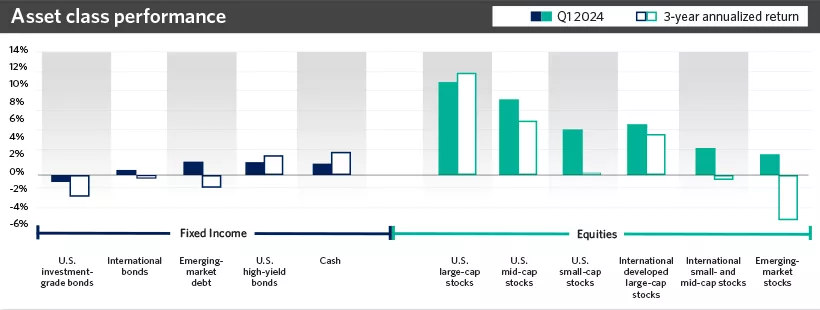

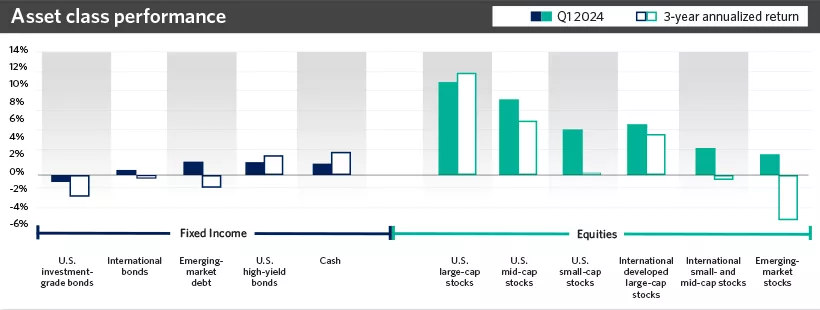

The above tables compare first-quarter performance in varying asset classes and stock market sectors with three- and five-year returns. Among asset classes, U.S. large-cap stocks rose 10.6% in the first quarter, U.S. mid-cap stocks rose 8.6%, U.S. small-cap stocks rose 5.2%, international developed large-cap stocks rose 5.8%, international small- and mid-cap stocks rose 3.1%, emerging-market stocks rose 2.4%, U.S. investment-grade bonds fell 0.8%, international bonds rose 0.6%, emerging-market debt rose 1.5%, U.S. high-yield bonds rose 1.5%, and cash rose 1.3%. In stock market sectors, information technology rose 12.7% in the first quarter, financials rose 12.5%, consumer staples rose 7.5%, consumer discretionary rose 5%, communication services rose 15.8%, health care rose 8.8%, industrials rose 11%, materials rose 8.9%, real estate fell 0.5%, utilities rose 4.6%, and energy rose 13.7%.

Quarterly market outlook - second quarter 2024

Our investment strategists provide Edward Jones’ perspective on the latest economic activity and what it may mean for you.

Asset class performance

Past performance does not guarantee future results. An index is unmanaged and is not available for direct investment.

This chart shows first-quarter returns and three-year annualized returns in the fixed-income and equity markets. In Q1, equity markets picked up where they left off in 2023, continuing their trend higher, while higher bond yields pressured investment-grade bond returns.

Past performance does not guarantee future results. An index is unmanaged and is not available for direct investment.

This chart shows first-quarter returns and three-year annualized returns in the fixed-income and equity markets. In Q1, equity markets picked up where they left off in 2023, continuing their trend higher, while higher bond yields pressured investment-grade bond returns.

Looking back at the 1st quarter

Equity markets picked up where they left off in 2023, continuing their trend higher, while higher bond yields pressured investment-grade bond returns.

Equity markets march higher; bonds pressured by higher yields

Equity markets rallied in the first quarter, with each of our recommended equity asset classes finishing higher, led by U.S. large-cap stocks, which gained 10.6%. Treasury yields moved higher in the first quarter, with the 10-year yield rising roughly 0.3 percentage points to 4.2% in response to higher-than-expected inflation readings, pressuring investment-grade bond returns.

Unlike bouts of equity market volatility in 2023 that were accompanied by rising bond yields, resilient economic activity and healthy corporate profits helped lift stocks in the first quarter despite rising bond yields.

