fed cannot be certain that inflation does not stay anchored higher after tariff increases take hold, and thus it prefers to see how the data emerges in the months ahead.

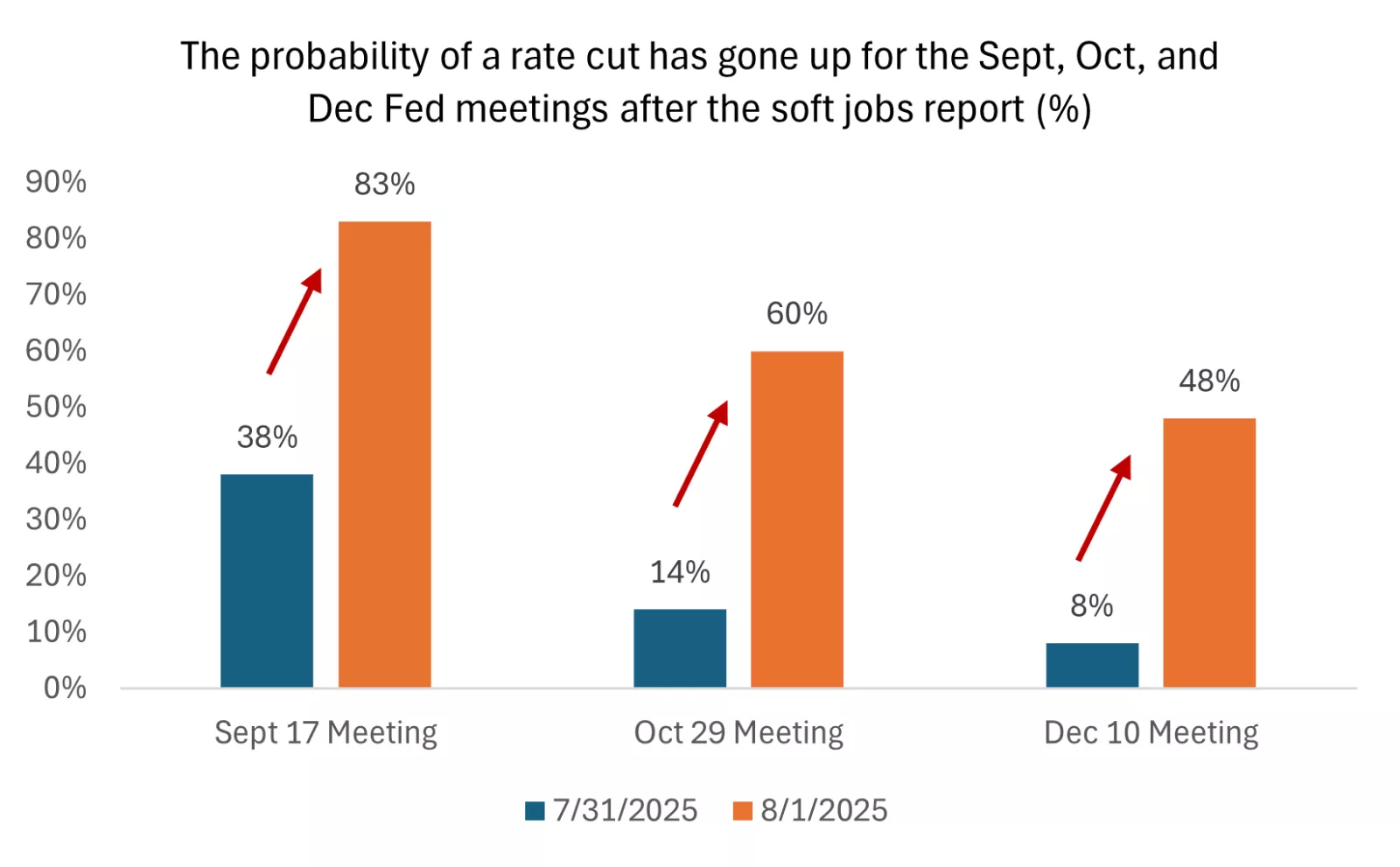

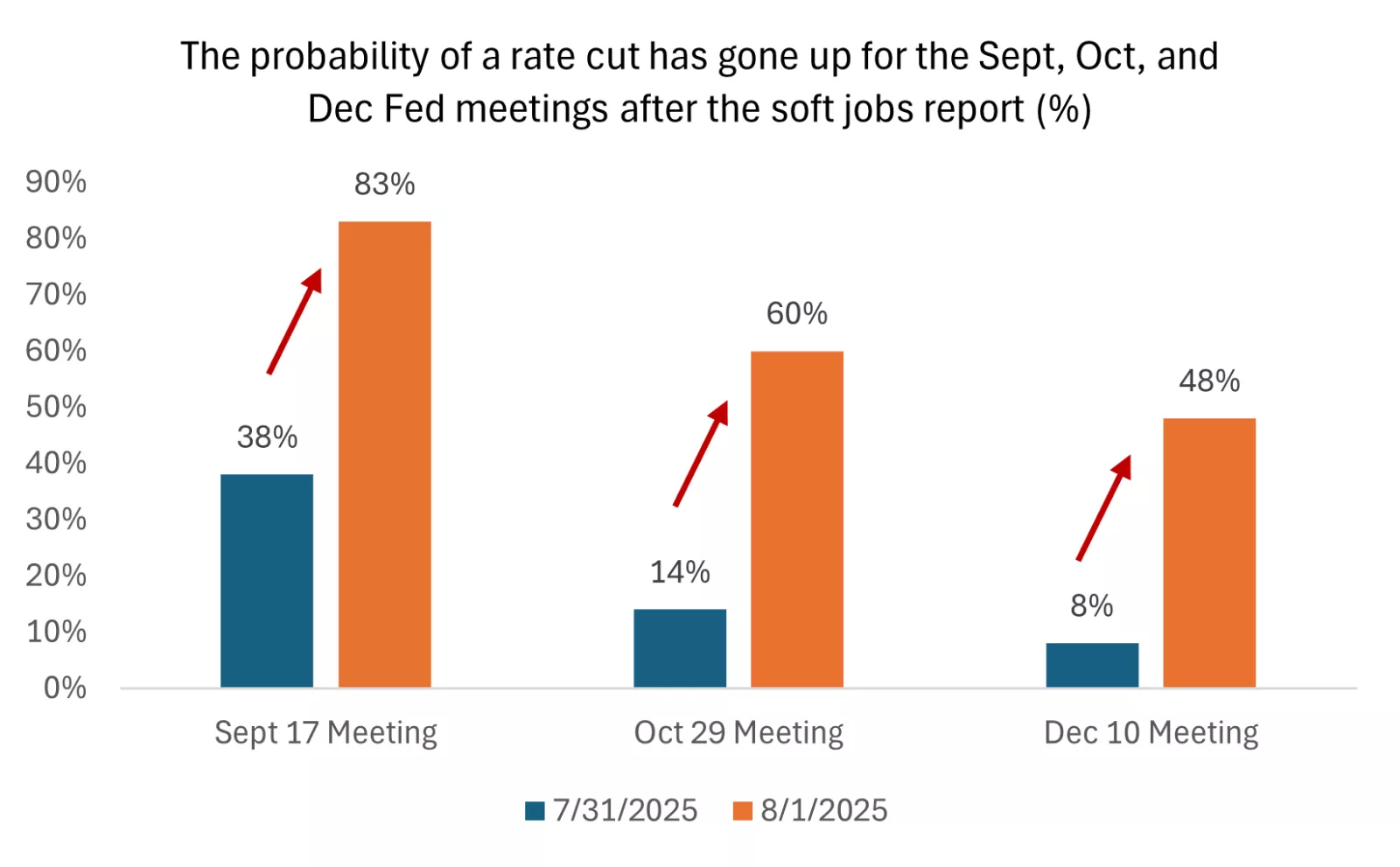

But perhaps the one factor that has shifted since last week's FOMC meeting is the U.S. labor market. Powell had characterized the labor market as balanced, with lower job openings but softer job growth. However, the July jobs report paints a picture of a clearly softening labor market, in our view, with jobs growth slowing meaningfully over the past three months (see section below). In this backdrop, given the Fed's dual mandate of stable prices and maximum employment, the FOMC may shift its focus to supporting the stalling labor market. In fact, markets are now pricing in about an 80% chance that the Fed cuts rates in September, well above the 38% probability after the Fed meeting, according to CME FedWatch.

This chart shows that the market probability of a Fed rate cut has gone up for the September, October, and December Fed meetings after the U.S. jobs report released on 8/1/25.

This chart shows that the market probability of a Fed rate cut has gone up for the September, October, and December Fed meetings after the U.S. jobs report released on 8/1/25.

Tariff rates are rising, and this likely means higher goods inflation

With the August 1 tariff deadline behind us, the U.S. administration has outlined trade deals and tariff rates with many of its trading partners. These tariff rates range from 10% to 41%, and according to the Yale Budget Lab, the average tariff rate in the U.S. will go from around 2.4% at the start of the year to about 18.3%, the highest since 1934. The latest round of tariffs is scheduled to take effect on August 7.

Example tariff rates with large U.S. trading partners:

This chart shows the average tariff rates imposed by the U.S. on its largest trading partners, compared to what they were on April 2.

This chart shows the average tariff rates imposed by the U.S. on its largest trading partners, compared to what they were on April 2.

While tariffs had already been elevated over the past several months, around 10% for most trading partners, moving them higher and maintaining them at these rates will likely mean higher goods inflation and softer consumption in the months ahead. Corporations that had built inventories ahead of tariffs will likely start to work these down and need to replenish at higher rates. And those companies and supply-chain partners that had been willing to absorb some of the tariff costs through lower profit margins may not be as willing to do so indefinitely. Thus, goods prices are likely to rise, and demand may fall in certain categories. Discretionary spending overall may come down as well.

