You very well might. There are three things to understand about long-term care events:

- They are likely to occur — We estimate almost half of retirees will need long-term care support during their lifetime. The longer you live, the more likely you’ll have a long-term care need.*

- They can last for a long time — Around 25% of events last longer than one year and 15% of events last longer than three years.*

- They might require varying levels of support — Some diagnoses, such as a stroke, may require substantial costs immediately. But the level of care for many long-term care events tends to progress — particularly those that last for a significant period of time. For example, the first year of care may be part-time care in your home, followed by full-time home care and then finally a nursing home.

Planning tip

The risk of a long-term care event is fairly likely, and the need can be significant, so we recommend everyone put a plan in place in case they need care.

Long-term care services are broad, ranging from help with day-to-day tasks (such as cleaning) to more substantial supervision required for one’s health and safety. When thinking about how you’d prefer to receive care, consider what you may want and need.

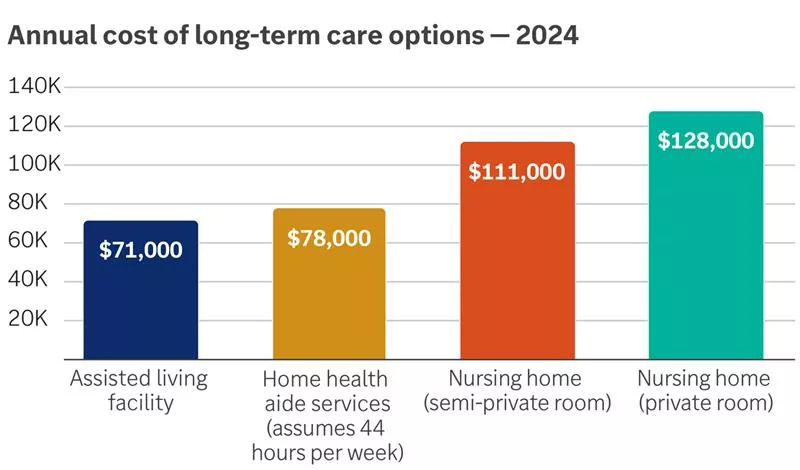

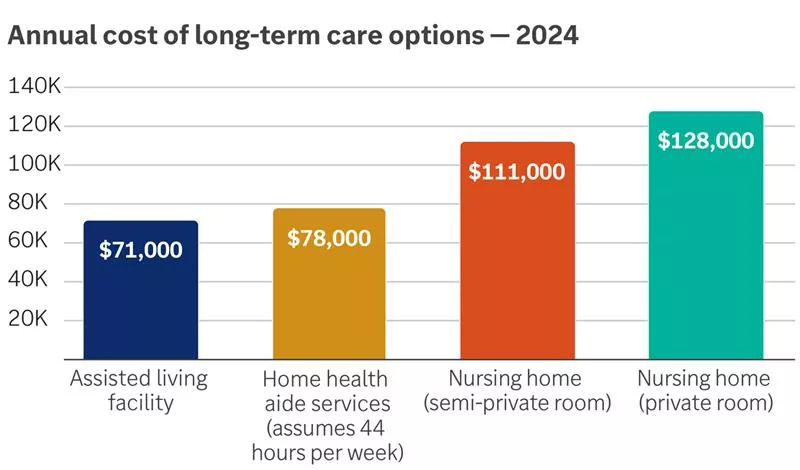

Many people prefer to stay in their own homes, and may initially rely on friends and family. But your care needs may progress to the point where you'd benefit from professional services. Paid care can still take place in one’s own home, but can also be provided in facilities such as rehabilitation centers, adult day cares, assisted living facilities and nursing homes. Costs vary substantially based on where care is received, as shown in the following chart.

The annual costs of long-term care options vary. Care in an assisted living facility costs $71,000; home health aide services (assuming 44 hours per week) costs $78,000; a semi-private room in a nursing home runs $111,000; a private room in a nursing home costs $128,000.

Source: Genworth 2024 Cost of Care Survey. Median values, rounded to the nearest thousand.

Planning tip

In practice, the majority of care is provided by informal caregivers — family and friends. While this may be sufficient for a period of time, informal caregiving can carry significant trade-offs for the caregiver as well as the person who needs care. So, it's important to have a plan to receive paid caregiving.

We recommend planning for $150,000 (in today's dollars) of care as a starting point and then adjusting based on your particular situation. The $150,000 is based on receiving two to three years of care with increasing levels of care support. From this starting point, you can adjust the amount needed based on your individual circumstances, such as your expected longevity or expected access to informal care.

Planning tip

When planning for long-term care costs, it’s important to:

- Start with an estimate of $150,000 and then adjust based on your particular situation.

- Consider where you may be living in retirement (which may not be the same as where you're living now). This could change your cost estimate, and can also help you build awareness of what services are available in your particular area.

- Build in reasonable inflation expectations for what care might cost when you need it, since a long-term care event might be decades away.

A financial advisor can help with these steps, to help ensure your cost estimates are appropriate for your situation.