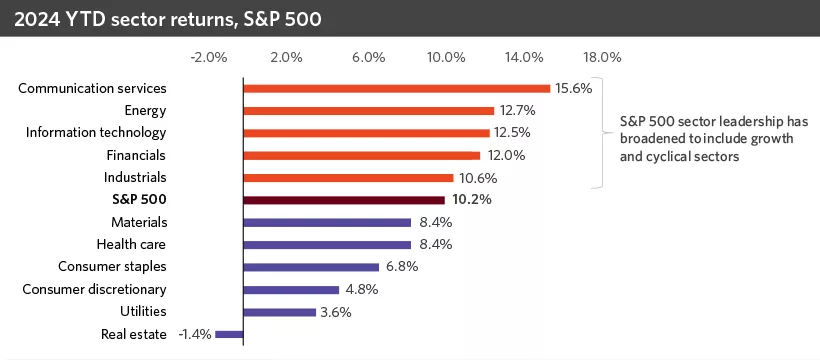

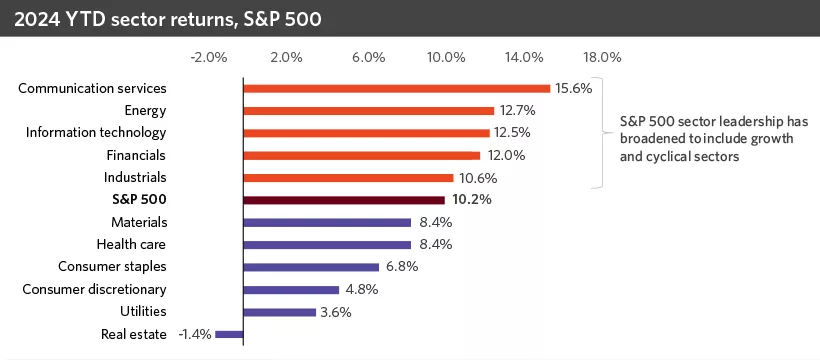

Broadening participation helped lift equity markets

2023 was characterized by narrow leadership, with a handful of mega-cap technology companies accounting for a large portion of the S&P 500’s gains. The technology, communication services and consumer discretionary sectors each returned over 40% in 2023, while no other sector returned more than 18%. Q1 saw continued strength in technology and communication services, with each sector higher by over 12%.

Cyclical sectors such as industrials, energy and financials saw strong performance as well, each rising by 11% or better. We’d look for broadening leadership to continue in 2024, with some of last year’s laggards potentially playing catch-up.

Markets adjust expectations for Fed rate cuts

Inflation data showed in Q1 that the trend remains lower; however, the path to the Federal Reserve’s 2% target could have bumps along the way. Core Consumer Price Index (CPI) inflation declined modestly, from a 3.9% year-over-year gain at the end of 2023 to 3.8% in February.

Despite the gradual trend lower, both the January and February CPI readings were above consensus expectations, leading markets to lower expectations for Fed rate cuts in 2024 and driving bond yields higher.

Action for investors

Broadening market leadership highlights the importance of maintaining diversification across multiple regions, styles and sectors. Work with your financial advisor to help ensure your portfolio is appropriately diversified and aligned with your long-term goals.