However, in our view, as the Fed alluded to, the tariff impact should be a one-time shift higher in prices, and then the impact on inflation may stabilize. In addition, keep in mind that the U.S. CPI inflation basket is largely based on services, not goods. In fact, services make up about 64% of the basket, while goods make up about 36%. So while tariffs may push up goods inflation, if services inflation continues to show signs of moderation – as it has in recent months – the overall inflation impact may be more modest.

The jobs data appears to be a meaningful downshift in the U.S. economic narrative

Prior to last week's U.S. jobs report, the narrative was that inflation was ticking higher but seemed contained, and the U.S. labor market looked resilient. The July jobs report, however, highlights that the U.S. labor market has been weaker than the data had indicated.

The July jobs report indicated a total of 73,000 new jobs were added, well below estimates of 104,000. Perhaps most importantly, the last two months of data were revised sharply lower, subtracting about 260,000 jobs from the totals. This brings the average job gains of the last three months to 35,000, well below the 127,000 average of the prior three months.

This chart shows that U.S. job gains have been softening and revised lower over the past two months.

This chart shows that U.S. job gains have been softening and revised lower over the past two months.

The unemployment rate ticked higher from 4.1% to 4.2%, still well below historical averages, although labor-force participation dropped to 62.2%, the lowest since November 2022.1 Job gains were concentrated in the health care field, while government and manufacturing sectors lost jobs. Notably, wage growth of 3.9% year-over-year still outpaced inflation rates of around 2.7%1, meaning consumers are still experiencing positive real wage gains.

In our view, the sizable downshift in the jobs data indicates that the U.S. economy may be entering a softer growth patch. A softer labor market, combined with higher tariff rates, may put some pressure on the consumer and household consumption. However, we also believe that the Federal Reserve is now more likely to cut interest rates, as reflected by markets as well. While growth may slow in the coming quarters, we do not see a recession on the horizon, and as we head toward 2026, we could see a rebound as interest rates move lower and as some marginal fiscal stimulus from the tax bill kicks in.

We recommend staying diversified and up in quality, and staying invested

After a nice run in financial markets, with the S&P 500 up over 20% since its April 8 lows, we may experience volatility as markets digest higher tariffs and a softer jobs market. In our view, investors can use these bouts of volatility to consider rebalancing portfolios, diversifying across equities and bonds, and adding quality investments at better prices. Keep in mind that we are also in the midst of the second-quarter earnings season, and thus far over 80% of companies have beaten earnings expectations – which means corporate earnings growth remains on track to be positive this year.1 In addition, we are likely to see the Federal Reserve cut interest rates this year, and the new tax bill to kick in starting in 2026, which should be supportive of market sentiment, in our view.

In this backdrop, we continue to favor U.S. large-cap and mid-cap equities. From a sector perspective, we prefer having exposure to growth and value sectors, including consumer discretionary, financials and health care. And within U.S. investment-grade bonds, we see value in extending duration in the 7- to 10-year maturity space, which can still allow you to lock in relatively higher yields and can offer the potential for price appreciation if the Fed lowers rates. Finally, remember that your financial advisor can help ensure you remain on track to meet your personal long-term financial goals, even as we climb walls of worry in the months ahead.

Mona Mahajan

Investment Strategist

Source: 1. FactSet

Weekly market stats

| INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

| Dow Jones Industrial Average | 43,589 | -2.9% | 2.5% |

| S&P 500 Index | 6,238 | -2.4% | 6.1% |

| NASDAQ | 20,650 | -2.2% | 6.9% |

| MSCI EAFE * | 2,606.40 | -3.1% | 15.2% |

| 10-yr Treasury Yield | 4.21% | -0.2% | 0.3% |

| Oil ($/bbl) | $67.30 | 3.3% | -6.2% |

| Bonds | $99.14 | 0.7% | 3.8% |

Source: FactSet, 8/1/2025. Bonds represented by the iShares Core U.S. Aggregate Bond ETF. Past performance does not guarantee future results. *Morningstar Direct, 8/3/2025.

The week ahead

Important economic releases this week include ISM PMI data.

Review last week's weekly market update.

Mona Mahajan

Mona Mahajan is responsible for developing and communicating the firm's macroeconomic and financial market views. Her background includes equity and fixed income analysis, global investment strategy and portfolio management.

She regularly appears on CNBC and Bloomberg TV, and in The Wall Street Journal and Barron’s.

Mona has a master’s in business administration from Harvard Business School and bachelor's degrees in finance and computer science from the Wharton School and the School of Engineering at the University of Pennsylvania.

Important Information:

The Weekly Market Update is published every Friday, after market close.

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss in declining markets.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent in international investing, including those related to currency fluctuations and foreign political and economic events.