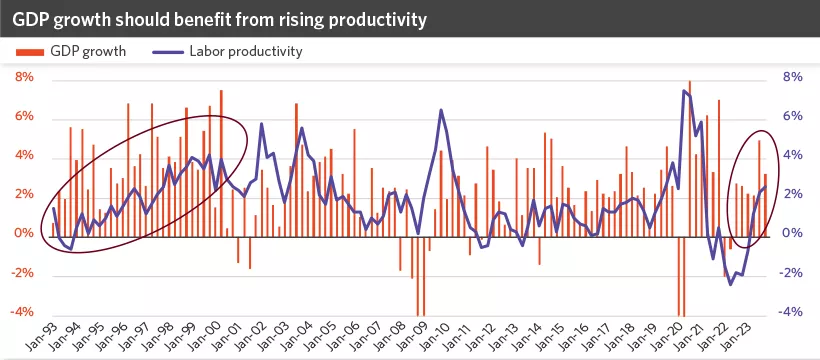

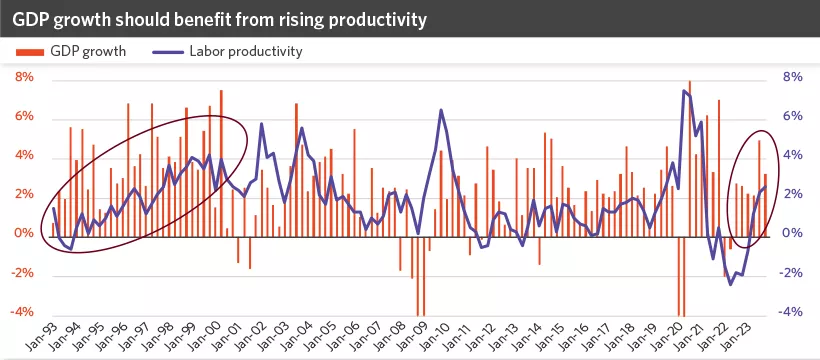

This chart shows GDP growth and labor productivity since January 1993. Labor productivity has been strong lately, which can support GDP growth even as payroll gains and wages moderate.

This chart shows GDP growth and labor productivity since January 1993. Labor productivity has been strong lately, which can support GDP growth even as payroll gains and wages moderate.

Economic outlook

Recession risks have faded, with the economy hitting its stride in recent quarters despite restrictive Fed policy. We think the expansion can continue, but we expect some momentum will fade as consumers show a bit of fatigue.

Lower inflation will be a necessary condition that should allow the Fed cut rates in the second half of the year, supporting GDP growth.

The inflation fight isn’t over

The catch-22 of healthy economic growth is that it creates upward pressure on inflation. Positively, Core Personal Consumption Expenditures (the Fed’s preferred measure of inflation) has fallen below 3%, though there’s still plenty of work to be done to reach the Fed’s 2% target.

While recent housing and goods production trends signal lower inflation, we wouldn’t rule out a few hiccups along the way. This may complicate the Fed’s job but likely won’t prevent rate cuts from starting this summer, which should support GDP growth ahead.

Labor market slack emerges

The labor market remains strong, with unemployment below 4% since 2022. We don’t expect a significant spike in unemployment, but trends in job openings and turnover signal some moderation in employment conditions. In our view, this will temper the pace of household spending, which was a strong driver of above-trend GDP growth in 2023.

Encouragingly, labor productivity has been strong, which can support GDP growth even as payroll gains and wages moderate. Recent improvement in business investment suggests that productivity gains could continue in the near term, while artificial intelligence could introduce a longer-term productivity boom, similar to the economic expansion of the 1990s.

Lagging areas staging a rebound

Housing and manufacturing contracted in 2023, though strong consumer spending largely overcame this weakness. Recently, the ISM manufacturing index rose to its highest reading since September 2022, while a pickup in durable goods orders signals a rebound in business spending. We expect GDP growth to slow from 2023’s levels, but a pickup in these lagging sectors should help extend the expansion.

Action for investors

We think U.S. economic growth will outpace that of global developed economies, supporting earnings growth and an overweight allocation to U.S. large-cap equity. Future Fed rate cuts and potentially lower yields favor extending duration within bond allocations.

Important information: Past performance does not guarantee future results. |

This chart shows equity sector returns year to date (as of 3/28/2024). S&P 500 sector leadership has broadened beyond mega-cap technology stocks to include growth and cyclical stocks.

This chart shows equity sector returns year to date (as of 3/28/2024). S&P 500 sector leadership has broadened beyond mega-cap technology stocks to include growth and cyclical stocks.

Equity outlook

Stock markets continued to rally in the first quarter of 2024, with the S&P 500 higher by nearly 10%. Underneath the surface, we have started to see market participation broaden beyond mega-cap technology stocks. Small- and mid-cap stocks have moved higher, and cyclical sectors have outperformed the broader index as well.

Market volatility may be likely after a strong rally

The S&P 500 rallied over 25% from late October 2023 through the first quarter of 2024, without a correction of 5% or more. After strong performance in Q1, we expect market volatility or a pullback to emerge, perhaps as uncertainty about the paths of inflation and the Fed lingers.

However, we would not expect any market correction to morph into a more severe bear market (a pullback of 20% or more). Down markets tend to occur when the economy is headed toward a recession or the Fed is raising rates — neither of which is in place today.

Thus, market volatility may be an opportunity to add to or diversify portfolios, particularly for investors who may not have fully participated in the recent rally.

Market leadership continues to broades

While the mega-cap technology theme has certainly continued to see momentum in the first quarter of 2024, there have also been encouraging signs that market leadership may be broadening.

From a sector perspective, while technology and communication services are still top performers, cyclical sectors like energy, financials and industrials are also outperforming the S&P 500. These sectors tend to do well when economic growth is steady or improving, which we believe is the case for the U.S. economy in 2024. Small- and mid-cap stocks are starting to play catch-up with U.S. large-cap stocks as well.

In our view, this broadening in leadership may continue over the next year, especially as the Fed potentially pivots to rate cuts and earnings growth also broadens across sectors.

Action for investors

We recommend overweighting U.S. equities in your portfolio, specifically U.S. large- and mid-cap stocks, which we believe can continue to outperform in the year ahead. Periods of market volatility or pullbacks can be opportunities to add to or diversify portfolios, particularly as the Fed gradually pivots to rate cuts and U.S. earnings growth broadens.

Important information: Past performance does not guarantee future results.

Diversification does not guarantee a profit or protect against loss in declining markets. |

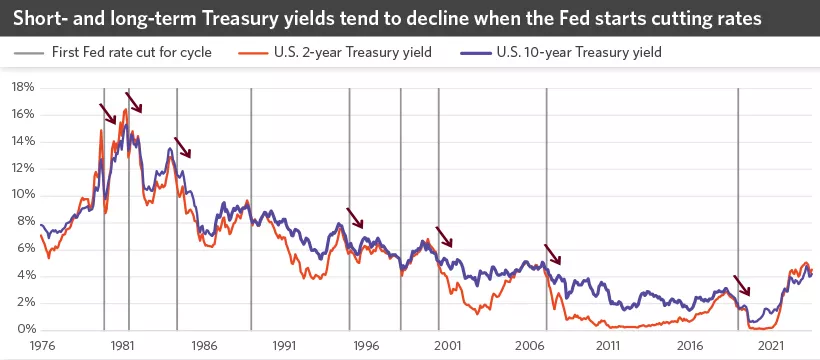

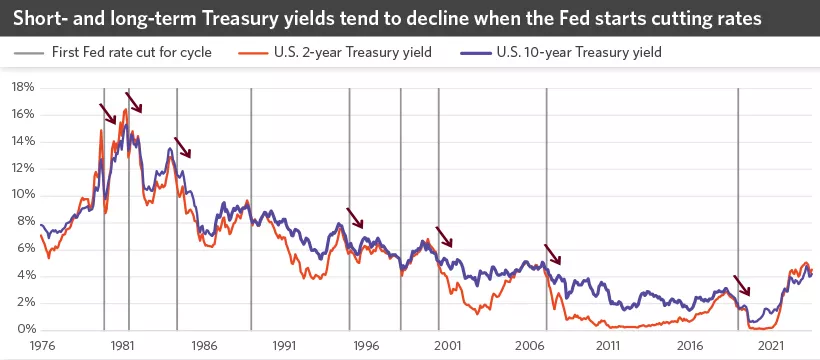

This chart shows the two-year and 10-year Treasury yields since 1976, and how they have historically reacted to the first Fed rate cut in a cycle.

This chart shows the two-year and 10-year Treasury yields since 1976, and how they have historically reacted to the first Fed rate cut in a cycle.

Fixed income outlook

Yields have risen in recent months, driven in part by the slowing decline of inflation. While higher yields have impacted bond prices — weighing on the U.S. bond market —Treasury yields generally remain well below highs for the cycle.

We expect the Fed to start cutting rates soon, which should drive short-term rates lower, steepening the yield curve. U.S. high-yield bond credit spreads are near historical lows, providing relatively less compensation for credit risk.

The Fed signals 3 rate cuts this year

The Fed updated its economic projections in March, maintaining expectations for three rate cuts this year. If inflation continues to moderate, as is expected, the Fed should be able to pivot to less-restrictive monetary policy soon. We expect rate cuts to start in the second half of the year if inflation continues its downward trend.

The yield curve could steepen

As the timing of Fed rate cuts becomes clearer, short-term yields could decline.

We expect short-term rates to fall more than long-term rates, steepening the yield curve, which has been inverted for nearly two years. This could increase reinvestment risk for short-term bonds and certificates of deposit as investors might have to reinvest maturing principal at lower rates.

Maturing CDs and short-term bonds could be a source of funds to reallocate to underrepresented asset classes of a well-diversified portfolio.

U.S. high-yield bond credit spreads are near historical lows

U.S. high-yield bonds have been a top-performing fixed-income asset class, benefiting from tighter credit spreads. Credit spread — which is the excess yield above U.S. Treasury bonds of comparable maturity — currently provides less compensation for credit risk, potentially making high-yield bonds relatively less attractive.

Emerging-market debt, which is also included with aggressive-income investments, is more attractive in our view, as it would benefit more from lower rates due to its longer duration.

Action for investors

We recommend underweighting fixed income relative to your long-term strategic asset allocations, as we expect U.S. stocks to outperform bonds over the near term. We also see an opportunity to overweight emerging-market debt, with U.S. high-yield bonds as a potential source of funds.

Within U.S. investment-grade bonds, extending duration by adding to intermediate- and long-term bonds can help reduce reinvestment risk by locking in rates for longer.

Important information: Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity. |

This chart shows that most major central banks expect to cut interest rates three times before year-end, while the Bank of Japan plans two rate hikes in that time period.

This chart shows that most major central banks expect to cut interest rates three times before year-end, while the Bank of Japan plans two rate hikes in that time period.

International outlook

U.S. equity markets continued to outperform through the first quarter, but leadership is starting to broaden, with several global markets hitting fresh record highs. These include the German DAX, the French CAC and Japan’s Nikkei.

While the U.S. will likely maintain its economic and earnings growth advantage, easier central bank policy in the months ahead and a rangebound U.S. dollar brighten the international outlook.

Central banks prepare for rate cuts

Global inflation will likely remain on a downward path the rest of 2024, allowing central banks to pivot to rate cuts. The Swiss National Bank became the first major central bank to cut rates in this cycle, with most others, including the Fed and the European Central Bank, likely to follow suit in the second half of the year.

While the Bank of Japan (BoJ) raised rates, it is only exiting negative rates, and policy will stay accommodative. In our view, the coordinated global easing cycle will help sustain the expansion and reaccelerate growth.

U.S. economy leads, but international growth likely past its worst

The eurozone economy has stalled over the past four quarters, while Japanese growth has downshifted. On the other hand, the U.S. economy has been boosted by strong consumption and a notable uptrend in productivity.

U.S. growth will likely continue to lead this year, but we expect global rate cutting to drive a recovery in manufacturing activity, lifting international growth prospects. The 32% discount in international developed equity valuations relative to U.S. stocks and attractive dividend yields justify in our view a neutral allocation to international stocks despite weaker economic and earnings momentum.

China headwinds persist

Activity in China appears to be regaining some momentum as policymakers are taking incremental steps to support the economy. However, ongoing pressures in the property sector, which accounts for 30% of China’s gross domestic product, as well as a challenging regulatory landscape, will continue to weigh on relative performance, in our view.

Action for investors

We recommend underweighting emerging-market equities, staying neutral with international developed equities, and overweighing U.S. stocks. Within fixed income, we see an opportunity to overweight emerging-market debt, which has higher interest rate sensitivity and historically outperforms U.S. bonds in periods following peak Fed policy.

Important information: Special risks are inherent to international investing, including those related to currency fluctuations and foreign political and economic events.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity. |

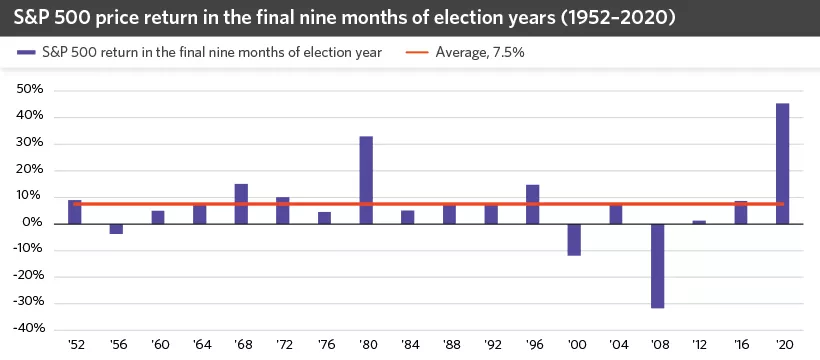

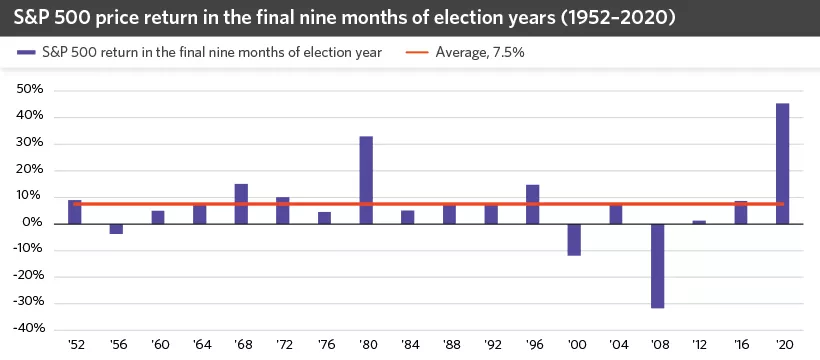

This chart shows the S&P 500’s return in the final nine months of an election year, in the past 18 elections going back to 1952. The average nine-month return for this time period is 7.5%.

This chart shows the S&P 500’s return in the final nine months of an election year, in the past 18 elections going back to 1952. The average nine-month return for this time period is 7.5%.

Presidential elections and the markets

The 2024 U.S. presidential election will be top of mind for many investors as we move through the year. While political uncertainty could drive short-term bouts of volatility, history shows the stock market tends to perform well in election years regardless of political outcomes.

Stocks have fared well in election years

In the past 18 elections going back to 1952, the S&P 500 has returned an average of 7.5% in the final nine months of an election year, and returns have been positive 83% of the time. This compares to an average gain of 6.8% in the final nine months of all years dating back to 1952, with returns positive 72% of the time.

We acknowledge that this year’s election has the potential to be contentious, which could spur short-term market volatility. However, one unique aspect of this year’s election is that both of the likely candidates have already served a term in office. To that end, markets have performed well under both Donald Trump and Joe Biden, with the S&P 500 returning roughly 16% per year from 2017–20 and 12.7% per year from 2021 through the end of March 2024.

Market familiarity with both candidates should provide investors confidence that stocks could continue to perform well under either party.

Economic growth and fundamentals are more important drivers of market returns

Over the long term, we believe economic growth and fundamental variables such as corporate earnings and interest rates have a more powerful influence on markets than politics. To that end, we expect the economic backdrop to remain supportive to equity markets in 2024.

Our view is for economic growth to slow from above-trend levels but remain positive, the Fed to begin cutting rates in the second half of the year, and corporate profit growth to accelerate in 2024. In our view, this backdrop creates a positive environment for equity markets, particularly in the U.S., regardless of who wins the election.

Action for investors

As we approach election day, we recommend using pockets of market volatility spurred by political uncertainty as an opportunity to add to quality investments in line with your long-term goals.

Important information: Past performance does not guarantee future results. |

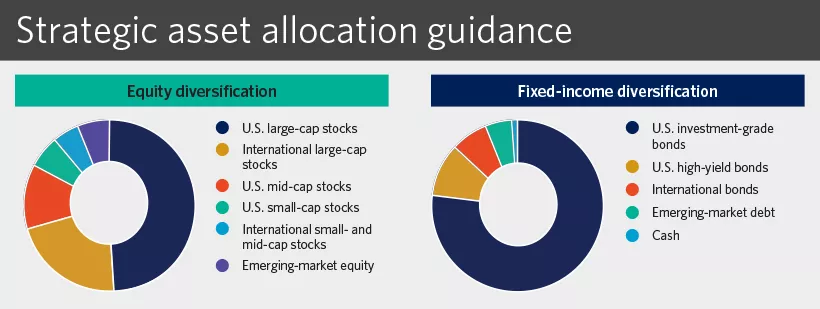

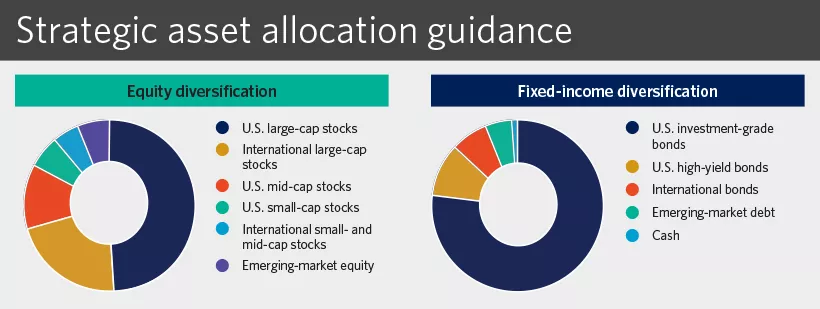

Strategic asset allocation guidance

Our strategic asset allocation represents our view of balanced diversification for the fixed-income and equity portions of a well-diversified portfolio, based on our outlook for the economy and markets over the next 30 years. The exact weightings (neutral weights) to each asset class will depend on the broad allocation to equity and fixed-income investments that most closely aligns with your comfort with risk and financial goals.

Within our strategic guidance, we recommend these asset classes, from highest to lowest weight:

Equity diversification: U.S. large-cap stocks, international large-cap stocks, U.S. mid-cap stocks, U.S. small-cap stocks, international small- and mid-cap stocks, emerging-market equity.

Fixed-income diversification: U.S. investment-grade bonds, U.S. high-yield bonds, international bonds, emerging-market debt, cash.

Within our strategic guidance, we recommend these asset classes, from highest to lowest weight:

Equity diversification: U.S. large-cap stocks, international large-cap stocks, U.S. mid-cap stocks, U.S. small-cap stocks, international small- and mid-cap stocks, emerging-market equity.

Fixed-income diversification: U.S. investment-grade bonds, U.S. high-yield bonds, international bonds, emerging-market debt, cash.

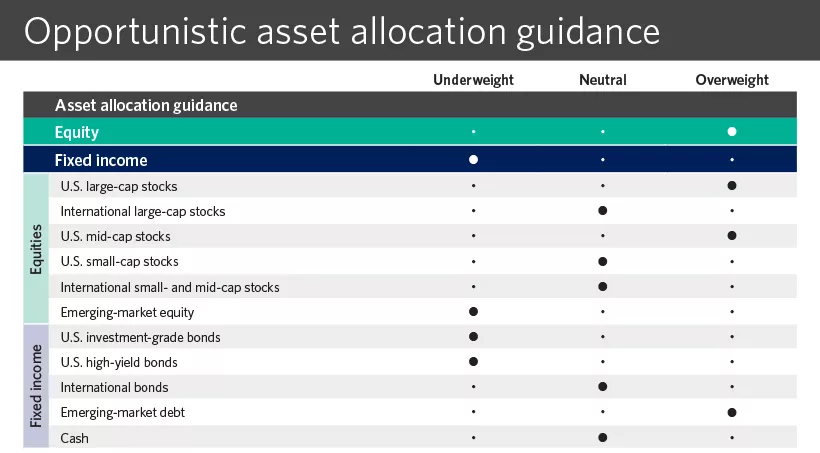

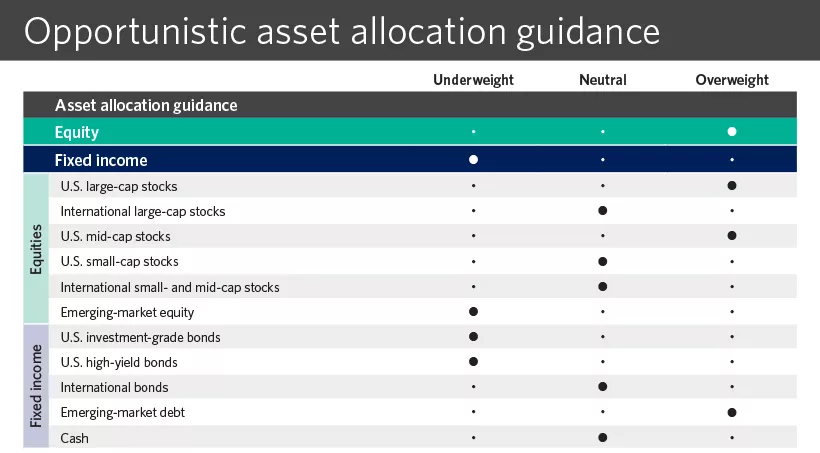

Opportunistic portfolio guidance

Our opportunistic portfolio guidance represents our timely investment advice based on our global outlook. We expect this guidance to enhance your portfolio’s return potential, relative to our long-term strategic portfolio guidance, without taking on unintentional risk.

Our opportunistic asset allocation guidance follows:

Equity — overweight overall; overweight for U.S. large-cap stocks and U.S. mid-cap stocks; neutral for international large-cap stocks, U.S. small-cap stocks and international small- and mid-cap stocks; underweight for emerging-market equity.

Fixed income — underweight overall; overweight for emerging-market debt; neutral for international bonds and cash; underweight for U.S. investment-grade bonds and U.S. high-yield bonds.

Our opportunistic asset allocation guidance follows:

Equity — overweight overall; overweight for U.S. large-cap stocks and U.S. mid-cap stocks; neutral for international large-cap stocks, U.S. small-cap stocks and international small- and mid-cap stocks; underweight for emerging-market equity.

Fixed income — underweight overall; overweight for emerging-market debt; neutral for international bonds and cash; underweight for U.S. investment-grade bonds and U.S. high-yield bonds.

Visit our monthly portfolio brief for a discussion of portfolio performance.

Investment performance benchmarks

It’s natural to compare your portfolio’s performance to market performance benchmarks, but it’s important to put this information in the right context and understand the mix of investments you own. Talk with your financial advisor about any next steps for your portfolio to help you stay on track toward your long-term goals.

As of March 28, 2024

Asset class performance

| Total returns | Q1 2024 | 3-year | 5-year |

|---|---|---|---|

| U.S. large-cap stocks | 10.6 | 11.6 | 15.0 |

| U.S. mid-cap stocks | 8.6 | 6.2 | 11.1 |

| U.S. small-cap stocks | 5.2 | 0.3 | 8.1 |

| Int'l developed large-cap stocks | 5.8 | 4.7 | 7.3 |

| Int'l small- & mid-cap stocks | 3.1 | -0.5 | 5.1 |

| Emerging-market stocks | 2.4 | -5.1 | 2.2 |

| U.S. investment-grade bonds | -0.8 | -2.5 | 0.4 |

| Int'l bonds | 0.6 | -0.4 | 1.0 |

| Emerging-market debt | 1.5 | -1.4 | 1.1 |

| U.S. high-yield bonds | 1.5 | 2.3 | 4.2 |

| Cash | 1.3 | 2.6 | 2.1 |

U.S. equity sector performance

| Total returns | Q1 2024 | 3-year | 5-year |

|---|---|---|---|

| Information Technology | 12.7 | 19.6 | 25.4 |

| Financials | 12.5 | 9.2 | 12.7 |

| Consumer Staples | 7.5 | 7.8 | 10.0 |

| Consumer Discretionary | 5.0 | 4.6 | 11.5 |

| Communication Services | 15.8 | 7.0 | 13.7 |

| Health Care | 8.8 | 10.1 | 12.0 |

| Industrials | 11.0 | 10.3 | 13.0 |

| Materials | 8.9 | 7.7 | 13.3 |

| Real Estate | -0.5 | 3.3 | 5.3 |

| Utilities | 4.6 | 4.4 | 5.9 |

| Energy | 13.7 | 29.6 | 12.8 |

Source: Morningstar Direct, 3/31/2024. Total returns in USD. 3- and 5-year periods are annualized returns. U.S. large-cap stocks represented by the S&P 500 Index. U.S. mid-cap stocks represented by the Russell Mid-cap Index. U.S. small-cap stocks represented by the Russell 2000 Index. International developed large-cap stocks represented by the MSCI EAFE Index. International small- and mid-cap stocks represented by the MSCI EAFE SMID Index. Emerging-market stocks represented by the MSCI EM Index. U.S. investment-grade bonds represented by the Bloomberg US Aggregate Bond Index. International bonds represented by the Bloomberg Global Aggregate Ex USD Hedged Index. Emerging-market debt represented by the Bloomberg Emerging Market USD Aggregate Index. U.S. high-yield bonds represented by the Bloomberg US HY 2% Issuer Cap Index. Cash represented by the Bloomberg US Treasury Bellwethers 3-Month index. Equity sectors of the S&P 500 Index. An index is unmanaged and is not available for direct investment. Performance does not include payment of any expenses, fees or sales charges, which would lower the performance results. The value of investments fluctuates, and investors can lose some or all of their principal. Past performance does not guarantee future results.

Investment Policy Committee

The Investment Policy Committee (IPC) defines and upholds Edward Jones investment philosophy, which is grounded in the principles of quality, diversification and a long-term focus.

The IPC meets regularly to talk about the markets, the economy and the current environment, propose new policies and review existing guidance — all with your financial needs at the center.

The IPC members — experts in economics, market strategy, asset allocation and financial solutions — each bring a unique perspective to developing recommendations that can help you achieve your financial goals.